845

ARTICLES

TAXING SPORTS

JOHN T. HOLDEN

*

& KATHRYN KISSKA-SCHULZE

**

Sports are no longer mere games. In today’s money-driven culture, they have

cultivated into a lucrative business enterprise where everyone—whether

professional or amateur; owner or player; coach or spectator—stands to make

significant money. Modern sports have also morphed into a landscape

encompassing both the traditional athletic events and the more novel esports and

daily fantasy sports (DFS) arenas. Across all these physical, digital, and

biological spheres, sports revenues are being measured in terms of billions. It thus

stands to reason why taxes have become a progressively critical discussion point

within U.S. professional and collegiate sports, the video gaming world, and the

newly legalized sports gambling industry. This Article is the first to provide a

holistic and modern analysis of the impact of U.S. tax law across the

contemporary business of sports and explore a more universal approach to the

varying tax issues affecting numerous relevant stakeholders, including

franchises, business ventures, universities, athletes, individuals, and federal

and state taxing jurisdictions.

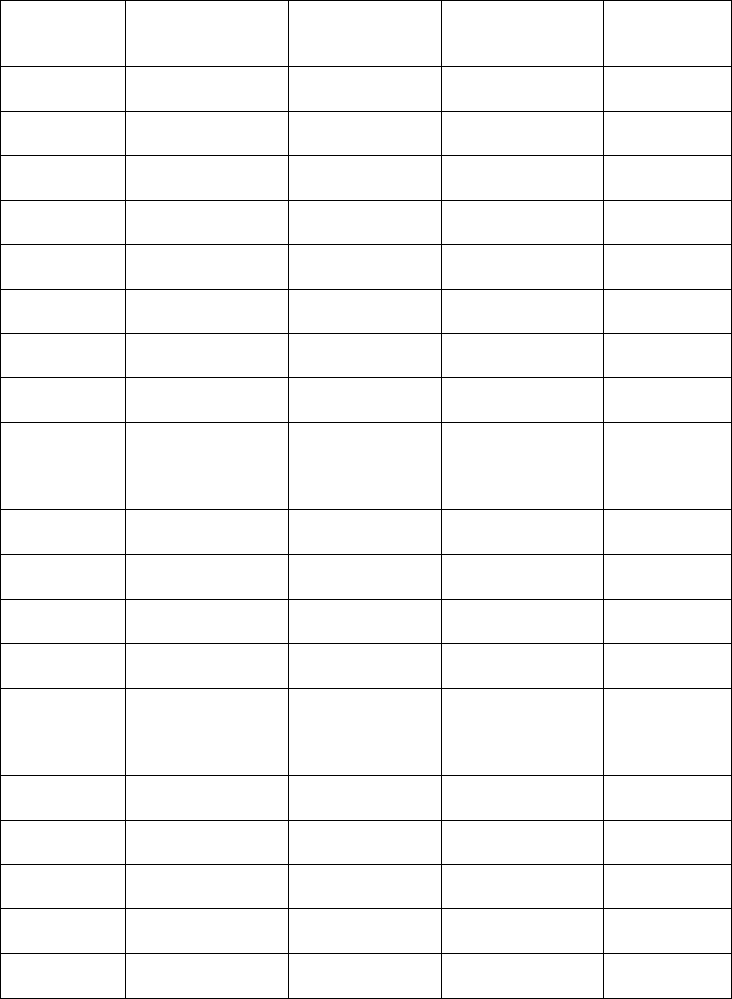

TABLE OF CONTENTS

Introduction ................................................................................ 846

I. Taxing U.S. Sports: A Historical Exploration ................ 855

A. Notable Tax Issues in Professional Sports ................ 857

1. The preferential tax treatment of

franchise owners and stadiums ............................ 858

2. The jock tax .......................................................... 862

3. Tax exemptions .................................................... 864

* Assistant Professor, Spears School of Business, Oklahoma State University.

** Associate Professor, Wilbur O. and Ann Powers College of Business, Clemson University.

846 AMERICAN UNIVERSITY LAW REVIEW [Vol. 71:845

B. The Historic Relationship Between

Taxes and College Sports .......................................... 866

1. The NCAA and member institutions’

tax-exempt status .................................................. 867

2. The unrelated business income tax .................... 868

3. Student-athletes’ grants-in-aid ............................. 869

4. Charitable donation deductions ......................... 870

II. Taxing Professional Sports: A Modern Update ............ 872

A. Financing Public Stadiums ........................................ 872

B. The TCJA’s Impact on Professional Sports .............. 874

III. Taxing College Sports .................................................. 877

A. The TCJA’s Impact on College Sports ...................... 883

1. Eliminating 80/20 ................................................ 883

2. Taxing executive compensation .......................... 884

3. Taxing private endowments ................................ 885

4. Disincentivizing charitable giving ....................... 885

B. Taxing NIL Income ................................................... 887

IV. Taxing the Evolving U.S. Sports Industry .................... 890

A. Taxing Legalized Sports Gambling ........................... 892

1. Federal taxation of sports gambling ................... 893

2. State taxation of sports gambling ........................ 896

B. Taxing Daily Fantasy Sports ....................................... 900

C. Taxing Esports ........................................................... 902

V. Recommendations for the Evolving

Business of Sports ............................................................. 905

Conclusion ................................................................................... 909

INTRODUCTION

It’s not just a game. To many, such sentiment embodies the acuteness

of current modern sport in the United States.

1

In recent decades,

1

. See, e.g., The Power and Politics of Sports: Why Games Aren’t Just Games Anymore, U. OF CHI.

INST. OF POL., https://web.archive.org/web/20210630124430/https://politics.uchicago

.edu/pages/juliet-macur-seminar-series (last visited Jan. 29, 2022); Luke Mason, The Economic

Impact of COVID-19 on US Sports, EMSI (May 28, 2020), https://usmain.wpengine.com/2020/

05/28/the-economic-impact-of-covid-19-on-us-sports-up-to-92-6k-lost-every-minute [https://

perma.cc/S2WB-76DE]; Hunter Amadeus Bayliss, Note, Not Just a Game: The Employment Status

and Collective Bargaining Rights of Professional ESports Players, 22 WASH. & LEE J. CIVIL RTS. & SOC.

JUST. 359, 360–61 (2016); Maureen A. Weston, COVID-19’s Lasting Impact on the Sports Industry:

Financial, Legal, and Innovation, 61 SANTA CLARA L. REV. 121, 157 (2020) (offering that “[s]port

is not ‘just a game’”); Henry M. Abromson, Comment, The Copyrightability of Sports Celebration

Moves: Dance Fever or Just Plain Sick?, 14 MARQ. SPORTS L. REV. 571, 574 (2004) (“Sport is not

2022] TAXING SPORTS 847

professional and amateur sports have transcended the boundaries of

American politics,

2

economics,

3

community values,

4

and mass media.

5

just a game it is a big business.”); Eric I. Long, The 1994 Baseball Strike Revisited: A Better Impasse

Analysis, 22 S. ILL. U. L.J. 117, 117 (1997) (opining that Major League Baseball is not a mere

game anymore, but a hugely profitable industry); see also Valrie Chambers & Michael E. Bitter,

Potential Tax Implications of NCAA Family Travel Allowances, 27 J. LEGAL ASPECTS SPORT 187, 192

(2017) (providing that college sports have morphed into a business); Marsha Durr, The

Tipping Point: Mayhem in College Sports Requires Congress to Finally Intervene in NCAA Governance,

8 ARIZ. ST. SPORTS & ENT. L.J. 26, 27 (2018) (opining that college sports have evolved from a

“niche pastime to a multi-billion-dollar industry”); David Ray Papke, Athletes in Trouble with the

Law: Journalistic Accounts for the Resentful Fan, 12 MARQ. SPORTS L. REV. 449, 449 (2001) (noting

that American sports have transitioned from being mere games to extremely lucrative

commercial enterprises).

