IATA

Annual

Review

2022

Contents

IATA Annual Review 2022

2

Contents

3

IATA Annual Review 2022

04 Members’ list

06 Willie Walsh, Director General

08 Robin Hayes Chair, Board of Governors

11 Industry Story

16 Safety

22 Security

24 Regulations

30 Environment and Sustainability

34 Passenger Experience

36 Cargo

40 Financial Services

42 Diversity & Inclusion

44 Airline Retailing

Contents

International Air Transport Association

Annual Review 2022

78th Annual General Meeting and

World Air Transport Summit, Doha, Qatar

Members’ list

IATA Annual Review 2022

4

A

ABX Air

Aegean Airlines

Aer Lingus

Aero Republica

Aerolineas Argentinas

Aeromar

Aeromexico

Africa World Airlines

Air Algerie

Air Arabia

Air Astana

Air Austral

Air Baltic

Air Botswana

Air Burkina

Air Cairo

Air Caledonie

Air Canada

Air Caraibes

Air China

Air Corsica

Air Dolomiti

Air Europa

Air France

Air Guilin

Air India

Air Koryo

Air Macau

Air Madagascar

Air Malta

Air Mauritius

Air Moldova

Air New Zealand

Air Niugini

Air Nostrum

Air Peace

Air Serbia

Air Seychelles

Air Tahiti

Air Tahiti Nui

Air Tanzania

Air Transat

Air Vanuatu

AirBridgeCargo Airlines

Aircalin

Airlink

Alaska Airlines

Albastar

Allied Air

AlMasria Universal

Airlines

American Airlines

ANA

APG Airlines

Arkia Israeli Airlines

Asiana Airlines

ASKY

ASL Airlines France

Atlantic Airways

Atlas Air

Austrian

Avianca

Avianca Costa Rica

Avianca Ecuador

Azerbaijan Airlines

Azores Airlines

Azul Brazilian Airlines

B

Badr Airlines

Bahamasair

Bamboo Airways

Bangkok Airways

Batik Air

Batik Air Malaysia

Belavia Belarusian

Airlines

Biman Bangladesh

Airlines

Binter Canarias

Blue Air

BoA Boliviana de

Aviacion

Braathens Regional

Airways

British Airways

Brussels Airlines

Bulgaria Air

C

Cabo Verde Airlines

CAL Cargo Airlines

Camair-Co

Cambodia Angkor Air

Capital Airlines

Cargojet Airways

Cargolux

Caribbean Airlines

Carpatair

China Airlines

China Cargo Airlines

China Eastern

China Express Airlines

China Postal Airlines

China Southern Airlines

CityJet

Condor

Congo Airways

Copa Airlines

Corendon Airlines

Corsair International

Croatia Airlines

Cubana

Cyprus Airways

Czech Airlines

D

Delta Air Lines

DHL Air

DHL Aviation

E

Eastern Airlines

Eastern Airways

Egyptair

EL AL

Emirates

Ethiopian Airlines

Etihad Airways

EuroAtlantic Airways

European Air Transport

Eurowings

EVA Air

Evelop Airlines

F

FedEx Express

Fiji Airways

Finnair

Fly Baghdad

FlyEgypt

Flynas

Flyone

Freebird Airlines

French Bee

Fuzhou Airlines

G

Garuda Indonesia

Georgian Airways

German Airways

GOL Linhas Aereas

Gulf Air

GX Airlines

H

Hahn Air

Hainan Airlines

Hawaiian Airlines

Hebei Airlines

Hi Fly

Hong Kong Air Cargo

Hong Kong Airlines

Hong Kong Express

Airways

I

Iberia

Icelandair

IndiGo

Iran Air

Iran Airtour Airline

Iran Aseman Airlines

Israir

ITA Airways

J

Japan Airlines

Japan Transocean Air

Jazeera Airways

Jeju Air

JetBlue

Jin Air

Jordan Aviation

Juneyao Airlines

K

Kam Air

Kenya Airways

KLM

Korean Air

Kunming Airlines

Kuwait Airways

Members’ list

Members’ list

5

IATA Annual Review 2022

L

LAM

Lao Airlines

LATAM Airlines Brasil

LATAM Airlines Colombia

LATAM Airlines Ecuador

LATAM Airlines Group

LATAM Airlines Paraguay

LATAM Airlines Peru

LATAM Cargo Brasil

LATAM Cargo Chile

Loong Air

LOT Polish Airlines

Lucky Air

Lufthansa

Lufthansa Cargo

Lufthansa CityLine

Luxair

M

Malaysia Airlines

Mandarin Airlines

Martinair Cargo

Mas Air

Mauritania Airlines

International

MEA

MIAT Mongolian Airlines

MNG Airlines

Myanmar Airways

International

N

National Airlines

NCA Nippon Cargo

Airlines

Neos

Nesma Airlines

Nile Air

NordStar

Nordwind Airlines

Nouvelair

O

Okay Airways

Olympic Air

Oman Air

Overland Airways

P

Paranair

Pegas Fly

Pegasus Airlines

PGA Portugalia Airlines

Philippine Airlines

PIA Pakistan

International Airlines

Polar Air Cargo

Poste Air Cargo

Precision Air

Privilege Style

Q

Qantas

Qatar Airways

Qazaq Air

R

Ravn Alaska

Rossiya Airlines

Royal Air Maroc

Royal Brunei

Royal Jordanian

Ruili Airlines

RusLine

RwandAir

S

S7 Airlines

Safair

SAS

SATA Air Acores

Saudi Arabian Airlines

SCAT Airlines

SF Airlines

Shandong Airlines

Shanghai Airlines

Shenzhen Airlines

Sichuan Airlines

Silk Way West Airlines

Singapore Airlines

SKY Airline

Smartavia

Smartwings

Solomon Airlines

Somon Air

South African Airways

SpiceJet

SriLankan Airlines

SunExpress

Suparna Airlines

SWISS

Syrianair

T

TAAG Angola Airlines

TACA

TAP Portugal

TAROM

Tassili Airlines

Thai Airways

International

Thai Lion Air

Thai Smile

Tianjin Airlines

Tunisair

Turkish Airlines

T’way Air

U

Ukraine International

Airlines

UNI AIR

United Airlines

UPS Airlines

Ural Airlines

Urumqi Air

UTair

Uzbekistan Airways

V

Vietjet

Vietnam Airlines

Virgin Atlantic

Virgin Australia

Vistara

Volaris

Volotea

Vueling

W

Wamos Air

West Air

WestJet

White Airways

Wideroe

World 2 Fly

X

Xiamen Airlines

Y

YTO Cargo Airlines

Willie Walsh, Director General

IATA Annual Review 2022

6

WILLIE WALSH, DIRECTOR GENERAL

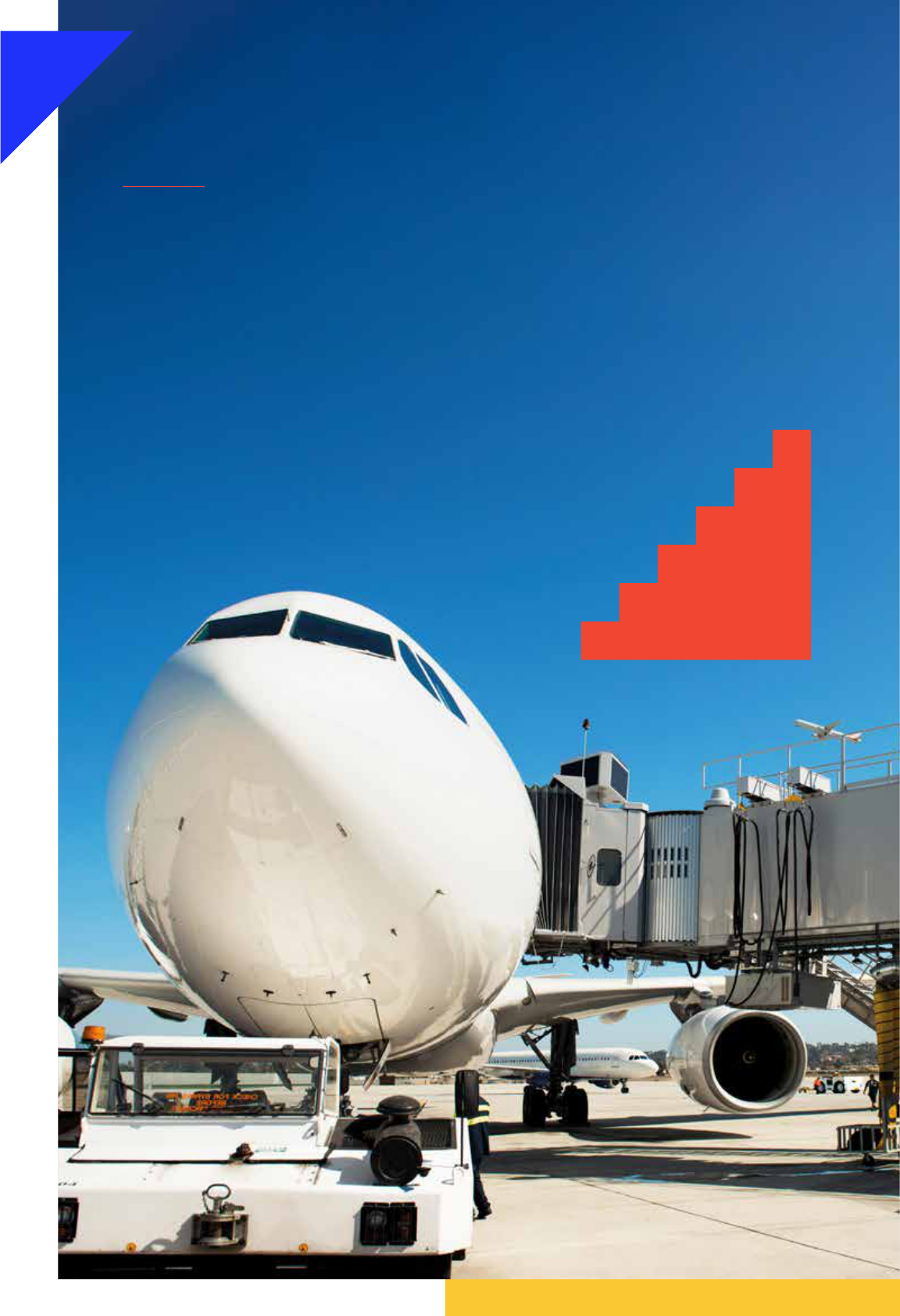

Keeping the

worldconnected

A

viation is resilient and on

the rise. After the worst

downturn in our history, we

have turned the corner on

the COVID-19 pandemic.

Industry losses are expected to

reduce to $9.7 billion in 2022; down

from $42.1 billion in 2021. That is a

huge improvement from losses of

$137.7 billion in 2020.

In growing numbers and with

rising excitement and enthusiasm,

peopleare again enjoying the

freedom to travel, to connect

withone another, and to see the

world. By the end of 2023, most

regions will be at—or exceeding—

pre-pandemic levels of demand.

Pandemic lessons

Looking back at the pandemic,

wecan point to our service

with pride. Where permitted by

governments, airlines kept the

world connected. Airlines kept

vital supply lanes open to deliver

lifesaving vaccines and medical

supplies. And they operated to the

highest levels of safety throughout.

Over and over, the aviation

workforce rose to the occasion.

In fact, the importance of aviation

was made absolutely clear

by thepandemic restrictions.

Peoplerecognized that their

qualityof life deteriorated and

economies suered.

This pandemic will not be the last.

It is vital, therefore, that we draw

the correct lessons so that we can

be better prepared next time. Top

of the list of lessons learned is that

travel restrictions did little to contain

the spread of COVID-19. The World

Health Organization (WHO) said

this from the beginning, but far too

manygovernments ignored their

sound advice. Governments must

dobetter next time.