2

. See, e.g., Sports, Politics & Social Movements, 25 JEFFREY S. MOORAD SPORTS L.J. 147, 147

(2018) (discussing the heightened awareness of political expression in modern professional

sports); Meredith McCleary, Politics and Sports: A Long and Complicated Relationship, NE. UNIV.

POL. REV. (Feb. 26, 2019), https://www.nupoliticalreview.com/2019/02/26/politics-and-

sports-a-long-and-complicated-relationship [https://perma.cc/N9WK-BTTR] (discussing

players’ recent use of their platforms to communicate their views on civil rights issues); Chris

Sheridan, Sports and Politics Are Mixed Forever; Get Used to It, FORBES (Aug. 29, 2020, 8:08 AM),

https://www.forbes.com/sites/chrissheridan/2020/08/29/sports-and-politics-are-mixed-

forever-get-used-to-it/?sh=1f7e0d636a54 (listing several historical moments where athletes

took publicized political stances).

3

. See, e.g., WLADIMIR ANDREFF & STEFAN SZYMANSKI, HANDBOOK ON THE ECONOMICS

OF SPORT (2006) (examining the myriad components of the international sports

economy and governance); Daniel A. Rascher et al., The Unique Economic Aspects of

Sports, 6 J. GLOB. SPORT MGMT. 1, 1–13 (July 29, 2019) (observing that “what makes the

economics of sports different from virtually any other product is that the product itself

is unique”); Walter C. Neale, The Peculiar Economics of Professional Sports, 78 Q.J.

ECONOMICS 1, 4 (1964) (describing professional sports as natural monopolies).

4

. See, e.g., Emily Sparvero & Laurence Chalip, Professional Teams as Leverageable Assets:

Strategic Creation of Community Value, 10 SPORT MGMT. REV. 1, 3–4 (2007) (discussing the

spike in public funding funneled into sports entertainment programs as a result of a neo-

liberal model of profit-driven governance); Laura Depta, 12 Ways Sports Make a Positive

Impact, BLEACHERREPORT (Feb. 2, 2015), https://bleacherreport.com/articles/2347988-12-

ways-sports-make-a-positiveimpact [https://perma.cc/6LH2-KZQ7] (listing the many

public benefits derived from sports, including job production, health, and community

enjoyment); Noelle Nikpour, Impact of Sports Is Huge in Society, SUN SENTINEL (Oct. 2, 2011),

https://www.sun-sentinel.com/news/fl-xpm-2011-10-02-fl-nncol-sports-oped1002-201110

02-story.html [https://perma.cc/KQ7L-5LWX] (regaling the sociocultural benefit of New

Orleans Superbowl win in the wake of Hurricane Katrina).

5

. See, e.g., Aafid Gulam, Role of Mass Media in Sports Communication, 1 INT’L J.

ADVANCED EDUC. RES. 5, 51–53 (2016) (evaluating the effects of sports across media

platforms and detailing the benefit to historically underrepresented communities in

sports); Cory Tadlock, Comment, Copyright Misuses, Fair Use, and Abuse: How Sports and

Media Companies Are Overreaching Their Copyright Protections, 7 J. MARSHALL REV. INTELL.

PROP. L. 621, 621 (2008) (evaluating how sports and media companies copyright

848 AMERICAN UNIVERSITY LAW REVIEW [Vol. 71:845

One need look no further than the social justice movements led by

high-profile athletes like Colin Kaepernick and Trevor Lawrence

who—among many others—established mobilized platforms to spur

collective action.

6

Author Michael Lewis’s bestseller, Moneyball: The Art

of Winning an Unfair Game, brought to light the impact of game theory

on strategizing sports and economics.

7

Society’s longing for increased

sports-related virtues like honesty, respect, teamwork, and dedication

extends beyond chalk-lined fields into classrooms, workspaces, and

communities.

8

Certainly, Hollywood, the video game industry, television

broadcasters, sports media companies, and leagues have capitalized on

warnings often exceed their legal authority); Arthur Miller Dialogue on “Sports, Media and

Race: The Impact on America”, 12 TEX. REV. ENT. & SPORTS L. 251, 256–57 (2011)

(describing the prevalence of white men over Black people and women in the sports

media industry); Frank Ryan & Matt Ganas, Rights of Publicity in Sports-Media, 67

SYRACUSE L. REV. 421, 421–24 (2017) (describing how the NLRB is changing students-

athletes’ rights in private universities).

6

. See Adam Epstein & Kathryn Kisska-Schulze, Northwestern University, The

University of Missouri, and the “Student-Athlete”: Mobilization Efforts and the Future, 26 J.

LEGAL ASPECTS SPORT 71, 89 (2016) (examining the impact of student-athlete

mobilization efforts on U.S. collegiate athletic reform); Roger M. Groves, Memorandum

from Student-Athletes to Schools: My Social Media Posts Regarding My Coaches or My Causes

Are Protected Speech—How the NLRB Is Restructuring Rights of Student-Athletes in Private

Institutions, 78 LA. L. REV. 69 (2017) (analyzing the relationship between student-

athlete activism and the institutions they play for); Adam Epstein, The Ambush at Rio,

16 J. MARSHALL REV. INTELL. PROP. L. 350, 373 (2017) (offering that professional and

amateur athletes embrace social media outlets to voice their opinions on select

injustices); Nicholas C. Daly, Note, Amateur Hour Is over: Time for College Athletes to Clock

in Under the FLSA, 37 GA. ST. U. L. REV. 471, 481–82 (2021) (noting that the NCAA’s

failure to issue COVID-19 directives to member institutions resulted in collective

groups of athletes advocating for health and safety protocols so they could play).

7

. See MICHAEL LEWIS, MONEYBALL: THE ART OF WINNING AN UNFAIR GAME (2004);

see also Panelists: Jeffrey S. Moorad, Billy Beane, Omar Minaya, & Phil Griffin,

Symposium, “Moneyball’s” Impact on Business and Sports, 19 VILL. SPORTS & ENT. L.J. 425,

450–51 (2012); Lara Grow & Nathaniel Grow, Protecting Big Data in the Big Leagues:

Trade Secrets in Professional Sports, 74 WASH & LEE L. REV. 1567, 1575 (2017) (offering

that “Moneyball” launched sabermetric principles into the sports arena, effectuating a

new way of thinking about sports).

8

. See DISCOVERY EDUC., WHAT SPORT MEANS IN AMERICA: A STUDY OF SPORT’S

ROLE IN SOCIETY 3 (2011), http://www.truesport.org/library/documents/about/

what_sport_means_in_america/what_sport_means_in_america.pdf

[https://perma.cc/PUN5-85H6] (detailing the role sport has in the moral

development of young students).

2022] TAXING SPORTS 849

the premise that sport—no matter its form—is not just a game, but a

lucrative enterprise from which to financially capitalize on.

9

Long gone are the days when athletes competed purely for spectator

adoration.

10

Today, sports are a big business where players, coaches,

owners, leagues, associations, commercial enterprises, fans, sponsors, the

media, and anyone in between stand to make (or lose) considerable

money.

11

U.S. sports have evolved into a multi-billion dollar industry,

12

encompassing both traditional athletic events and the more novel esports

and daily fantasy sports (DFS) arenas.