Working with governments

Many governments recognized

aviation’s vital role as an economic

lynchpin, providing nancial relief to

numerous airlines. As governments

now rebuild their regulatory

agendas, it is critical that they

continue to focus on regulations

that create value. IATA will be

vigilant and remind governments

that the benets of regulation must

exceed the costs they create.

Slot regulation is a case in point.

The Worldwide Airport Slot

Guidelines are fundamental to

delivering reliable schedules

with insucient airport capacity.

When government-imposed

travel restrictions stopped

airlines operating, exibility on

slot rules preserved networks

and connectivity. Now, as

routes are being re-opened and

demand returns, we still require

exibility in slot rules, particularly

as airports race to hire back

sta tomeet surging demand.

There isabsolutely no reason to

treat thereturn to normal as an

opportunity to rewrite the slot

rulesthat performed admirably

before the lockdown.

Likewise, we see the temptation

to introduce new consumer

regulations, on everything

from airline service oerings

to accessible travel. We are

committed to making travel

accessible, but the focus of any new

rules needs to be on addressing

the operational issues in this area,

rather than imposing penalties.

Regulators must not tolerate

infrastructure providers seeking to

recover pandemic losses by using

their natural monopoly powers

to price-gouge their customers.

With some airports already in the

process of implementing double-

digit increases, governments

must understand that the light

touch regulations proposed by

many airports come with a heavy

price topay for consumers, the

economy,and airlines.

Sustainability

At our 77th AGM, our members

resolved to achieve net zero

carbon emissions by 2050. That

was quickly followed by similar

commitments across the industry.

The missing component is a

similarly ambitious long-term target

by governments, which should be

articulated at this year’s Assembly

of the International Civil Aviation

Organization (ICAO).

The Assembly will also be an

opportunity for governments to

shore-up their support for CORSIA

(Carbon Osetting and Reduction

Scheme for International Aviation)

with a sensible baseline agreement

that fairly recognizes the adjusted

baseline of 2019. Individual

governments must not undermine

CORSIA’s eectiveness with

competing, duplicative, or politically

divisive extra-territorial initiatives.

To achieve net zero by 2050,

airlines must rely on infrastructure,

supplier partners, and the oset

providers to do their part with

credible initiatives that deliver real

reductions. The game changer,

however, is sustainable aviation fuel

(SAF), which is expected to account

for about 65% of our carbon

Willie Walsh, Director General

7

IATA Annual Review 2022

mitigation eorts by 2050. Airlines

bought every drop of SAF that was

available in 2021 and made forward

purchase agreements worth

some $17 billion. As with the wind

and solar energy transitions, the

tipping point will be facilitated by

government incentives, not taxes.

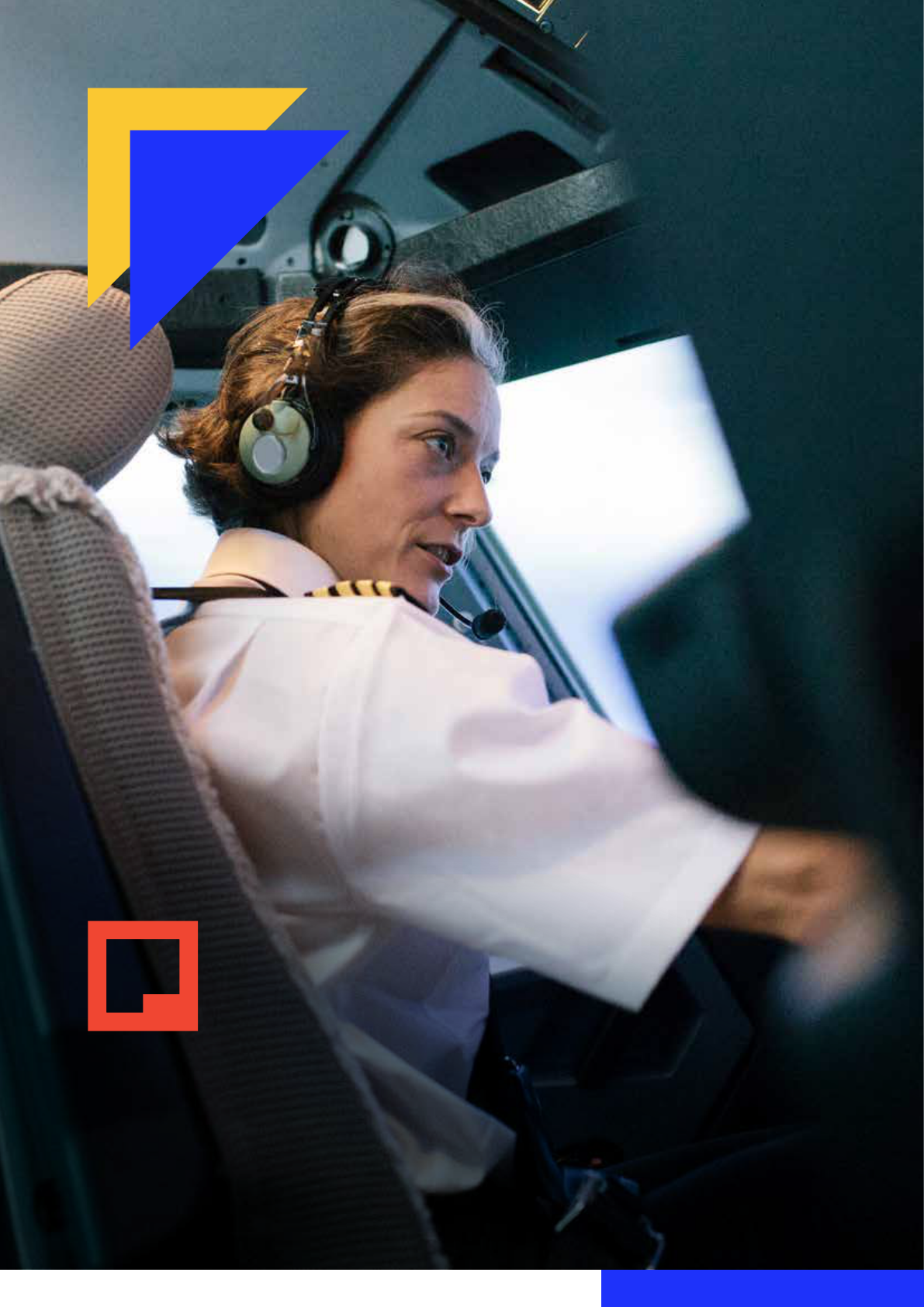

Diversity

The last challenge to highlight is

improving gender diversity. We

have made progress, but aviation

continues to be male dominated. By

not having better gender balance,

we are short-changing our industry

on talent, and in the long term

this is not sustainable. There is no

way to successfully address labor

shortages if we do not take full

advantage of the female half of the

population. Change is happening

but we must make it happen faster

through the examples of the IATA

Diversity and Inclusion Awards

andthe commitments of the

25by2025 initiative.

IATA

In the 14 months since taking on

theresponsibilities of Director

General, I have gained a deep

“By the end of 2023,

most regions will be

at—or exceeding—

pre-pandemic

appreciation of the excellent

work being done by the IATA

team in serving the needs of

our members. Examples of their

eorts are present throughout

this document. This includes our

nancial settlement systems

that have remained reliable

even under extreme stress. I am

determined to make IATA even

more eective in the coming year

and I know my IATA colleagues

share this commitment.

Willie Walsh,

Director General

Robin Hayes Chair, Board of Governors

IATA Annual Review 2022

8

ROBIN HAYES, CHAIR, IATA BOARD OF GOVERNORS, CEO OF JETBLUE AIRWAYS

Accelerating the

energytransition

Q

Though the pandemic is not

completely behind us, the

recovery is underway. Are you

optimistic? And what do we need

to learn from the two years of

COVID-19?

Yes, I’m incredibly optimistic.

After more than two years, we are

turningthe corner on COVID and

are on a path to sustained recovery,

with travel almost back to 2019

levels in several parts of the world.

Key to this rebound has been the

removal of many of the restrictive

COVID travel policies.

Throughout the pandemic, as an

industry we’ve had to face the

challenges of operating with a

patchwork of entry regulations

that have been dicult for airlines

and travelers alike. We’ve learned

the importance of working with

governments worldwide to

streamline entry requirements

to countries for customers

and airlines. Many of these

requirements are no longer in

place, but we need to remain

focused on ensuring unied

protocols and procedures so

thatwe can be better prepared

forthe next challenge that we

faceas an industry.

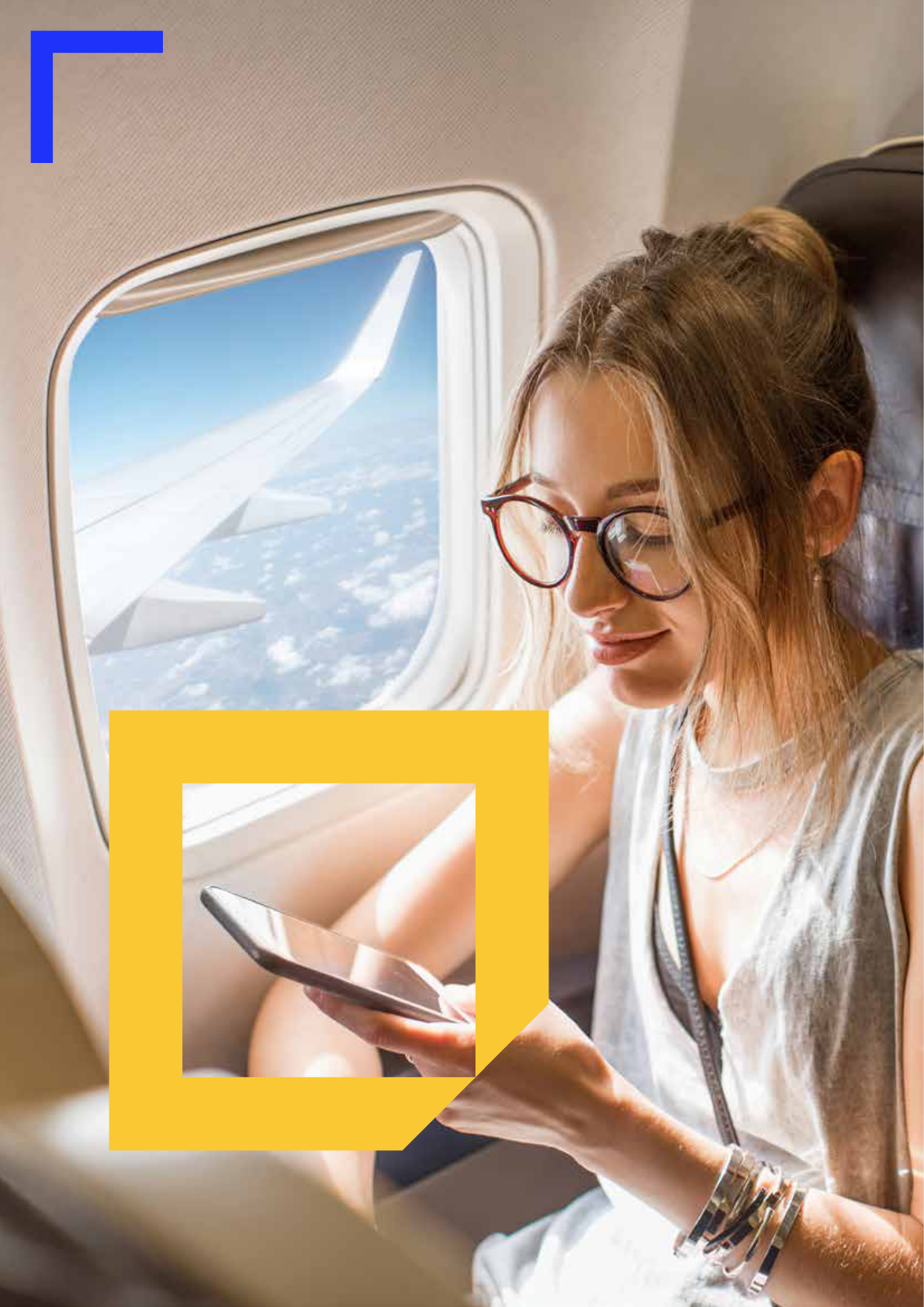

Q

As people return to traveling,

how have customer

expectations changed, and

arethere demand shifts that

willrequire a response at the

industry level?

As an industry, we were already

focused on technology before the

pandemic. Technology proved an

incredible resource because it

provided the tools and services

to reduce our customers’ shared

touchpoints while keeping a focus

on safety and social distancing.

We’ve seen that customers

appreciate and adapt to technology

enhancements, and we are certain

that their expectations moving

forward will be on the increasingly

seamless experience that we can

provide through technology.

We’re also seeing that customers

appreciate the enhanced cleaning

measures that our industry

introduced during the pandemic.

Though the mask mandates have

dropped in many of the countries

around the world, we’re also going

to see a number of travelers

continue wearing masks.

We’ve seen the demand for leisure

travel come roaring back, with

some airlines and airports reporting

the highest passenger numbers

since the start of the pandemic.

Business travel is not recovering

as quickly, but we’re seeing trends

that show that it, too, is getting

back on track. Companies know

that virtual networking is limited,

and that business travel is vital to

attracting clients and supporting

collaboration and teamwork.

Q

What would you say to

airports that are campaigning

for reduced economic regulation?

We need more than ever to work

together to support the recovery

of our industry, and a key way

to do this is to ensure that we’re

protecting our customers. Without

strong economic regulation,

airports and air navigation service

providers (ANSPs) can operate as

a monopoly in any given market.

As such, they could arbitrarily and

unfairly raise their prices to the

detriment of travelers and airlines.

“The volatility of energy

markets is highlighting

our need to transition

even more quickly to

sustainable aviation

Robin Hayes Chair, Board of Governors

9

IATA Annual Review 2022

Without competition, we also know

that there is no urgency to provide

quality or timely service.

I am sure each and every airport

campaigning for reduced economic

regulation has no plan to abuse a

position of power, but economic

regulation is the only protection

we can provide for travelers.

Regulations also play an important

part in moving our industry and

services forward by encouraging

airports and ANSPs to strive for

investments that improve cost

eciency and service levels. Our

industry is never without scrutiny,

and we need economic regulation

to protect our business and ensure

we’re all providing the highest level

of service possible to travelers.

Q

The industry made a

commitment to achieve net-

zero emissions by 2050. Are we

making sucient progress?

Climate change remains the

greatest threat to our world and

the greatest challenge for our

industry. We need to continue to

tackle it and to ensure that our

partners, including governments,

play their part in solving long-

standing issues. No one airline or

airport or aircraft manufacturer

will be able to move the needle

forward alone. Iwas pleased that

we passed Fly Net Zeroat our

Annual General Meetinglast year.

We need everyone, especially our

business partners in the industry, to

continue investing and innovating

in technologies and products

that allow us to keep our forward

momentum, from aircraft that can

use 100% sustainable aviation fuels

(SAF) to improved aircraft engines

and airline-related machinery.

The volatility of energy markets is

highlighting our need to transition

quickly to SAF. Unfortunately, SAF

are not being produced at levels

that the industry needs, and pricing

remains high. SAF are essential to

our strategy for reaching net-zero.

We need to work together as an

industry, and we need appropriate

government policy that supports

the increased production of SAF,

sothey are more widely available

and at a better price.

One of our other issues is that

net-zero does come at a cost, and

we need to make sure we prioritize

sustainability while also protecting

our business. Ultimately, I believe

Fly Net Zero is going to help us

be successful by coordinating

the eorts of the entire industry

to meet our net-zero emissions

goalby 2050 and by helping us

stay on track with our short- and

medium-term targets.

Q

As we look ahead to the next

ve years, what do you see

as aviation’s biggest challenges?

And what is IATA’s role in

addressing them?

Climate change and environmental

issues remain our greatest

challenges. Not only is reducing our

carbon emissions the right thing to

do but also we’re under tremendous

pressure from governments and

travelers to adopt measures

to reduce the environmental

Robin Hayes Chair, Board of Governors

IATA Annual Review 2022

10

impact oftravel. As the unifying

organization of our industry, IATA

must make sure it moves forward

in the Fly Net Zero program and

hits targets. And the industry

must share with governments and

communities the progress we’re

making in our eorts.

In the short term, it is imperative

that we manage and retain talent in

the industry. Because of the highly

specialized nature of our work and

the impact of the pandemic, we’re

experiencing workforce shortages.

We are therefore laser focused

on supporting the talent pipeline

to ensure that we’re fostering

opportunities and overcoming

challenges, educational or

nancial, to entering our industry.

IATA has been providing training

for aviationprofessionals for 50

years, and so it is going to play an

important part in contributing to

theindustry recovery. By working

with our partners, we can attract

new talent and help shape the

future of aviation.

As we look to the future, we

also need to focus on improving

diversity within our industry.

IATA’s 25by2025 program will be

a principal enabler in increasing

the number of women in senior

positions by either 25% or to

a minimum of 25% by 2025.

Diversity, equity, and inclusion are

fundamental for the future of our

industry. Companies that have

great diversity at the management

level perform the best. Research

shows that companies that rank

high in diversity are also more

likely to attract top talent, to

improve customer and employee

satisfaction, and to have better

decision-making and nancial

returns. By establishing a culture

of diversity, equity, and inclusion,

the aviation industry will secure its

talent pipeline for years to come.

Robin Hayes, Chair,

IATA Board of Governors,

CEO of JetBlue Airways

MEMBERSHIP OF THE BOARD OF GOVERNORS

As at 9 June 2022

1. Abdelhamid Addou

Chairman and Chief

Executive Ocer

ROYAL AIR MAROC

2. Akbar Al Baker

Group Chief Executive

QATAR AIRWAYS

3. Ibrahim Al-Omar

Director General

SAUDI ARABIAN AIRLINES

4. Roberto Alvo

Chief Executive Ocer

LATAM AIRLINES GROUP

5. Enrique Javier

Beltranena Mejicano

President and Chief

Executive Ocer

VOLARIS

6. Walter Cho

Chairman and Chief

Executive Ocer

KOREAN AIR

7. Donald Colleran

President and Chief

Executive Ocer

FEDEX EXPRESS

8. Ronojoy Dutta

Chief Executive Ocer

INDIGO AIRLINES

9. Pieter Elbers

President and Chief

Executive Ocer

KLM ROYAL DUTCH

AIRLINES

10. Mohamad El-Hout

Chairman and Director

General

MIDDLE EAST AIRLINES

11. Luis Gallego Martín

Chief Executive Ocer

IAG (representing Iberia)

12. Goh Choon Phong

Chief Executive Ocer

SINGAPORE AIRLINES

13. Robin Hayes

[Chair of the Board]

President and Chief

Executive Ocer

JETBLUE AIRWAYS

14. Pedro Heilbron

Chief Executive Ocer

COPA AIRLINES

15. Izham Ismail

Group Chief Executive

Ocer

MALAYSIA AIRLINES

16. Scott Kirby

Chief Executive Ocer

UNITED AIRLINES

17. Liu Shaoyong

Chairman

CHINA EASTERN

AIRLINES

18. Ma Xulun

Chairman, President, and

Chief Executive Ocer

CHINA SOUTHERN

AIRLINES

19. Christine

Ourmières-Widener

Chief Executive Ocer

TAP AIR PORTUGAL

20. Topi Manner

President and Chief

Executive Ocer

FINNAIR

21. Yvonne

Manzi Makolo

Chief Executive Ocer

RWANDAIR

22. Mehmet TevkNane

Vice-Chairperson of

the Board (Managing

Director)

PEGASUS AIRLINES

23. Douglas Parker

Chairman

AMERICAN AIRLINES

24. Michael Rousseau

President and Chief

Executive Ocer

AIR CANADA

25. MAjay Singh

Chairman and

ManagingDirector

SPICEJET LIMITED

26. Benjamin Smith

Chief Executive Ocer

AIR FRANCE / KLM

(representing Air France)

27. Carsten Spohr

Chairman and Chief

Executive Ocer

LUFTHANSA

28. Tang Kin Wing

Augustus

Chief Executive Ocer

CATHAY PACIFIC

AIRWAYS LIMITED

29. Willie Walsh

Director General

IATA

ALSO SERVED

(To March 2022)

Yuji Hirako

President and Chief

Executive Ocer

ALL NIPPON AIRWAYS

(To March 2022)

Tewolde GebreMariam

Chief Executive Ocer

ETHIOPIAN AIRLINES

(To March 2022)

Mikhail Poluboyarinov

Chief Executive Ocer

and Chairman of the

Management Board

AEROFLOT

(To October 2021)

Adrian Neuhauser

Chief Executive Ocer

AVIANCA

(To October 2021)