13

PricewaterhouseCoopers forecasts

the North American sports market value will reach $83.1 billion by 2023.

14

The National Football League (NFL) currently tops U.S. league market

revenues at $13 billion with Major League Baseball (MLB) sitting second

at $9.5 billion.

15

In fiscal year 2019, Division I college athletics boasted

9

. See, e.g., Chris Morgan, Football and Hollywood: A Retrospective, YARDBARKER (Aug.

28, 2021), https://www.yardbarker.com/entertainment/articles/football_and_

hollywood_a_retrospective/s1__31243898#slide_1 [https://perma.cc/DK9M-C6VC]

(listing a myriad of football stories depicted in Hollywood movies); STEPHEN F. ROSS &

STEFAN SZYMANSKI, FANS OF THE WORLD UNITE! A (CAPITALIST) MANIFESTO FOR SPORTS

CONSUMERS 22 (2008) (offering that avid fans enjoy sports, regardless of their

exploitation); Shafin Diamond Tejani, The Future of Sports Looks a Lot like Video Games,

MARKER (May 12, 2020), https://marker.medium.com/the-future-of-sports-looks-a-lot-

like-video-games-591e55e8eb40 (noting that video games are a “natural pivot” from

live sports).

10

. Wm. Tucker Griffith, Note, Beyond the Perfect Score: Protecting Routine-Oriented

Athletic Performance with Copyright Law, 30 CONN. L. REV. 675, 676 (1998) (noting that

Grecian Olympiads completed in athletic events to win spectator affection).

11

. See Kara Fratto, The Taxation of Professional U.S. Athletes in Both the United States

and Canada, 14 SPORTS LAWS. J. 29, 29 (2007) (opining that increased athlete salaries,

ticket prices, franchise costs, and contemporary sporting facilities have propelled

professional sports into a big business); see also Kathryn Kisska-Schulze, This Is Our

House!—The Tax Man Comes to College Sports, 29 MARQ. SPORTS L. REV. 347, 351–55

(2019) (discussing the lucrative business of college sports).

12

. See PRICEWATERHOUSECOOPERS, PWC 2021 SPORTS OUTLOOK (2021), https://www.p

wc.com/us/en/industries/tmt/assets/pwc-2021-tmt-sports-outlook.pdf

[https://perma.cc/96WZ-WCYM] [hereinafter PWC 2021] (analyzing the compound

annual growth rate of North American Sports).

13

. See John T. Holden et al., A Short Treatise on Esports and the Law: How America

Regulates Its Next National Pastime, 2020 U. ILL. L. REV. 509, 511 (2020) (offering that

esports is a billion-dollar industry); see also Daniel J. Larson, Note, Can Daily Fantasy

Sports Overcome the Odds?, 17 J. HIGH TECH. L. 451, 451 (2017) (documenting that DFS

is a multi-billion dollar industry).

14

. See PWC 2021, supra note 12, at 2.

15

. Devon Anderson, Ranking Professional Sports Leagues by Revenue, ULTIMATE CORP.

LEAGUE (Apr. 10, 2019), https://ultimatecorporateleague.com/ranking-professional-

sports-leagues-by-revenue [https://perma.cc/46P5-2BDW].

850 AMERICAN UNIVERSITY LAW REVIEW [Vol. 71:845

revenues of $15.8 billion.

16

Although historically a mere “subset of sports

culture,” esports have since matured into an industry all to its own, with a

2022 market value forecast of $1.8 billion.

17

In 2018, the U.S. DFS industry

generated $2.9 billion.

18

The recently expanded legalized sports betting

industry is funneling millions of dollars into select state coffers monthly,

19

while in 2018, U.S. sports media rights revenue reached $21.88 billion.

20

Even youth sports have blossomed into a billion-dollar industry.

21

Although staggering, these numbers fail to reflect the engorged salaries

of coaching staff and professional athletes.

22

Measuring figures in terms of “billions” naturally gratifies the

paradigm that sport is not just a game anymore. Across the globe, the

sports industry is valued between $480 and $620 billion,

23

eclipsing

national gross domestic product (GDP) rates in most countries.

24

Notably, the U.S. leads the global sports industry with 32.5% of the

16

. NCAA RSCH., 15-YEAR TRENDS IN DIVISION I ATHLETICS FINANCES (2020), https://

ncaaorg.s3.amazonaws.com/research/Finances/2020RES_D1-RevExp_Report.pdf

[https://perma.cc/KX4G-T4S2].

17

. Esports Ecosystem Report 2021: The Key Industry Companies and Trends Growing the

Esports Market, BUS. INSIDER (Aug. 3, 2021), https://www.businessinsider.com/esports-

ecosystem-market-report [https://perma.cc/4JU3-N2N9].

18

. MORDOR INTEL., NORTH AMERICAN FANTASY SPORTS MARKET—GROWTH,

TRENDS, COVID-19 IMPACT, AND FORECASTS (2021–2026),

https://www.mordorintelligence.com/industry-reports/north-america-fantasy-sports-market

[https://perma.cc/4CUM-KNEU].

19

. US Sports Betting Revenue 2020, LINES, https://www.thelines.com/betting/

revenue [ https://perma.cc/PGG2-MUWF].

20

. Christina Gough, Sports Media Rights Total Revenue in the U.S. 2021, STATISTA

(Feb. 26, 2021), https://www.statista.com/statistics/1024089/sports-media-rights-

revenue-usa [https://perma.cc/RU2R-W4K2].

21

. Sean Gregory, How Kids’ Sports Became a $15 Billion Industry, TIME (Aug. 24, 2017,

6:45 AM), https://time.com/4913687/how-kids-sports-became-15-billion-industry.

22

. See Kathryn Kisska-Schulze & Adam Epstein, “Show Me the Money!”—Analyzing

the Potential State Tax Implications of Paying Student-Athletes, 14 VA. SPORTS & ENT. L.J. 13,

29 (2014) (opining that escalating professional athlete salaries have prompted

increased scrutiny from state taxing jurisdictions); Lora Wuerdeman, Comment,

Sidelining Big Business in Intercollegiate Athletics, How the NCAA Can De-Escalate the Arms

Race by Implementing a Budgetary Allocation for Athletic Departments, 39 N.C. CENT. L. REV.

85, 89 (2017) (noting that collegiate coaching salaries have risen 500% since 1985);

Fratto, supra note 11, at 29 (opining that professional athletes’ salaries have escalated).

23

. Sports Industry Highlights, MEDIUM (Oct. 17, 2019), https://medium.com/qara/

sports-industry-report-3244bd253b8 [https://perma.cc/5GG5-YG3F].

24

. The Sports Market, KEARNEY, https://www.nl.kearney.com/communications-

media-technology/article?/a/the-sports-market [https://perma.cc/78WM-53MA].

2022] TAXING SPORTS 851

market share.

25

Thus, it stands to reason why taxation has become a

progressively critical discussion point within U.S. professional and

amateur sports arenas, the video gaming world, and legalized sports

gambling industry. U.S. taxing jurisdictions continue to pursue

opportunities to usurp larger portions of this revenue-sharing

market.

26

Such efforts are not surprising, given that the U.S. economy

has weathered two recessions since September 11, 2001, and a global

pandemic.

27

Due in large part to these national economic crises,

individual states are foraging for alternative revenue sources to

counterbalance evaporating federal subsidies, with particular interest

paid to the emergent legalized sports betting market.

28

In addition,

Congress has shown increased interest in garnering a larger

percentage of professional athletes’ salaries and sports franchise

operation revenue,

29

while making it more difficult for colleges and

25

. D.Tighe, Share of the Global Sports Market 2018, by Country, STATISTA (Nov. 27.