Alan Joyce

Chief Executive Ocer

QANTAS

Industry Story

11

IATA Annual Review 2022

INDUSTRY STORY

On the path

torecovery

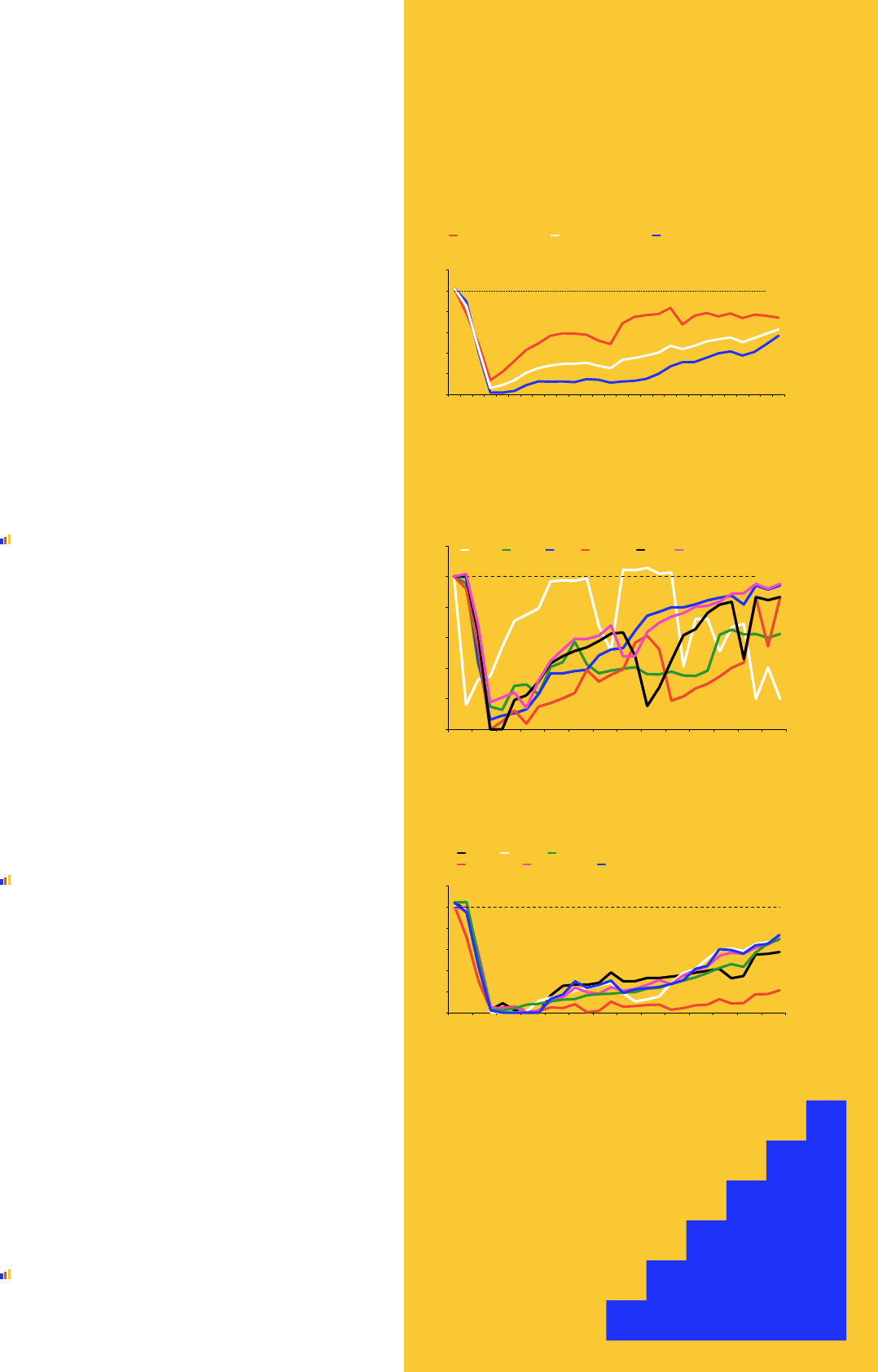

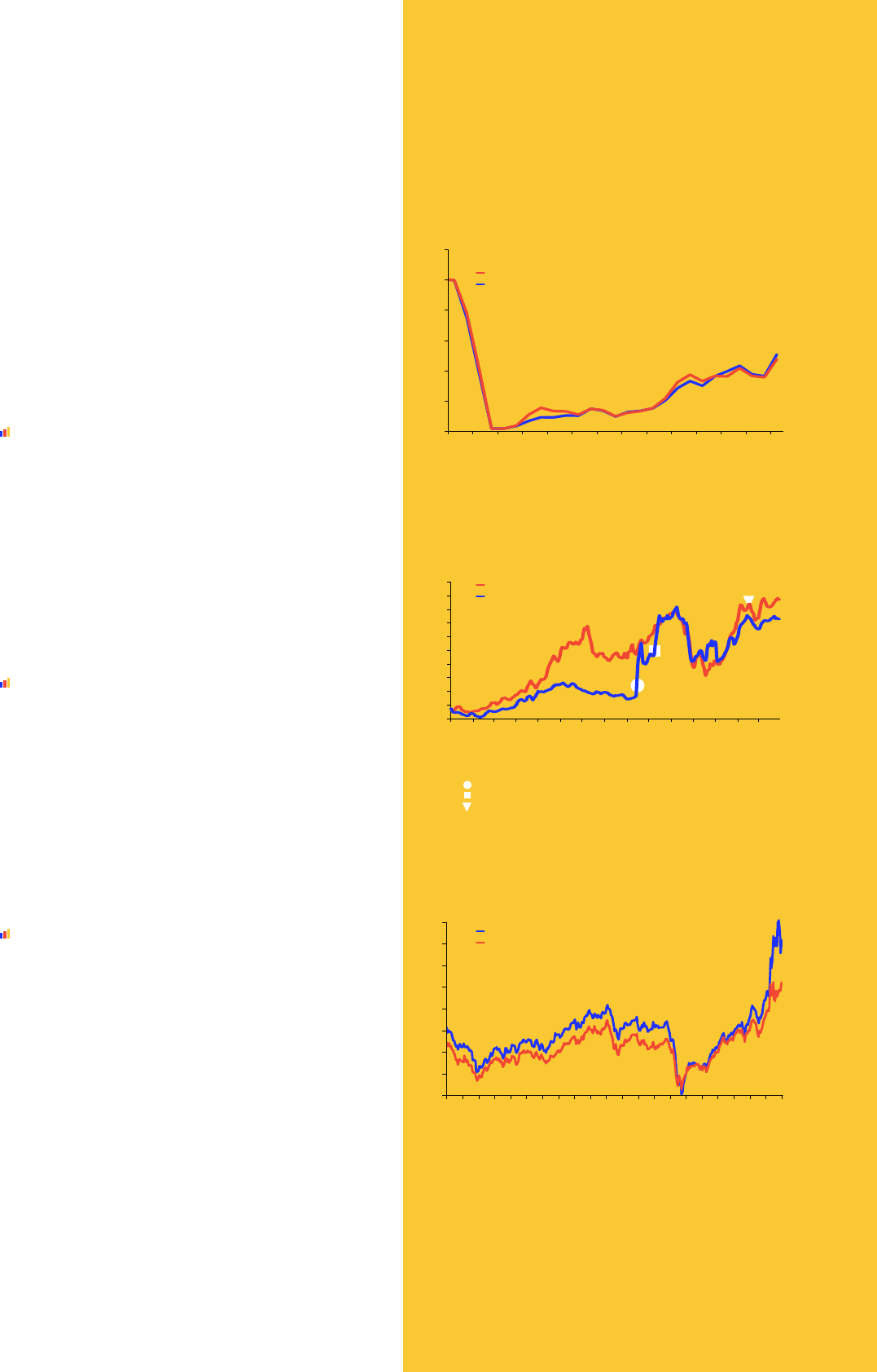

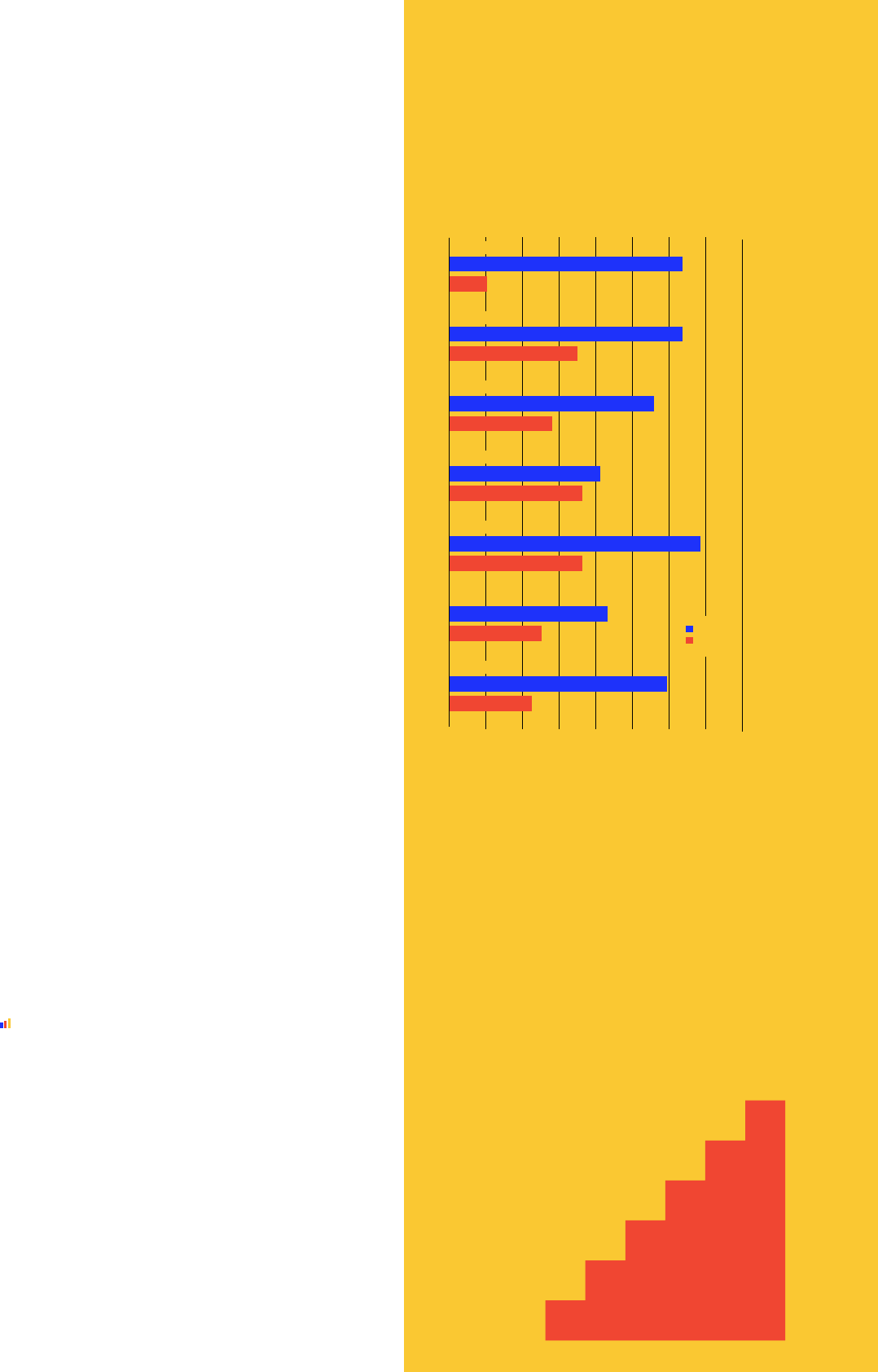

02 Seasonally adjusted domestic RPKs

(indexed to January 2020 = 100)

01 Percentage change in RPKs

03 International RPKs, YoY% change

120

100

80

60

40

20

0

20%

0%

-20%

-40%

-60%

-80%

-10 0%

20%

0%

-20%

-40%

-60%

-80%

-10 0%

Jan-20

Jan-20

Mar-20

Mar-20

May-20

May-20

Jul-20

Jul-20

Sep-20

Sep-20

Nov-20

Nov-20

Jan-21

Jan-21

Mar-21

Mar-21

May-21

May-21

Jul-21

Jul-21

Sep-21

Sep-21

Nov-21

Nov-21

Jan-21

Jan-21

Mar-22

Mar-22

China

Japan

USA

Australia

India

Brazil

Jan-20

Mar-20

Apr-20

Feb-20

May-20

Jun-20

Jul-20

Aug-20

Sep-20

Oct-20

Nov-20

Dec-20

Jan-21

Feb-21

Mar-21

April-21

May-21

Jun-21

Jul-21

Aug-21

Sep-21

Oct-21

Nov-21

Dec-21

Jan-21

Feb-21

Mar-22

Apr-22

April 2022 vs April 2019

Domestic RPKs

-25.8%

Industry total

-37.2%

International RPKs

-43.4%

Africa

Europe

Middle East

Asia Pacic

Latin America

North America

Industry Story

IATA Annual Review 2022

12

Air passenger trac

International air travel continues its recovery

The recovery of international air trac following its

COVID-19 low point in 2020 accelerated in 2021. But

some domestic markets stagnated.

Following the initial hit from the pandemic and for

most of 2020 and early 2021, international air travel

was adversely aected by travel restrictions, such

that travelers preferred less-restricted domestic

trips. Those trends reversed around mid-2021.

When governments started to lift international travel

restrictions, strong demand for international travel

ensued, especially for leisure and short-haul trips.

Domestic revenue passenger kilometers (RPKs),

conversely, trended sideways, mainly because Asian

markets, such as China, that had initially recovered

fastwere hit by renewed outbreaks of the virus.

01 Source: IATA’s Monthly Trac Statistics

Domestic markets are strongly dependent

on COVID-19 policies and pandemic-related

developments

Air travel demand diverges strongly among the largest

domestic markets. In Russia, the shift from international

to domestic air travel and favorable government policies

regarding the latter meant domestic RPKs trended

above 2019 levels for all of 2021 and prior to the war

with Ukraine. China’s domestic RPKs have returned

close to their 2019 values on several occasions only to

deteriorate following outbreaks of the Delta and Omicron

variants. The United States has seen a slow but steady

recovery in domestic air travel demand. Elsewhere,

some domestic markets continue to see volatility in

air trac amid renewed outbreaks of COVID-19 and its

variants even as 2022 witnesses reduced pressure from

COVID on health systems globally.

02 Source: IATA’s Monthly Trac Statistics

The recovery in international air travel is

resilient to shocks, but Asia-Pacic is struggling

The worldwide easing of government border

policies was arguably the main reason for growth in

international air passenger trac in 2021 and into

2022. Africa, Latin America, and the Middle East saw

faster initial letups of travel restrictions than Europe

and North America, but all of these regions have

broadly recovered in step, albeit slowly. The outlier

is Asia-Pacic, where strict government policies and

cautious travelers led to only marginal improvement in

international air transport RPKs in 2021.

In early 2022, international travel maintained its

recovery in all regions. The pace of that recovery,

however, continued to diverge between Asia-Pacic

and the rest of the world, although some Asia-Pacic

markets, such as Australia, have begun recovering

faster than the region overall following their

governments’ relaxation of restrictions.

03 Source: IATA’s Monthly Trac Statistics

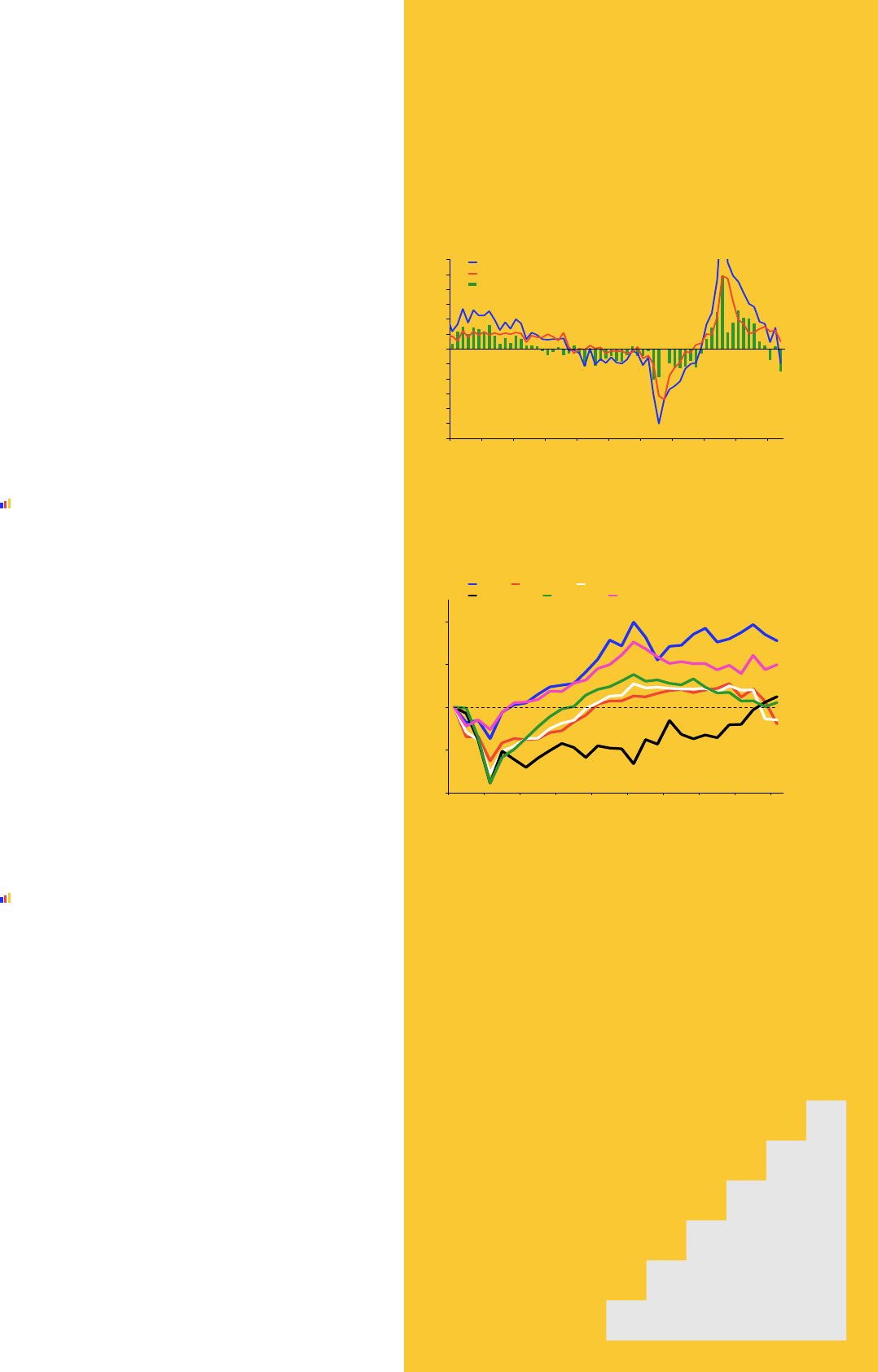

04 International RPKs by cabin class,

indexed to January 2020 = 100

05 Percentage change in bookings

in the United States and Europe

06 Jet fuel and crude oil prices

120

100

80

60

40

20

0

0%

-10 %

-20%

-30%

-40%

-50%

-60%

-70 %

-80%

-90%

-10 0%

Jan-21

Jan-20

Feb-21

Mar-20

Mar-21

May-20

Apr-21

Jul-20

May-21

Sep-20

Jun-21

Nov-20

Jul-21

Jan-21

Aug-21

Mar-21

Sep-21

May-21

Oct-21

Jul-21

Nov-21

Sep-21

Dec-21

Nov-21

Jan-22

Jan-21

Feb-22

Mar-22

Mar-22

Share of int’l RPKs by class

(identical in 2019 and 2021)

Economy 92%

Premium 8%

Bookings made in the US

Bookings made in Europe

20 Sept: US travel ban to be lifted in Nov

15 Oct: Concrete US reopening date announced

24 Feb: Escalation of war in Ukraine

Purchase date

Jet fuel price

Crude oli price (Brent)

175

155

135

115

95

75

55

35

15

May-16

Sep-15

Jan-17

Sep-17

Sep-18

May-18

May-19

May-20

May-21

May-22

May-15

Jan-16

Sep-16

May-17

Jan-18

Jan-19

Jan-20

Jan-21

Jan-22

Sep-19

Sep-20

Sep-21

$/barrel

Industry Story

13

IATA Annual Review 2022

Economy- and premium-class travel have fallen

and risen at the same pace during the pandemic

There has been much speculation throughout the

pandemic of the possible signicant impact on

business travel of video conferencing technology

and tightened corporate travel budgets. Trac

volumes in premium and economy cabin classes have

nonetheless mostly recovered in tandem and their

respective market shares are unchanged from 2019.

This is potentially the result of declines in airfares for

rst and business class relative to other classes and to

increased demand from leisure travelers for comfort

and space onboard aircraft.

04 Source: IATA’s Monthly Trac Statistics

The willingness of people to travel

deesthepandemic and other shocks

The US-Europe market illustrates that people’s

willingness to travel by air has remained strong

throughout the pandemic. The easing of air travel

restrictions has often been followed by a surge in ticket

sales. Except for countries directly aected by the

war in Ukraine, demand has been mostly untouched,

with ticket sales falling for only a week or so before

recovering. Not even ination has so far put people

o air travel. It is likely, though, that demand would be

stronger without these various shocks.

05 Source: IATA Economics, using Direct Data Service (DDS)

Jet fuel and crude oil prices rose markedly

in 2021 and early 2022, pressuring already

strained airline nances

Economic activity globally recovered well in 2021

from the depths of the pandemic, pushing demand

and prices for oil steadily higher. Initially, the crack

spread—the gap between crude oil and jet fuel prices—

was negligible, but it has grown since mid-2021. The

war in Ukraine, robust global economic activity, and

insucient crude supply led to a surge in crude oil

prices in early 2022. Jet fuel prices rose even more

quickly, driven by heightened demand.

06 Sources: S&P Global, Renitive Eikon

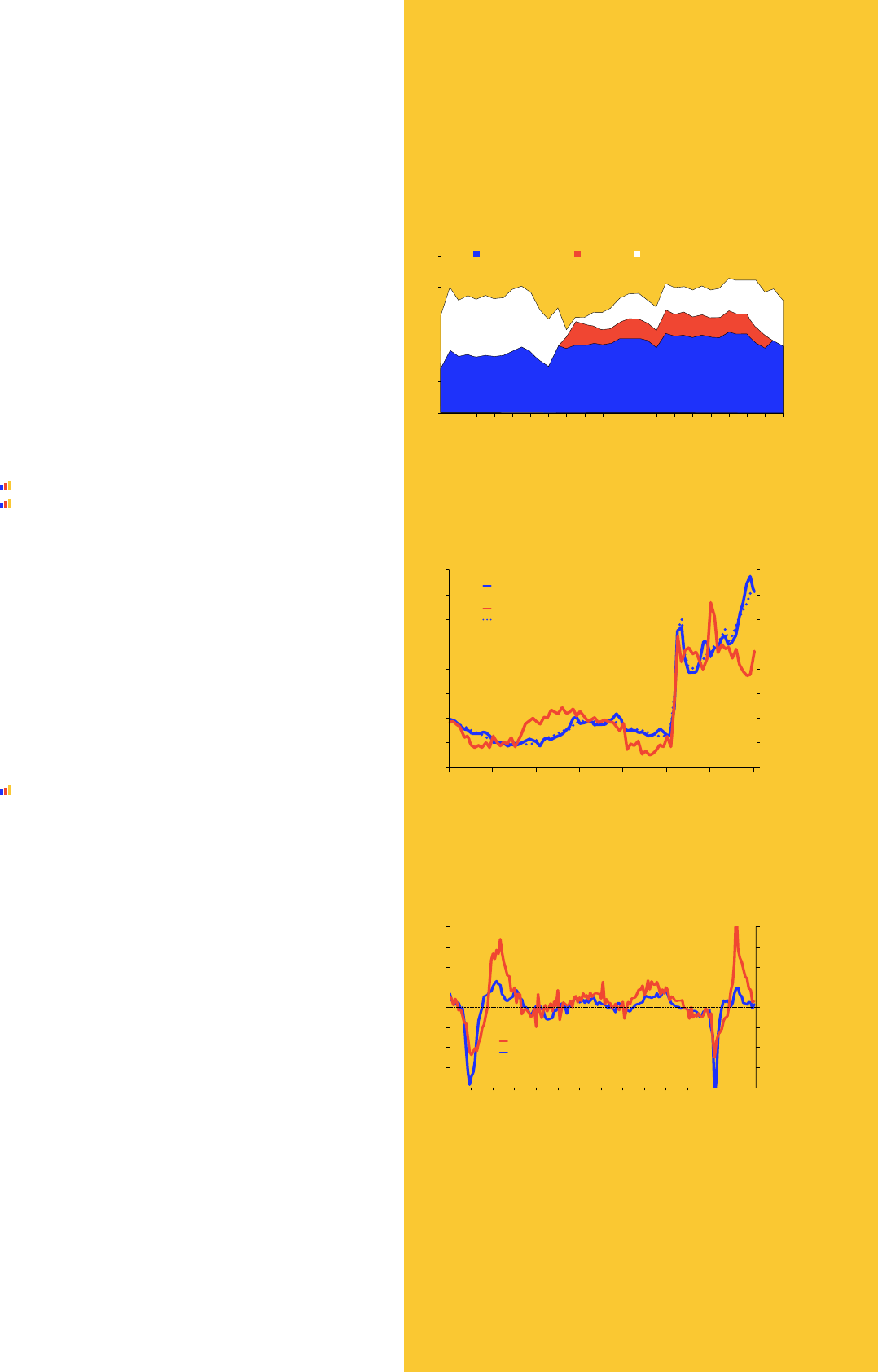

07 Percentage growth in air cargo demand

08 International CTKs,

indexed to January 2020 = 100

Industry-wide CTKs

Global goods trade

Relative performance of air cargo growth

% year-

on-year

30%

25%

20%

15%

10%

5%

0%

-5%

-10 %

-15%

-20%

-25%

-30%

Jan-17

Jan-20

Jul-17

Apr-20

Jan-18

Jul-20

Jul-18

Oct-20

Jan-19

Jan-21

Jul-19

Apr-21

Jan-20

Jul-21

Jul-20

Jul-21

Jan-21

Oct-21

Jul-21

Jan-22

Jul-21

140

120

100

80

60

Africa

Asia Pacic

Europe

Latin America

Middle East

North America

Industry Story

IATA Annual Review 2022

14

Air cargo trac

Air cargo grew strongly in 2021,

outperformingthe wider goods trade,

butresults deteriorated in 2022

As is typical during economic upturns, global air cargo

transport grew faster than the overall goods trade in

2021. This is because demand for goods rebounded

strongly, and businesses often did not have enough

inventory to meet that demand, inducing them to turn to

air cargo for rapid restocking. This inventory restocking

cycle tapered o somewhat at the end of 2021 into

early 2022 as the rebound in economic activity slowed

and ination began to rise. Air cargo trac continues

to grow in year-on-year terms, but its growth clearly

softened in the second half of 2021 and may well

weaken further as 2022 progresses.