2020), https://www.statista.com/statistics/1087429/global-sports-market-share-by-

country (calculating that China holds a distant second spot at 12.7% of the market

share).

26

. See, e.g., Kathryn Kisska-Schulze & John T. Holden, Betting on Education, 81

OHIO ST. L.J. 465, 509–10 (2020) (providing that over 100 bills have been introduced

in the U.S. to legalize sports betting in an effort to support states’ future budgets);

Kisska-Schulze & Epstein, supra note 22, at 29 (noting that escalating professional

athletes’ salaries have led states to more closely scrutinize them for tax purposes); Ross

Dellenger, New Congressional NIL Bill Targets Expansive Change to Athlete Compensation,

Video Game Licensing, SPORTS ILLUSTRATED (Feb. 4, 2021), https://www.si.com/college/

2021/02/04/ncaa-nil-video-game-rights-congress-bill [https://perma.cc/R987-

LUB8] (detailing the Congressional bill granting college athletes the right to strike

collective bargaining agreements).

27

. See Rebecca N. Morrow, Accelerating Depreciation in Recession, 19 FLA. TAX REV.

465, 471 (2016) (noting that there have been two recent recessions, one in 2001 and

the second in 2007); see also Rodney P. Mock & Kathryn Kisska-Schulze, Saving the

Nonessential with Radical Tax Policy, 90 U. CIN. L. REV. 197, 199 (2021) (offering that the

onset of the COVID-19 pandemic resulted in the United States suffering rapid

economic decline).

28

. See Kisska-Schulze & Holden, supra note 26, at 480–81; see also Andrew

Osterland, State Tax Departments Set Their Sights on Pro-Athletes’ Earnings, CNBC (Jan. 11,

2021, 8:30 AM), https://www.cnbc.com/2021/01/11/state-tax-departments-set-their-

sights-on-pro-athletes-earnings-.html [https://perma.cc/LED8-RTMK].

29

. See Mark Goldstick, How Trump’s New Tax Bill Will Impact Star Athletes, SPORTS

ILLUSTRATED (Apr. 17, 2018), https://www.si.com/more-sports/2018/04/17/donald-

trump-new-tax-bill-athletes-salaries-states [https://perma.cc/V4YW-GDUH] (describing

how former President Trump’s tax plan would eliminate athletes’ deductions for many

items, including training expenses, union dues, and agent commission); see also Kari

Smoker et al., Pandora’s Box Enters the Batter’s Box: How the Tax Cuts and Jobs Act’s Unintended

Consequences Places MLB, and All North American Leagues, in Tax Chaos, 26 JEFFREY S.

852 AMERICAN UNIVERSITY LAW REVIEW [Vol. 71:845

universities to acquire necessary funding for their athletic programs.

30

Taxes are definitely complicating sports.

31

Over the last five decades, sports betting has eclipsed the separate

industries that drove its development. In 2008, scholars Robert Holo

and Jonathan Talansky published a formative article addressing the tax

implications surrounding the “business of sports,” or perhaps more

appropriately branded, the “business of American professional

franchises.”

32

In particular, their work detailed the Internal Revenue

Service’s (IRS) varied attempts to keep pace with the rapidly growing

professional sports industry amidst then-recent legislative and

regulatory actions. Holo and Talansky focused primarily on taxing

sponsorship and broadcasting revenue,

33

ticket sales and seat

licensing,

34

franchise player contracts,

35

intangibles,

36

individual player

contracts,

37

and catching the home run ball.

38

While these issues

remain germane to professional franchises, thirteen years later the

“business of sports” has expanded considerably.

39

DFS took off in 2009,

after Nigel Eccles launched FanDuel, one of the two largest U.S.

MOORAD SPORTS L.J. 291–93 (2019) (evaluating the TCJA’s impact on professional sports

trades and noting that “[f]or the first time in over fifty years, the gains realized on

professional sports trades are no longer tax-exempt”).

30

. Kisska-Schulze, supra note 11, at 347–48 (examining the impact of the TCJA

on college sports programs).

31

. See, e.g., Taxes in Sports Make Game Day Complicated, NE. U. D’AMORE-MCKIM SCH.

BUSINESS, https://onlinebusiness.northeastern.edu/blog/taxes-in-sports-make-game-day-c

omplicated [https://perma.cc/NZT2-EVTV] (explaining how discrepancies in the top tax

brackets across the states are magnified by salary caps); K. Sean Packard, Income Taxes for

Pro Athletes Are Reminder of How Complicated U.S. Tax Code Is, FORBES (Apr. 18, 2021, 9:20 AM),

https://www.forbes.com/sites/kurtbadenhausen/2017/04/18/income-taxes-for-pro-

athletes-are-reminder-of-how-complicated-u-s-tax-code/?sh=7a4c60b3411e [https://perm

a.cc/4XJZ-YDQU] (describing how many people struggle to understand which tax forms

to use to report income and which items to deduct); The Esports Tax Reckoning: What Players

and Teams Need to Know, GORDON L. (Feb. 24, 2020), https://gordonlawltd.com/esports-

tax-reckoning [https://perma.cc/84VB-YUC8] (noting that some states have initiated

programs to help athletes understand their tax obligations).

32

. Robert Holo & Jonathan Talansky, Taxing the Business of Sports, 9 FLA. TAX REV.

161, 162, 163 (2008).

33

. Id. at 163–77.

34

. Id. at 177–85.

35

. Id. at 184–85.

36

. Id. at 184–206.

37

. Id. at 205–08.

38

. Id. at 208–14.

39

. See PWC 2021, supra note 12.

2022] TAXING SPORTS 853

fantasy sports sites.

40

Although video games have been integral to U.S.

culture since Space Invaders entered homes in the 1970s,

41

modern

esports exploded after 2010, when the livestreaming gaming platform

Twitch turned video games into a spectator sport.

42

In 2017, then-

President Donald Trump signed into law the Tax Cuts and Jobs Act

43

(TCJA), impacting both professional and collegiate athletics.

44

Subsequently, in 2018, the U.S. Supreme Court held that the federal

prohibition on sports wagering unconstitutionally commandeered

state legislatures, thus opening the door for all states to capitalize on

sports-betting revenue.

45

Just one year later, California became the first

of many states to legislatively allow student-athletes to capitalize on the

commercialized use of their name, image, and likeness (NIL).

46

Later,

in 2021, the U.S. Supreme Court unanimously struck down the

National Collegiate Athletic Association’s (NCAA) rules restricting

unlimited, in-kind benefits provided to Division-I basketball and bowl

subdivision football student-athletes.

47

The time is ripe to reexamine the impact of tax across the entire

“business of sports” amidst a more contemporary setting. Certainly,

there has always existed a connection between sports and taxation.

48

Indeed, the effect of tax law on the U.S. sports industry has cultivated

into a rich platform of academic discourse.

49

However, there exists a

40

. See Joshua Shancer, Legislative Update: Daily Fantasy Sports and the Clash of Internet

Gambling Regulation, 27 DEPAUL J. ART TECH. & INTELL. PROP. L. 295, 307 (2017).

41

. See Space Invaders, ENCYC. BRITANNICA (Apr. 8, 2015), https://www.britannica.c

om/topic/Space-Invaders [https://perma.cc/XB7Q-4S2J].

42

. Ben Popper, Field of Streams: How Twitch Made Video Games a Spectator Sport,

VERGE (Sept. 30, 2013, 9:00 AM), https://www.theverge.com/2013/9/30/4719766/

twitch-raises-20-million-esports-market-booming [https://perma.cc/H5JH-YCPU].

43

. Pub. L. No. 115-97, 131 Stat. 2054 (codified at 26 U.S.C. §§ 274, 512).

44

. See H.R. 1, 115th Cong. § 13704 (2018); see also Kisska-Schulze, supra note 11,

at 347–48 (examining the TCJA’s impact on college sports); Smoker et al., supra note

29 (evaluating impact of the TCJA on professional sports trades).

45

. See Murphy v. Nat’l Collegiate Athletic Ass’n, 138 S. Ct. 1461, 1478 (2018); see

also Kisska-Schulze & Holden, supra note 26, at 509–10 (analyzing the intersection

between sports gambling, education, and taxation).

46

. See Fair Pay to Play Act, CAL. EDUC. CODE § 67456(a)(1), (3), (e)(1) (2021); see

also Kathryn Kisska-Schulze & Adam Epstein, Changing the Face of College Sports One Tax

Return at a Time, 73 OKLA. L. REV. 3, 457–59 (2021) (examining the federal and state

tax implications of student-athletes once they capitalize on NIL earnings).

47

. See Nat’l Collegiate Athletic Ass’n v. Alston, 141 S. Ct. 2141 (2021).

48

. See infra Part I.

49

. See, e.g., Richard Schmalbeck & Lawrence Zelenak, The NCAA and the IRS: Life

at the Intersection of College Sports and the Federal Income Tax, 92 S. CAL. L. REV. 1087, 1087–

854 AMERICAN UNIVERSITY LAW REVIEW [Vol. 71:845

lacuna in the current literature in providing a holistic picture of the

influence of tax across all facets of U.S. sport as it exists today. The

purpose of this Article is to fill that void.

This Article adds to present scholarly literature by updating and

extending Holo and Talansky’s formative work, providing both historic

and modernized analyses of the effect of U.S. tax law across the newly

expanded “business of sports.”

50

While Holo, Talansky, and others have

focused their analyses on nuanced tax issues affecting professional and

amateur sports, video gaming, DFS, and sports gambling,

51

this Article

is the first to bring these discussions together to offer a more universal

representation of the impact of U.S. taxes across multiple relevant

players, including franchises, business ventures, universities, athletes,

individuals, and federal and state taxing jurisdictions. This Article then

proposes select tax recommendations for the future, in light of this

rapidly expanding arena.

To appreciate the evolving tax landscape amidst a revolutionized

U.S. sports industry, this Article proceeds as follows. Part I examines

the historic connection between U.S. sports and taxation. Part II

assesses the impact of tax legislation on the U.S. professional sports

89 (2019) (scrutinizing the convergence of federal tax law and college athletics);

Nathaniel Grow, Regulating Professional Sports Leagues, 72 WASH. & LEE L. REV. 573, 599–

600 (2015) (opining on tax subsidy opportunities for new sports leagues); Addison

Fontein, Comment, The Home Team Advantage: Why Lawmakers and the Judiciary Should

Bench the Jock Tax, 7 ARIZ. ST. SPORTS & ENT. L.J. 327, 328 (2018) (disagreeing with the

constitutionality of the jock tax); Alan Pogroszewski, When Is a CPA as Important as Your

ERA? A Comprehensive Evaluation and Examination of State Tax Issues on Professional

Athletes, 19 MARQ. SPORTS L. REV. 395, 395, 402 (2009) (discussing the application of

state tax laws to professional athletes).

50

. To the extent possible, the purpose of this Article is to examine major tax

issues impacting professional and collegiate sports, as well as the legalized gambling,

DFS, and esports industries. However, the Authors acknowledge that this analysis is

not complete across all facets of sport. For example, there exist tax issues within select

areas of sport, including the Olympics (see, e.g., United States Appreciation for

Olympians and Paralympians Act of 2016, H.R. 5946, 114th Cong. (2016)) and horse

racing (see, e.g., Horseracing Integrity and Safety Act of 2020, H.R. 1754, 116th Cong.

(2020)), which are not touched on in this Article. Further, this Article does not

purport to opine on every conceivable tax issue that may arise among relevant sports

industry stakeholders.

51

. See Holo & Talansky, supra note 32, at 162; see also John T. Holden & Thomas

A. Baker III, The Econtractor? Defining the Esports Employment Relationship, 56 AM. BUS. L.J.

391, 418 (2019) (noting that taxes play a role in esports competitions); Matthew H.

Hambrick, Comment, Is the Recent Trend of States Legalizing Daily Fantasy Sports in an

Effort to Raise Revenue a “Safe Play” to Make Money or Simply a “Hail Mary”?, 48 CUMB. L.

REV. 243, 274–82 (2017) (exploring state efforts to tax DFS revenue).

2022] TAXING SPORTS 855

arena. Part III identifies the various tax exposures facing the college

sports arena, both at the institutional and student-athlete levels. Part

IV explores the tax implications surrounding the legalized sports

gambling industry, DFS, and esports. Part V provides select tax

recommendations surrounding the expanding U.S. sports arena.

Finally, this Article concludes that taxes play an integral role in the

continuously evolving sports industry, with both Congress and the

states progressively targeting it.

I. TAXING U.S. SPORTS: A HISTORICAL EXPLORATION

In 2017, Bloomberg published an article headlined, “Buy a Sports

Team, Get a Tax Break.”

52

Facially, such a recommendation may sound

absurd to the casual reader; however, following the implementation of

the American Jobs Creation Act of 2004,

53

sports franchise owners can

deduct large portions of their team’s purchase price against their

taxable income.

54

Such benefits allowed Los Angeles Clippers owner

Steve Ballmer to pay just 12% in taxes on his 2018, $656 million

earnings.

55

Professional sports team owners have long used their franchises to

entertain broad tax benefits, with few (if any) being more creative than

businessman Bill Veeck.

56

After purchasing the Cleveland Indians

(soon to be Guardians) baseball team in 1946, Veeck launched a

successful lobbying effort to allow team owners to deduct player

contracts as depreciable assets, thus codifying the Roster Depreciation

Allowance (RDA).

57

The RDA allows professional sports team owners

to amortize the purchase price of their franchise over a fifteen-year

52

. Justin Fox, Buy a Sports Team, Get a Tax Break, BLOOMBERG (Sept. 8, 2017, 1:55

PM), https://www.bloomberg.com/opinion/articles/2017-09-08/buy-a-sports-team-get-

a-tax-break.

53

. Pub. L. 108-307 357, 118 Stat. 1418 (2004) (codified at 26 U.S.C. § 1).

54

. See I.R.C. § 197 (establishing that the deductible amount is amortized over a

fifteen-year period); Treas. Reg. § 1.197-2 (b)(10); see also Fox, supra note 52.

55

. Robert Faturechi et al., The Billionaire Playbook: How Sports Owners Use Their

Teams to Avoid Millions in Taxes, PROPUBLICA (July 8, 2021, 5:00 AM), https://www.pro

publica.org/article/the-billionaire-playbook-how-sports-owners-use-their-teams-to-av

oid-millions-in-taxes?utm_source=sailthru&utm_medium=email&utm_campaign=IRS

&utm_content=feature [https://perma.cc/29KL-S5J2].

56

. Stephen R. Keeney, The Roster Depreciation Allowance: How Major League Baseball

Teams Turn Profits into Losses, BASEBALL RSCH. J., Spring 2016, https://sabr.org/

journal/article/the-roster-depreciation-allowance-how-major-league-baseball-teams-

turn-profits-into-losses [https://perma.cc/T82K-PEEZ].