07 Sources: IATA’s Monthly Trac Statistics,

Netherlands Centraal Planbureau (CPB)

Air cargo volumes for many leading routes and

markets have softened, but volumes in Africa

and Latin America continue to surge

Globally, air cargo volumes are trending sideways,

hiding the disparity among the main markets and

regions. North America, the Middle East, Asia-Pacic,

and Europe posted strong growth in air cargo volumes

in late 2020 and early 2021, but volumes thereafter lost

steam. This is partly explained by elevated ination

and related supply issues, the end of the inventory

restocking cycle, and a shift in demand from goods to

services. Airlines in Latin America lost air cargo market

share to other regions but exited their bankruptcy

procedures, which allowed them to post strong

performances in early 2022 and to begin the expected

consolidation process in the region. The cargo tonne

kilometers (CTKs) own by African airlines have been

buoyant throughout the pandemic, mainly driven by a

vigorous ow of goods and investments from China.

08 Source: IATA’s Monthly Trac Statistics

09 Percentage growth in air cargo demand

11 Percentage growth in

manufacturingexport orders

10 Cargo yields and load factors,

indexedto January 2012 = 100

Millions

2008

2009

2010

2011

2012

2013

2014

2015

2015

2016

2016

2017

2017

2018

2018

2019

2019

2020

2020

2021

2021

2022

2022

25

20

15

10

5

0

4.4

4.0

3.6

3.2

2.8

2.4

2.0

1.6

1.2

132

127

122

117

112

107

102

97

92

Dedicated freighters Preighters Passenger aircraft bellies

Aug-19

Apr-19

Dec-19

Apr-20

Oct-20

Aug-20

Feb-21

Aug-21

Feb-22

Feb-19

Jun-19

Oct-19

Feb-20

Jun-20

Dec-20

Jun-21

Dec-21

Apr-21

Oct-21

Arpr-22

51%

49%

4%

25%

71%

21%

18%

61%

28%

13%

59%

70

65

60

55

50

45

40

35

30

40%

30%

20%

10%

0%

-10 %

-20%

-30%

-40%

Growth in industry CTKs (RHS)

Global PMI component export orders

Manufacturing New export orders PMI (50 = no change)

($/kilogram)

Global air cargo yield, including fuel

andother surcharges (LHS)

Industry-wide cargo load factor (RHS)

Seasonally adjusted

Industry Story

15

IATA Annual Review 2022

Passenger aircraft belly capacity is recovering

but remains lower than pre-pandemic levels

Amid greatly diminished international passenger

trac, particularly as the pandemic took full eect,

passenger aircraft belly capacity declined substantially.

To compensate, airlines temporarily converted some

oftheir passenger aircraft to freighters, which are

dubbed “preighters.” The result was record air cargo

load factors and yields.

The air cargo load factor hit a peak in mid-2021

beforefalling as a result of lower demand and

increasedcapacity. Air cargo yields also fell in the

second half of 2021 until Omicron, labor shortages,

and other disruptions sent them to new heights at

theoutset of 2022.

09 Source: IATA’s Monthly Trac Statistics

10 Sources: IATA’s CargoIS and Monthly Trac Statistics

Export orders, key indicators of demand

for air cargo transport, were moderate

in 2021 and early 2022

The diculties faced by air cargo trac are visible

in the purchasing managers’ index (PMI) for export

orders—historically a leading indicator of air cargo

demand. Thisindicator revealed that export orders

were moderate for most of 2021 amid softening

growth.However, it turned unsupportive in January

2022, when its value dipped below 50, which signals

a deterioration on the month. Although the index

improved in February, ination, the war in Ukraine,

and renewed lockdowns in China again put downward

pressures on export orders and air cargo demand.

11 Sources: IATA’s Monthly Trac Statistics, IHS Markit

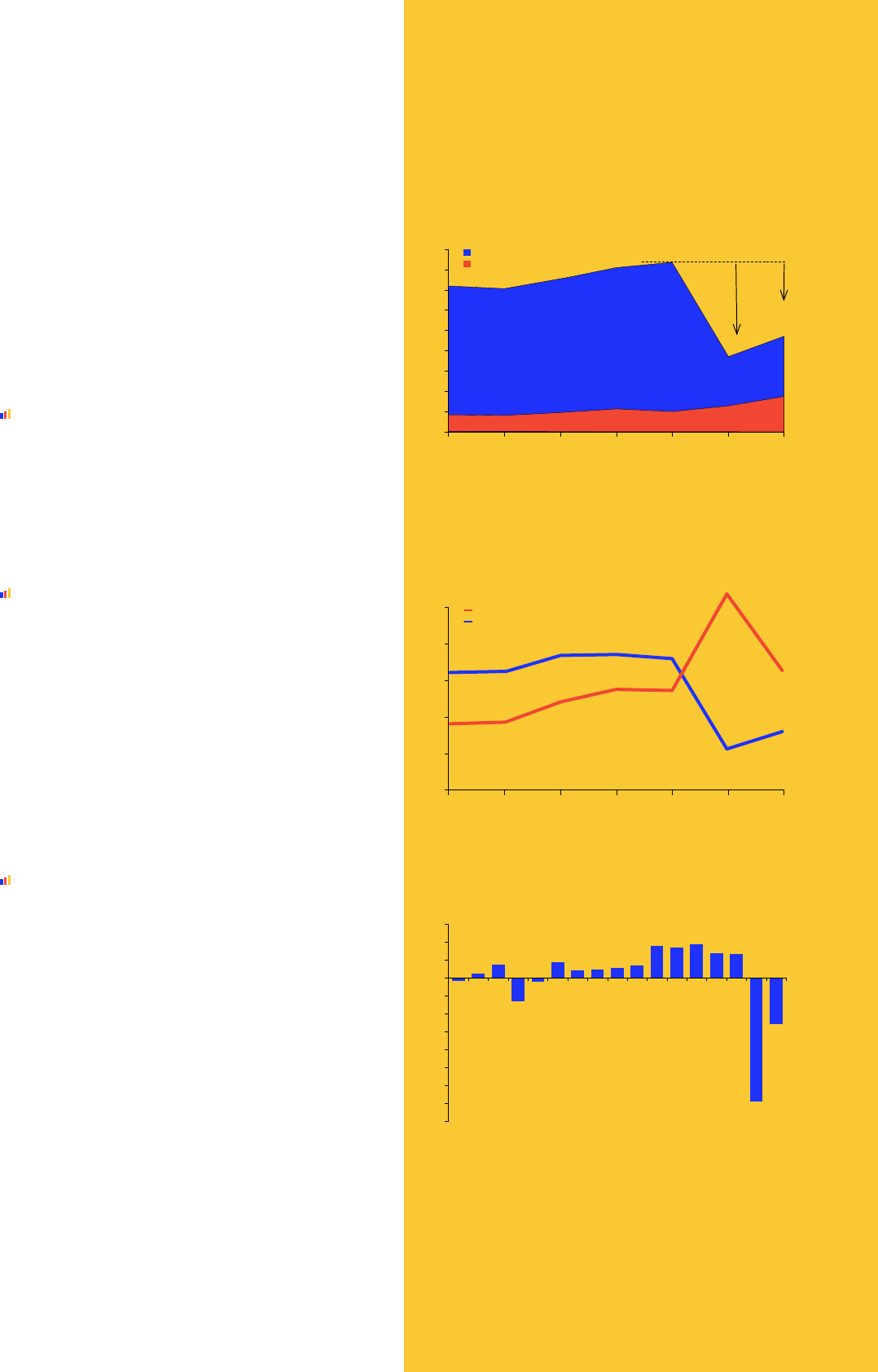

$ Billion

900

800

700

600

500

400

300

200

100

0

Passenger revenues

Cargo revenues

2015

2016

2017

2018

2019

2020

2021

12 Global airline revenues

13 Breakeven and actual passenger

andcargo load factors

2021:

57% of

2019

level

2022:

79% of

2019

level

% ATKs

$ Billion

2015

2014

2013

2012

2011

2010

2009

2008

2007

2006

2005

2016

2017

2018

2019

2020

2021

14 Air transport industry net posttax prots

60

40

20

0

-20

-40

-60

-80

-10 0

-120

-14 0

-14 0

-4.1

5.0

14.7

-26.1

-4.6

17.3

8.3

9.2

10.7

13.8

36.0

34.2

37.6

27.3

26.4

-137.7

-51.8

Industry Story

IATA Annual Review 2022

16

Airline nancials

Cargo and passenger revenues rose in 2021

butremain far from their precrisis levels

Air cargo revenues have nevertheless been the bright

story for airlines during the pandemic. They rose nearly

75% in 2021 compared with 2019 on the back of strong

demand and record cargo yields. That, however, was far

from enough to oset the fall in passenger revenues,

which in 2021 were still more than 60% under their 2019

level. This left overall airlines revenues in 2021 fully 57%

below revenues for 2019.

12 Source: IATA Economics

Airlines’ combined load factor remains below

the level required for nancial breakeven

Improvements in air passenger trac and strong air

cargo demand meant airlines were able to increase

their overall load factor in 2021 compared with 2020.

Despite this improvement, the load factor continues

to be below where it must be for airlines to break

evennancially.

13 Source: IATA Economics

Air transport again registered net posttax

losses in 2021 with improvement on the horizon

Based on IATA’s October 2021 estimates, industry-

wide net posttax losses eased from $138 billion in 2020

to $52 billion in 2021 on the back of improvements in

passenger trac and a strong air cargo performance.

IATA expects a further reduction in losses in 2022 as

the recovery extends. It is clear, however, that higher jet

fuel and labor costs, the impact of ination on demand,

outbreaks of COVID-19 in China, and a broad-based

slowdown in economic activity will put downward

pressure on airline nancials. Some airlines, though,

are expected to turn a prot in 2022, particularly those

with large domestic markets and open borders.

14 Source: IATA Economics

2015

2016

2017

2018

2019

2020

2021

80%

75%

70%

65%

60%

55%

Breakeven load factor (passenger + cargo)

Overall load factor (passenger + cargo)

0%

5%

10%

15%

20%

30%

25%

40%

35%

15 Airline operating margin by region

2020

2021 E

% revenue

North America

European

Asia-Pacic

Middle East

Latin American

Africa

Industry

Industry Story

17

IATA Annual Review 2022

Airline nances improved in all regions in 2021

and are expected to improve further in 2022,

with North America leading the way

IATA’s October 2021 estimates anticipated reduced,

widespread operational losses in 2021. Those

estimates anticipate the same for 2022 across all the

main regions of airline registration, although the degree

of improvement will vary signicantly region by region.

Airlines based in North America are the best placed

nancially, beneting as they do from the large US

market, strong trac ows to Latin America and

Europe, and resilient economies. This is the only region

where the operating margin is expected to turn positive

in 2022.