57

. Id.; 26 U.S.C. § 197.

856 AMERICAN UNIVERSITY LAW REVIEW [Vol. 71:845

period.

58

Some argue that the RDA allows team owners to misrepresent

the true value of their ownership stake through “gymnastic bookkeeping

techniques.”

59

Although Congress has periodically revised the tax laws

that impact the RDA, it has never sought to end the exemption

directly.

60

Even before Veeck’s successful RDA campaign, MLB team owners

sued the IRS over the ability to deduct the entirety of player contracts.

61

During that same period, MLB franchise owners were not solely unique

in seeking preferential IRS tax treatment. Between 1942 and 2015, the

NFL

62

—which morphed from a million into a billion-dollar enterprise

thanks in large part to broadcasting rights revenue—was recognized by

the IRS as a not-for-profit tax-exempt entity.

63

As professional sports

matured, and athletes and coaches were induced by more lucrative

contract agreements, state jurisdictions launched individual efforts to

gain a piece of the “business of sports” pie.

64

58

. 26 U.S.C. § 197; Keeney, supra note 56.

59

. Keeney, supra note 56. The RDA is not wholly unique. Numerous businesses

depreciate the costs of tangible and intangible assets. See, e.g., Elizabeth V. Zanet & Stanley C.

Ruchelman, Tax Basics of Intellectual Property, LANDSLIDE, July/August 2018, at 39, 40,

http://publications.ruchelaw.com/pdfs/2018/tax-basics-intellectual-property.pdf [https://

perma.cc/HRT2-W6V3] (discussing depreciating costs in the intellectual property space

where amortizable assets include intangible assets such as patents, copyrights, formulas,

processes, and designs). However, the RDA is distinctive because it applies to sports franchises.

Keeney, supra note 56. Unlike most assets, which become valueless after a period, sports

franchise values continue to increase. Id. The normal depreciation allowance generally

permits businesses to count losses as a cost of operation; however, the RDA permits companies

to count losses on assets with increasing values. Id.

60

. Id.

61

. Id. (citing Chi. Nat’l League Ball Club v. Comm’r, No. 57620, 1933 WL 4911

(B.T.A. Apr. 17, 1933), aff’d, Comm’r v. Chi. Nat’l League Ball Club, 74 F.2d 1010 (7th

Cir. 1935)); see also Comm’r v. Pittsburgh Athletic Co., 72 F.2d 883, 884 (3d Cir. 1934)

(affirming the Board of Tax Appeals decision that the cost of a player’s contract is a

business expense in the year it was paid including a contract with an option to renew).

62

. See Rohan Nadkarni, NFL Teams Made Record $7.24 Billion in National Revenue Last

Season, SPORTS ILLUSTRATED (July 20, 2015), https://www.si.com/nfl/2015/07/20/nfl-

national-revenue-money-sharing-billions [https://perma.cc/X8C9-C97F] (noting that

in 2015, the NFL generated $7.24 billion in revenue, with each team receiving $226.4

million in revenue sharing from the league).

63

. Jared Dubin, NFL Ends Tax Exempt Status After 73 Years: 3 Things to Know, CBS

SPORTS (Apr. 28, 2015, 1:36 PM), https://www.cbssports.com/nfl/news/nfl-ends-tax-

exempt-status-after-73-years-3-things-to-know [https://perma.cc/73BV-N8EQ]; see also

John Vrooman, The Economic Structure of the NFL, in THE ECONOMIC STRUCTURE OF THE

NATIONAL FOOTBALL LEAGUE: THE STATE OF THE ART, 7 (Kevin G. Quinn ed., 2012)

(noting the impact of broadcast media on the NFL’s economics).

64

. See infra Section I.A.2.

2022] TAXING SPORTS 857

Across a separate playing sphere, the college sports arena enjoyed

vast preferential tax treatment until the implementation of the TCJA.

65

Unlike professional athletes, student-athletes enjoy a wide berth of

favorable tax treatment based on their amateur status.

66

Similarly, the

college sports industry as a whole has enjoyed relatively amicable tax

treatment due to universities, athletic departments, and the NCAA

qualifying for tax-exempt status.

67

Some of this geniality, however, is

now shifting.

68

To appreciate the current status of taxation across the broader sports

arena, it is beneficial to first appraise a sampling of historic tax issues

impacting the greater U.S. sports sphere. As such, Section A examines

notable tax issues that have impacted professional sports. Section B

explores the historic impact of taxes on college sports.

A. Notable Tax Issues in Professional Sports

In 1789, Benjamin Franklin penned the famous quote: “in this world

nothing can be certain, except death and taxes.”

69

No one likes paying

taxes; but once revenue or income is generated, it is virtually

guaranteed that the tax man cometh.

70

Amidst the billion-dollar

professional sports industry, taxes play a critical role. In fact, significant

academic literature is dedicated to examining the impact of taxation

on both owners and athletes.

71

Across these varied discussions, three

65

. Schmalbeck & Zelenak, supra note 49, at 1089.

66

. Kisska-Schulze & Epstein, supra note 46, at 479.

67

. Kathryn Kisska-Schulze & Adam Epstein, The Claim Game: Analyzing the Tax

Implications of Student-Athlete Insurance Policy Payouts, 25 JEFFREY S. MOORAD SPORTS L.J.

231, 250 (2018).

68

. Kisska-Schulze & Epstein, supra note 46, at 480.

69

. See Madsen Pirie, Death and Taxes, ADAM SMITH INST. (Nov. 13, 2019),

https://www.adamsmith.org/blog/death-and-taxes [https://perma.cc/QUB4-59H4].

70

. See Ryan Cochran, Comment, “Failure to File” Syndrome; Lawyers, Accountants and

Specific Intent, 30 CUMB. L. REV. 507, 507 (2000).

71

. See, e.g., Scott A. Jensen, Comment, Financing Professional Sports Facilities with

Federal Tax Subsidies: Is It Sound Tax Policy?, 10 MARQ. SPORTS L.J. 425, 460 (2000)

(proposing that the Internal Revenue Code be amended to restrict or eliminate

stadium tax-exempt financing); Matthew Akers, A Race to the Bottom? International

Income Tax Regimes’ Impact on the Movement of Athletic Talent, 17 U. DENV. SPORTS & ENT.

L.J. 11, 56–59 (2015) (providing tax recommendations to better attract international

athletic talent); William H. Baker, Taxation and Professional Sports—A Look Inside the

Huddle, 9 MARQ. SPORTS L.J. 287, 288 (1999) (examining the tax implications of

professional sports franchises, stadiums, and athletes’ income); Jeffrey L. Krasney, State

Income Taxation of Nonresident Professional Athletes, 2 SPORTS LAWS. J. 127, 132 (1995)

(examining state and local taxation on migratory nonresident professional athletes);

858 AMERICAN UNIVERSITY LAW REVIEW [Vol. 71:845

areas remain historically pronounced: (1) the preferential tax treatment

of franchise owners and stadiums, (2) the jock tax, and (3) professional

sports leagues’ tax-exempt status.

1. The preferential tax treatment of franchise owners and stadiums

Numerous scholars have explored the historic use of taxpayer

money and tax-exempt bonds to finance professional sports stadiums.

72

Following Veeck’s successful campaign in securing the RDA,

73

then-

MLB commissioner Ford Frick began working toward stadium

subsidies to likewise revolutionize the business of sports.

74

Frick

announced that cities seeking professional baseball teams would be

required to subsidize stadium construction.

75

Effectively, tax dollars

built professional sports facilities.