Slow gains in international air trac meant that the

nances of European airlines improved marginally in

2021. Their earnings before interest and taxes (EBIT)

margin was at minus 17.4% at year-end 2021.

Drivers of nancial performance for airlines in

Asia-Pacic are mixed. The international air travel

recovery was almost nonexistent in this region in

2021, and even the region’s largest domestic markets

continue to be troubled by renewed COVID-19

outbreaks and risk-averse governments.

Air carriers in the Middle East experienced slow growth

in their operating margins in 2021. This was due mainly

to the region’s dependency on long-haul international

air travel, which is expected to take longer than other

market segments to return to its 2019 trac levels.

Latin American carriers posted the worst operating

margin on aggregate in 2020 and 2021, with several

airlines proceeding with US Chapter 11 bankruptcy.

There is nevertheless robust demand for leisure travel

in some markets to and from the region, which has

helped to improve regional airline nances somewhat.

In Africa, airline operating margins were around minus

13% in 2021, a resilient outcome. Looking ahead,

low-income countries in Africa are likely to struggle

economically in the near term, which will dampen the

recovery of air transport in those countries.

15 Source: IATA Economics

Safety

IATA Annual Review 2022

18

I

n the face of numerous

operational challenges, the airline

industry improved its safety

performance in several key areas

in 2021 compared with 2020 and

the 2017–2021 average.

Highlights of 2021 safety

performance:

● The total number of accidents,

the all-accident rate, and fatalities

were reduced

● IATA members and airlines on the

IATA Operational Safety Audit

(IOSA) registry (which includes

allIATA members) experienced

zero fatal accidents

● No runway/taxiway excursion

accidents occurred for the first

time in at least 15 years.

These strong results occurred as

the industry ramped-up operations

from the low point of April 2020,

while addressing issues that

included:

● Ensuring proficiency for air crew

flying reduced schedules or

returning to work after furlough

● The loss of many highly skilled

individuals owing to retirement

orredundancy

● Safely returning aircraft to

service after parking them for

extended periods

● Inconsistent and rapidly changing

border control measures that

placed significant stress on

aircrew in navigating testing and

quarantine requirements.

To ensure that IATA can support the

industry in delivering continuous

improvement in aviation safety,

a new three-pillar IATA Safety

Strategy has been developed:

● Safety Leadership:

Organizational safety begins

at the top. The IATA Safety

Leadership Program aims to

leverage the safety leadership

mindset of aviation executives to

highlight the benefits of a positive

safety culture to enhance safety

performance. Safety Leadership

principles, a Safety Leadership

Charter, and Safety Leadership

talks are all being utilized to

emphasize the criticality of

leadership. IATA’s Aviation Safety

Culture (I-ASC) Survey provides

airlines with a tool to measure

and continuously improve

their safety cultures using a

standardized methodology and

key performance indicators.

SAFETY

New three-pillar

safety strategy

Safety

19

IATA Annual Review 2022

Aviation and 5G

Though 5G telecommunications

services have been successfully

implemented in many jurisdictions

around the world with little to no

impact on airline operations, this

was not the case in the United

C-band 5G operations in January

2022 at certain US airports created

enormous disruption to aviation,

owing to the potential risk of

interference with radio altimeters

that are critical to aircraft landing

safety was not compromised,

on airlines as they worked to

comply with the special conditions

established by the US Federal

Aviation Administration (FAA) for

safe operations in the presence

Furthermore, it is anticipated that

the FAA will require airlines to

at their own expense to enable the

respective aircraft to continue to

serve 114 US airports where 5G

Protection of the civil aviation

spectrum and aircraft safety

IATA continues engaging with

governments to mitigate threats

to the civil aviation spectrum,

including encouraging responsible

Safety

IATA Annual Review 2022

20

All accident

rate (accidents

per one million

ights)

2021

1.01

(1 accident every

0.99million ights)

2020

1.58

(1 accident every

0.63 million ights)

1.23

(1 accident every

0.81 million ights)

All accident

rateforIATA

memberairlines

2021

0.44

(1 accident every

2.27million ights)

2020

0.77

(1 accident every

1.30 million ights)

0.72

(1 accident every

1.39 million ights)

Total

accidents

2021

26

2020

35

44.2

Fatal

accidents

2021

7

(1 jet and 6turboprop)

2020

5

7.4

Fatalities

2021

121

2020

132

207

Fatality

risk

2021

0.23

2020

0.13

0.14

● Safety Risk: This pillar captures

new and emerging aviation

hazards that put safety at risk

and offers potential industry

mitigations through a single

repository—the IATA Global

Safety Risk Management

Framework (GSRMF). It enables

the assessment and prioritization

of hazards and risks, captured

from across industry, to support

safety improvements through

safety risk assessments and

guidance material. As IATA

transforms its IOSA program

froma compliance-based

process to a risk-based one,

safety insights from audits will

add significant context to the

issues IATA looks to address

through safety improvement

programs. The IATA Global

Aviation Data Management

(GADM) platform, which contains

large amounts of safety data, will

support this by validating data

around identified safety risks.

IOSA will provide de-identified

safety insights from audits that

will feed into the GSRMF.

● Safety Connect: The IATA

Safety Connect program has

been designed to encourage

active communication among

airlines’ safety and compliance

managers regarding current

and emerging potential safety

issues. It provides a conduit to

exchangesafety intelligence

between peers to support a

deeper industry understanding

of current issues and employ

mitigations used by others to

collectively raise the baron

safety performance.

“To ensure that IATA can support the

industry in delivering continuous

improvement in aviation safety,

a new three-pillar IATA Safety

Safety

21

IATA Annual Review 2022

IATA member

airlines

fatalityrisk

2021

0.00

2020

0.06

0.04

Jet hull losses

(perone million

ights)

2021

0.13

(1 major accident

every7.7 million ights)

2020

0.16

(1 major accident

every6.3 million ights)

0.15

(1 major accident every

6.7 million ights

Turboprop hull

losses(per one

million ights)

2021

1.77

(1 hull loss every

0.56million ights)

2020

1.59

(1 hull loss every

0.63million ights)

1.22

(1 hull loss every

0.82million ights)

Total ights

(million)

2021

25.7

2020

22.2

36.6

Security

IATA Annual Review 2022

22

A

viation’s security

challenges include

cyberattacks on

corporatesystems,

geopolitical tensions resulting

in airspace closures, and

terrorism against assets, people,

and reputation. To keep pace,

governments are providing

supportand resources to

aviation, including capacity

building, so that countries with

limited resources can meet and

exceed their securityobligations.

These eortskeep ying secure

despitethe numerous threats.

Issues surrounding the safe and

secure management of civil aviation

in conict zones, and in the airport

environment persist, and in some

regions have escalated. In the

Kingdom of Saudi Arabia in 2021,

for example, 54 individual attacks

or attempted attacks were ocially

reported against airports under civil

control. Similarly, there were fatal

attacks reported in January 2022 in

the United Arab Emirates involving

the unlawful use of Unmanned

Aircraft Systems (UAS).

To counter these challenges,

information sharing is critical. IATA

facilitates the timely sharing of

information among key industry

participants through its Tactical

Operations Portal (ITOP).

The invasion of Ukraine by Russia

underscores the importance

of timely collaborative risk

assessment between governments

and the industry. As of end April

2022, all Ukrainian and large parts

SECURITY

Aviation maintains

its vigilance against

security threats

“IATA facilitates the

timely sharing of

information among key

industry participants

through its Tactical

of Russian airspace were closed to

civil aviation operations. Airspace

closures, regardless of the

reason, come with huge penalties

for aviation. Longer ight times

increased operating costs, fuel

consumption, and CO2 emissions,

for example. Any airspace closure

for whatever reason needs to

be monitored and reviewed on a

regular basis.

Meanwhile, the digital jamming

of civil aircraft global position

systemsand spoong even outside

conict zones—known as fake

information tactics—persists. To

assist the industry in mitigating this

risk, IATA manages a multitude of

outreach communications.

Governments have ocially warned

industry partners that cyberattacks

have increased across all enterprise

systems associated with critical

infrastructure services, including

transport. There have been no

incidents reported that have

targeted or aected the safety of

ight and/or met the threshold of an

act of unlawful interference. There

are indications, however, that state-

sponsored actors have increased

capabilities to disrupt civil aviation,

with data breaches causing supply

chain disruptions. International and

national cybersecurity eorts focus

on reducing the risks of unregulated

supply chains, and unknown network

and software vulnerabilities,

including ransomware.

Security

23

IATA Annual Review 2022

Regulations

IATA Annual Review 2022

24

Regulations

25

IATA Annual Review 2022

G

overnments need to weigh

the impact that additional

aviation taxes will have on

the contribution of aviation

connectivity to economic growth

versus higher tax revenue from the

economy as a whole. In principle,

aviation taxation should be

proportionate and fair and should

avoid competitive distortion

Green and carbon taxes

There has been a urry of green

and carbon (CO

2

) tax initiatives

across Europe, including proposed

increases to ticket taxes. In

early 2022, Belgium instigated a

passenger tax, and the Netherlands

tripled its tax. Carbon pricing

proposals in the form of taxes that

will potentially penalize aviation for

CO

2

emissions beyond the scope of

the EU Emissions Trading Scheme

have likewise been proposed.

The air transport industry is

advocating for the EU and other

nations to promote and incentivize

investments in SAF rather than

implement taxes to generate

revenue that is rarely invested in

projects to cut aviation emissions.

EU energy taxation directive

The industry is also monitoring

developments under the EU Energy

Taxation Directive concerning

the proposed fuel tax on intra-

EU ights—from which airlines

are exempt—and how this would

put EU airlines at a competitive

disadvantage. The EU, meanwhile,

must respect air services

agreements (ASAs) that exempt

airlines from non-EU countries

operating ights between EU

member countries from fuel tax.

Where the EU doesn’t have ASAs

with non-EU countries, the EU has

left the door open to apply a fuel

tax on the ights of non-EU airlines

operating from EU airports.

Base erosion and prot sharing

In November 2021, 137 countries

joined a two-pillar plan to reform

international taxation rules to

reduce base erosion and prot

sharing (BEPS) where multinational

enterprises exploit gaps and

mismatches between dierent

country’s tax systems. The global

airline industry is in the scope of the

new rules, but the annual turnover

threshold of the rules is so high that

it may apply to only ve major airline

groups. The threshold, though, could

drop 50% by 2030, which would put

more airlines in the scope of the

rules, especially as airlines recover

following the 2023 implementation

of the reformed rules.

Unruly passengers

There is growing concern

among airlines, passengers, and

governments over the increasing

frequency and severity of unruly

incidents involving violence

and harassment by passengers

againstcrews and other

passengers and failure to comply

with safety and public health

instructions. Yet, loopholes in

international air laws often result

in oenses going unpunished.

The air transport industry has

consequently adopted a set of

principles to deal with unruly

passenger behavior. In April 2022,

IATA bolstered those principles

with its publication of a high-level

document, Even safer and more

enjoyable air travel for all—a

strategy for reducing the problem

of unruly and disruptive passenger

Regulations need

to be consistent

Regulations

IATA Annual Review 2022

26

incidents, that uses examples

of good practice to illustrate the

practical steps to take to reduce

unruly and disruptive passenger

issues. These steps include

urginggovernments

● to communicate the types of

prohibited conduct onboard

aircraft and the legal and other

consequences of such conduct,

in line with Annex 9 of the

ChicagoConvention;

● to ratify Montreal Protocol 14

and thereby remove barriers to

enforcement and prosecution;

● to review the types of

enforcement measures that

are in place, including such

penalties as fines, which can be

issued to ensure that there are

consequences for disruptive

behavior; and

● to support the work of airlines

and other industry stakeholders

to prevent unruly and disruptive

passenger incidents.