76

Prior to Frick’s declaration, many

Richard A. Kaplan, Note, The NBA Luxury Tax Model: A Misguided Regulatory Regime, 104

COLUM. L. REV. 1615, 1617 (2004) (exploring the NBA luxury tax model).

72

. See, e.g., Logan E. Gans, Take Me out to the Ball Game, but Should the Crowd’s Taxes

Pay for It?, 29 VA. TAX REV. 751, 754 (2010) (discussing the evolution of stadium

construction financing and the taxes local governments use to finance the federally

tax-exempt bonds used today); Steven D. Zavodnick, Jr., Note, If You (Pay to) Build It,

They Will Come: Rethinking Publicly-Financed Professional Sports Stadiums After the Atlanta

Braves Deal with Cobb County, 53 GA. L. REV. 407, 410 (2018) (using the Atlanta Braves’s

new stadium as a case study to examine the history of publicly funded stadiums, the

bargaining power teams have over municipalities, and the perverse incentives of

federal tax laws on local governments); Daniel McClurg, Comment, Leveling the Playing

Field: Publicly Financed Professional Sports Facilities, 53 WAKE FOREST L. REV. 233, 234–35

(2018) (providing an overview of the tax loophole that allowed the use of tax-exempt

bonds for stadium construction to become the norm and exploring challenges to

financing plans); Frank A. Mayer, III, Stadium Financing: Where We Are, How We Got Here,

and Where We Are Going, 12 VILL. SPORTS & ENT. L.J. 195, 196–97 (2005) (noting the

historic use of private and public funding for stadiums and comparing the benefits

and drawbacks of each type of financing); Courtney Gesualdi, Note, Sports Stadiums as

Public Works Projects: How to Stop Professional Teams from Exploiting Taxpayers, 13 VA.

SPORTS & ENT. L.J. 281, 283, 294 (2014) (examining how the tax code incentivizes local

government officials to build professional sports stadiums using public funds).

73

. See supra notes 56–60 and accompanying text.

74

. Don Bauder, San Diego’s Welfare Plan for Hotel Owners, SAN DIEGO READER (Apr.

27, 2016), https://www.sandiegoreader.com/news/2016/apr/27/city-lights-conventi

on-centers-lose-bundles-money [https://perma.cc/E2WT-MDXK].

75

. Id. Although demands for public financing of professional sports stadiums and

arenas originated with Commissioner Frick, public construction of stadiums dates to

the early 1800s when stadiums were constructed with a wide range of uses in mind. See

id.; Mayer, supra note 72, at 207.

76

. See Sarah Kunst, Tax Cuts for Stadiums, Tax Cuts for Owners, Tax Cuts for Those

Who Don’t Need It, FORBES (Nov. 28, 2017, 10:59 PM), https://www.forbes.com/sites/

sarahkunst/2017/11/28/tax-cuts-for-stadiums-tax-cuts-for-owners-tax-cuts-for-those-

2022] TAXING SPORTS 859

teams played in privately owned stadiums, often constructed and

operated by team owners.

77

While select locales extolled funds to

construct stadiums in the hopes of attracting international events like

the Olympics during the early part of the twentieth century, it was not

until the 1960s that cities began funding professional sports stadiums

en masse.

78

In fact, in the nearly forty years between Frick’s nascent

vision and the 1990s, more than 75% of professional sports teams’

stadiums were erected via public funding.

79

The prospect of acquiring a professional sports team prompted

cities to seek avenues for enticement. Milwaukee was the first to

construct a publicly funded stadium in the hopes of attracting the

Braves baseball team in 1953.

80

The Dodgers left Brooklyn, New York

for Los Angeles, California in 1958, due to the City of Angels’s new

publicly funded stadium, an event that launched a cascade of similarly

funded stadiums across the country.

81

By the end of the 1950s, MLB

team owners saw new stadiums constructed with nearly 100% public

financing.

82

Capitalizing on the demand for baseball, MLB expanded

the number of professional teams during the 1960s from sixteen to

twenty-four.

83

With the rise in supply, public funding for stadiums later

decreased to a low 60% range.

84

During the 1970s and 1980s, cities continued bidding on

professional sports teams with promises of new stadiums. During this

period, thirty-nine stadiums were constructed.

85

Those numbers,

who-dont-need-it/?sh=4bee428f3bf6 [https://perma.cc/2EEW-Z8HS] (noting that

over the last fifteen years federal taxpayers have spent close to $4 billion funding the

thirty-six stadiums build with tax-exempt bonds).

77

. NEIL DEMAUSE & JOANNA CAGAN, FIELD OF SCHEMES: HOW THE GREAT STADIUM

SWINDLE TURNS PUBLIC MONEY INTO PRIVATE PROFIT 28 (2008).

78

. Zavodnick, supra note 72, at 411–12.

79

. DEMAUSE & CAGAN, supra note 77, at 28.

80

. See Marc Edelman, Sports and the City: How to Curb Professional Sports Teams’

Demands for Free Public Stadiums, 6 RUTGERS J.L. & PUB. POL’Y 35, 39–40 (2008) (observing

that in the two years after the Braves moved from Boston to Milwaukee, two other teams

relocated for publicly funded stadiums as well: the St. Louis Browns, which became the

Baltimore Orioles, and the Philadelphia Athletics, which moved to Kansas City).

81

. Zavodnick, supra note 72, at 412.

82

. Edelman, supra note 80, at 41. Professor Edelman attributes the rise in public

financing to the MLB limiting the supply of new baseball teams. By limiting supply,

the price for acquiring a team rose, namely in the form of public funding for stadium

construction. Id.

83

. Id. at 42.

84

. Id.

85

. Id. at 44.

860 AMERICAN UNIVERSITY LAW REVIEW [Vol. 71:845

however, were dwarfed by the next two decades. Between 1990 and

1998, thirty-two stadiums were built with public money, with another

forty constructed between 1999 and 2008.

86

In addition, increased

demands for sports stadiums ensued across shorter intervals. In 2002,

for example, the San Antonio Spurs sought a replacement arena only

ten years after the construction of its then-current stadium.

87

In the

1990s, cities began constructing new stadiums that appealed to older

stylistics with modern amenities (referred to as the stadium

renaissance), originating with the construction of Oriole Park at

Camden Yards in Baltimore, Maryland.

88

Along with new construction

came corresponding promises of economic redevelopment in surrounding

areas; however, many such promises seemingly missed the mark.

89

Despite the shortage of fulfilled returns, stadium construction

projects endured with increasing frequency and significant taxpayer

money.

90

For example, in 2017, Georgia taxpayers paid $700 million

86

. Id.

87

. Id. at 45.

88

. Noah Trister, The Camden Effect: At 25, Ballpark’s Legacy Is Large in MLB,

ASSOCIATED PRESS (Mar. 31, 2017), https://apnews.com/article/ef16520aaacf4d10ad

1328e43e203e25?utm_campaign=socialflow&utm_source=twitter&utm_medium=ap_

sports (following the construction of Camden Yards, the city of Cleveland constructed

the similarly styled Jacobs Field, since re-named to Progressive Field).

89

. Bloomberg News, Orioles Stadium Yields No Baltimore Rebirth, FIN. & COM. (Nov. 30,

2013, 6:55 AM), https://finance-commerce.com/2013/11/orioles-stadium-yields-no-

baltimore-rebirth [https://perma.cc/7EHW-SW46]. But see Thomas Boswell, Nationals

Park Has Become an Urban Development Triumph. Who Knew?, WASH. POST (Sept. 14, 2016),

https://www.washingtonpost.com/sports/nationals/nationals-park-has-become-an-

urban-development-triumph-who-knew/2016/09/14/7cf60e3c-7a80-11e6-bd86-

b7bbd53d2b5d_story.html (remarking on the transformation of Southeast Washington,

D.C. fueled in large part by the investment of taxpayer dollars in the ballpark).