Accessibility

IATA again consulted extensively

with disabled persons, industry

representatives, and wheelchair

and aircraft manufacturers to

develop policies and propose

solutions to make air transport

increasingly accessible for

travelers with disabilities. An

important concern for this traveler

group is damage to mobility aids.

In March 2022, IATA’s Mobility Aids

Action Group provided a number of

conclusions and recommendations:

● The dimensions and weight of

some mobility aids cause loading

and off-loading challenges.

Mobility aids must be stored in an

upright position and often cannot

be configured to fit through cargo

doors or secured in the cargo hold.

● Communication with passengers

must improve to ensure

that accurate dimensions

of mobility aids are shared

with carriers. Without this

information, carriersmay not

be able to correctly assemble

or disassemble a mobility aid.

Incorrect information can also

lead to injuries to handlers.

● Communication is also vital for

the safe handling of lithium-ion

batteries, which are used to

power some mobility aids and

must be properly disassembled

or disconnected to be compliant

with air transport’s dangerous

goods regulations.

The airline industry is doing what it

can to minimize damage to mobility

aids. But a major breakthrough for

the benet of travelers will only

come when wheelchair and other

mobility aid manufacturers change

their product designs to meet

the demands of air travel. In the

meantime, the Mobility Aids Action

Group seeks agreement on various

initiatives, including advocacy, with

national regulators for a market-

driven solution for mobility aids

suited to air travel.

Slots

Government restrictions on travel

once more challenged the slot

allocation system in 2021. And IATA

and airlines again urged regulators

not to return fully to the 80-20 slot-

use rule for the northern summer

2022 season, particularly while

it remained unclear when travel

restrictions would be lifted.

The Worldwide Airport Slot Board

(WASB) proposed measures that

recognize the global nature of

airline networks and their exposure

to changing circumstances in

dierent markets, such as how

the closure of one end of a route

dramatically aects the other end.

WASB’s measures recommend

some slot series returns for still-

closed routes and force majeure

for unknowns. Disappointingly,

the UK government announced

a 70% use rate for summer 2022

with no options, while the European

Commission agreed to a 64% rate.

Most other regulators remained

committed to the WASB approach

or to continued full slot alleviation.

In March, Singapore University of

Technology and Design’s Aviation

Studies Institute published a white

paper cowritten with IATA: Slot

Allocation Amidst COVID Recovery,

which focuses on the Association of

“Government

restrictions on travel

once more challenged

the slot allocation

Regulations

27

IATA Annual Review 2022

Working with

governments

fora safe

restart of

aviation

T

hroughout 2021, the

industry worked with

governments to secure a

safe, globally coordinated

restart of air transport. At the

ICAO High Level Conference on

COVID-19 (HLCC) in October 2021,

countries acknowledged that

greater harmonization between

countries was important to restore

international connectivity, rebuild

the condence of the traveling

public, and facilitate the revival of

the global economy.

At that time, most countries had

reopened their borders, at least

partially, or had announced plans

to do so. Almost all countries,

however, still had in place extensive

requirements with which air

travelers and airlines had to comply,

with little to no coordination or

consistency among countries

regarding those requirements.

Recognizing that industry input

was needed to help countries

deliver on the commitments they’d

made at the HLCC, IATA published

Restart to Recovery: A Blueprint

for Simplifying Air Travel during

COVID-19. The publication is

designed to assist governments

with practical recommendations

and best practices to make the

international air travel experience

simple, predictable, and consistent.

Southeast Asian Nations (ASEAN).

The paper concludes that the

most useful measure adopted by

authorities worldwide has been

“the ability to return series of slots

in advance of the season, while

protecting future rights to the same

slots. This has provided clarity

to airport planners, prevented

airlines from being expected to

y unnecessarily, and provided

other airlines with more access

opportunities.”

The same thinking features in the

WASB guidance for future seasons.

WASB oers a balance between

pandemic impact and demand

recovery based on best practices.

Slot relief is crucial in heavily

travel-restricted markets. In

other markets, the slot system

is under pressure from soaring

demand, which outstrips airlines’

eorts to restart fast. Signicant

operational challenges at

airports, often because of a

lack of security-cleared sta,

are causing bottlenecks and

ight cancellations. In May 2022,

Schiphol Airport requested that

airlines halt bookings to relieve

pressure on the airport. It is vital

that such requests are signaled

well in advance so that slots can

be recongured and consumers

minimally inconvenienced. It is

also essential that airlines that

cannot operate their slots because

of cancellations beyond their

control are not penalized under the

minimum slot-use rules in place.

A further complication to the slot

system has recently emerged with

the closure of Russian airspace

following that country’s invasion

of Ukraine. Severe and ongoing

disruption to schedules means

that maximum exibility at slot-

coordinated airports is needed

to enable carriers to retime

slots. IATA is working with the

Worldwide Airport Coordinators

Group (WWACG) to ensure that

exibility and information on

schedule updates can be shared

between aviation stakeholders and

passengers as quickly as possible.

Regulations

IATA Annual Review 2022

28

Responding poorly to Omicron

The emergence of the Omicron

variant in late November 2021

led to knee-jerk responses from

many governments, including

renewed border closures and

additional testing and quarantine

requirements. These responses

were imposed with little warning

or coordination despite clear

statements from the World Health

Organization (WHO) that such

draconian measures are ineective

and probably counterproductive.

IATA called for governments to “use

the experience of the last two years

to move to a coordinated, data-

driven approach that nds safe

alternatives to border closures and

quarantine.” It added that “travel

restrictions are not a long-term

solution to control COVID variants.”

It quickly became apparent that

strict border measures were indeed

ineective against Omicron given

the extreme transmissibility of the

variant. Professor David Heymann,

of the London School of Hygiene

and Tropical Medicine, noted that

“the travel bans that followed the

discovery of Omicron did not contain

its spread. That is because by the

time it was identied, it was already

present in many places.” Research

carried out for IATA and ACI

Europe by Oxera and Edge Health

also foundpredeparture testing

requirements to be ineective

at stopping or even slowing the

spreadof the Omicron variant.

Professor Heymann further

argued that travel measures

were increasingly unnecessary in

countries with high levels of vaccine

uptake because vaccination

oers good protection against

severe outcomes. In this respect,

many countries have rightly

begun to treat COVID-19 as an

endemic disease and are shifting

the responsibility for COVID risk

assessment and risk management

to individuals.

Rebounding from Omicron and

aiming for a return to normal

Omicron and vaccines have driven

a shift in government policies from

strict person-based measures to the

alleviation of controls once sufcient

levels of population protection have

been reached. As more countries

apply this approach, IATA is calling

on governments to align their border

measures to achieve a return to a

pre-pandemic travel experience.

Border measures should take into

account the Oxera and Edge Health

research indicating that testing

does not signicantly inuence

the spread of the virus and its

“As the industry

recovery gathers

momentum, it is

important to take stock

variants. And contact tracing,

including the lengthy and complex

passenger locator forms (PLFs)

that have become ubiquitous, calls

for a joint, holistic approach. The

border should not be seen as the

only line of defense. If there is no

contact tracing taking place within

a domestic destination, it makes

no sense for travelers to that

destination to ll out a PLF. The same

logic applies to vaccine certicates

and other health credentials.

Restoring the passenger

experience that airlines are used to

oering requires more than just the

relaxation of border measures. The

onboard experience must go back

to normal too. In particular, mask

mandates should be relaxed in line

with domestic settings. Masking

onboard should be voluntary and

a matter of choice for passengers

and crew. There is no logic in

requiring masks onboard aircraft

when they are not required in

restaurants, at cultural and sporting

venues, or even within airports.

Looking ahead with resilience

and preparedness

As the industry recovery gathers

momentum, it is important to

take stock of the lessons learned

and to ensure that the industry is

resilient to future variants of the

SARS-COV2 virus. Government and

international organizations, too,

need to be much better prepared

for health emergencies, with global

pandemics expected to become

increasingly common.

Digital tools have the potential

not only to transform identity

management and facilitate

contactless travel but also

to heighten the resilience of

international travel amid health

emergencies. Throughout 2022 and

beyond, IATA will collaborate with

ICAO, WHO, and other stakeholders

to ensure that all are fully prepared

for the next global health event

and for a quicker, more consistent

response than has been the case

during the COVID pandemic. This

will be a key theme of IATA’s input

at the ICAO Assembly from 27

September to 7 October 2022.

Regulations

29

IATA Annual Review 2022

Environment and Sustainability

IATA Annual Review 2022

30 C

limate change is an

existential threat, and

environmental action

remains top of the

industry’s agenda. At the 77th IATA

Annual General Meeting in Boston,

United States, IATA member airlines

passed a resolution committing

them to achieving net zero carbon

emissions from their operations

by2050. This brings air transport

inline with the objective of the

ParisAgreement to limit global

warming to1.5°C.

Success will require the coordinated

eorts of the entire industry

(airlines, airports, air navigation

service providers, manufacturers)

and signicant government support.

The industry must progressively

reduce its emissions and

accommodate growing demand,

which is particularly strong in the

developing world.

To serve the needs of the 10 billion

people expected to y in 2050, at

least 1.8 gigatons of carbon must

be abated in that year. Moreover,

the net zero commitment implies

that a cumulative total of 21.2

gigatons of carbon will be abated

between now and 2050.

The resolution demands that all

industry stakeholders commit

to addressing the environmental

impact of their policies, products,

and activities with concrete actions

and clear timelines, including:

● Fuel-producing companies

bringing large scale, cost-

competitive sustainable aviation

fuels (SAF) to the market

● Governments and air navigation

service providers (ANSPs)

eliminating inefficiencies in

airtraffic management and

airspace infrastructure

● Aircraft and engine

manufacturers producing

radically more efficient airframe

and propulsion technologies

● Airport operators providing the

needed infrastructure to supply

sustainable aviation fuels (SAF)

ina cost-effective manner.

An immediate enabler is the

International Civil Aviation

Organization’s (ICAO) Carbon

Osetting and Reduction Scheme

for International Aviation (CORSIA).

This will stabilize international

emissions in the short-to-medium

term. Support for this was rearmed

in IATA’s net zero resolution. Under

CORSIA, airlines are required to

purchase eligible emission units to

oset increases in CO2 emissions

above a baseline, which is dened

as the average of emissions in 2019

and 2020. In 2020, the ICAO Council

ENVIRONMENT AND SUSTAINABILITY

The industry

strengthened

itssustainability

commitment

withFly Net Zero

Environment and Sustainability

31

IATA Annual Review 2022

Environment and Sustainability

IATA Annual Review 2022

32

decided that 2019 emissions

from international aviation will

be CORSIA’s baseline for its pilot

phase (2021–2023). However, the

baseline for 2024–2035 remains to

be decided and is under discussion

by ICAO member states. It should be

agreed on at ICAO’s 41st Assembly,

taking place from 27 September to

14 October 2022.

Progress to date

To reach the climate goal, the

aviation industry has unveiled a raft

of initiatives, from major purchases

of SAF and investments to grow

SAF supply, to prototype electric

and hydrogen aircraft. Bringing

sucient SAF to market and making

radical new technology a reality will

require a massive eort from all

stakeholders in the sector.

● In 2021, 100 million liters of

SAFwere produced and used

byairlines. Some 38 countries

have passed SAF-specific

policies so far.

● In 2022, more than 450,000

flights will operate using SAF

andairlines will agree some

$17billion in forward purchases.

● New SAF production capacity is

coming online across the world.

● Airlines and manufacturers

are joining forces to develop

hydrogen-powered aircraft or

technical solutions to make

alternative means of propulsion

commercially viable.

To help passengers and the

industry accurately understand

their emissions, in March 2022

IATA released the rst Industry-

developed Passenger CO2

Calculation Methodology. It uses

veried airline operational data

to provide the most accurate

emissions calculation for a

specicight. This is particularly

true in the corporate sector where