90

. See Andy McGeady, The Great American Stadium: High Cost, Short Lifespan, IRISH

TIMES (May 24, 2016, 6:56 PM), https://www.irishtimes.com/sport/the-great-america

n-stadium-high-cost-short-lifespan-1.2659341 [https://perma.cc/AR4Y-9TB7] (noting

how the lifespan of U.S. stadiums has shortened to twenty years or fewer). There are

few areas studied by academic economists that seem to generate as much consensus as

the proposition that public financing of sport stadiums fails to economically benefit

taxpayers. See Robert A. Baade & Richard F. Dye, Sports Stadiums and Area Development:

A Critical Review, 2 ECON. DEV. Q. 265, 274 (1988) (finding the economic development

rationale used to justify publicly funding stadiums is weak and unsupported by

evidence); John Siegfried & Andrew Zimbalist, A Note on the Local Economic Impact of

Sports Expenditures, 3 J. SPORTS ECON. 361, 362 (2002) (noting the economic

development argument for publicly funding stadiums has been persuasive despite

being incorrect); Dennis Coates & Brad R. Humphreys, Do Economists Reach a

Conclusion on Subsidies for Sports Franchises, Stadiums, and Mega-Events, 5 ECON J. WATCH

2022] TAXING SPORTS 861

for the Atlanta Falcons’s Mercedes-Benz Stadium.

91

Oriole Park cost

Maryland citizens $14 million per year.

92

In fact, since 1997, NFL teams

have received almost $7 billion in taxpayer money to fund new

stadiums.

93

Moreover, professional sports teams have benefited from

hundreds of millions of dollars in federal subsidies to finance stadiums

via tax-exempt municipal bonds following the passage of the Tax

Reform Act of 1986.

94

These subsidies have accounted for significant

construction funding, including $431 million for the new Yankee

Stadium in New York, $205 million for Soldier Field in Chicago, and

$164 million for Paul Brown Stadium in Cincinnati.

95

Although some

have tried to restrict the use of these tax benefits, tax-exempt bonds

(in conjunction with taxpayer funding) continue to serve as the

mainstay for funding professional sports facilities.

96

294, 310–11 (2008) (highlighting the widespread agreement among economists that

sports subsidies do not have a positive impact on the local economy).

91

. Nicole Vowell, Millions of Taxpayer Dollars Spent on Sports Stadiums—Who’s Benefiting?,

FOX4 (Oct. 22, 2018, 2:41 PM), https://www.fox4now.com/news/national/democracy-

2018/millions-of-taxpayer-dollars-spent-on-sports-stadiumswhos-benefiting.

92

. James Dator, Publicly Funding Stadiums for Billionaires Is a Scam, SBNATION (June

9, 2021, 11:11 AM), https://www.sbnation.com/2021/6/9/22525916/public-funding-

stadiums-nfl-panthers [https://perma.cc/ENQ8-4ZDQ].

93

. Michael David Smith, NFL Stadiums Have Received an Estimated $6.7 Billion from

Taxpayers, NBC SPORTS (Mar. 28, 2017, 9:23 AM), https://profootballtalk.nbcsports.c

om/2017/03/28/nfl-stadiums-have-received-an-estimated-6-7-billion-from-taxpayers

[https://perma.cc/D5GT-9GPJ].

94

. See Tax Reform Act of 1986, Pub. L. No. 99-514, 100 Stat. 2085 (1986) (codified

in scattered sections of 26 U.S.C.); I.R.C. § 103(a); see also Jose Trejos, Senate Bill May End

Federal Tax Breaks for Stadiums, TAX FOUND. (June 19, 2017), https://taxfoundation.org/

senate-bill-may-end-federal-stadium-subsidies [https://perma.cc/24UA-RV2Q] (noting

the tax break for stadiums was an unintended consequence of the Tax Reform Act of

1986 which has resulted in over $3 billion in federal tax exemptions in the last two

decades).

95

. Wayne Anderman, Stadium Bonds: A Homerun or Strike out During the COVID-19

Pandemic?, MUNICIPALBONDS.COM (Sept. 2, 2020), https://www.municipalbonds.com/

education/stadium-bonds-homerun-or-strike-out-during-covid-19 [https://perma.cc/

DN8F-3TJ3].

96

. See Anoop K. Bhasin, Tax-Exempt Bond Financing of Sports Stadiums: Is the Price

Right?, 7 VILL. SPORTS & ENT. L.J. 181, 183–85 (2000) (noting that U.S. Senator

Moynihan opposed the use of tax-exempt bonds to fund professional stadiums);

Trejos, supra note 94 (documenting that Senators Cory Booker and James Lankford

sponsored a bipartisan bill in 2017 to end the practice of issuing tax-exempt bonds for

sports stadium construction).

862 AMERICAN UNIVERSITY LAW REVIEW [Vol. 71:845

2. The jock tax

Like stadium subsidies, much has been written on the so-called “jock

tax.”

97

Although cities, counties, and states willingly subsidize stadium

construction to the benefit of billionaire owners, many locales have not

afforded such gratuitous tax benefits to professional athletes.

98

Jock

taxes—which permit states to tax nonresident professional athletes’

income when engaging in sporting events hosted within their

jurisdictions

99

—originated in the 1960s, but became more widely

familiar in 1991 when California sought to collect taxes from Michael

Jordan and his Chicago Bulls teammates following their team’s defeat

of the Los Angeles Lakers in the National Basketball Association

(NBA) finals.

100

Illinois lawmakers responded in kind by passing

“Michael Jordan’s revenge,” which likewise taxed visiting teams playing

in their state.

101

Soon after, other states and cities, including Cleveland,

Kansas City, Philadelphia, and Detroit, passed similar taxes.

102

97

. See, e.g., Fontein, supra note 49, at 328–29 (arguing the jock tax is

unconstitutional because it allows a state to intentionally and systematically

discriminate and tax income extraterritorially); Alan Pogroszewski & Kari A. Smoker,

Is Tennessee’s Version of the “Jock Tax” Unconstitutional?, 23 MARQ. SPORTS L. REV. 415, 433

(2013) (examining Tennessee’s version of the jock tax and concluding that it is

unconstitutional); Nick Overbay, Comment, A Uniform Application of the Jock Tax: The

Need for Congressional Action, 27 MARQ. SPORTS L. REV. 217, 217–18 (2016) (arguing that

enacting a uniform allocation method for states to tax nonresident athletes would ease

administrative burdens and preempt constitutional challenges); Kirk Berger, Note,

Foul Play: Tennessee’s Unequal Application of Its Jock Tax Against Professional Athletes, 13

CARDOZO PUB. L. POL’Y & ETHICS J. 333, 337 (2014) (comparing jock taxes in the United

States and concluding that Tennessee’s jock tax is unconstitutional).

98

. See Mary Pilon, The Jock-Tax Man, NEW YORKER (Apr. 10, 2015), https://www.new

yorker.com/business/currency/the-jock-tax-man [https://perma.cc/K4WP-NYXK]

(describing special taxes levied against professional athletes when traveling to play in

other states).

99

. Fontein, supra note 49, at 327.

100

. Pilon, supra note 98.

101

. Id.; see also Jonathan Nehring, An Overview and History of the Jock Tax, TAXABALL

INCOME (Apr. 15, 2014), http://www.taxaball.com/blog/an-overview-and-history-of-

the-jock-tax [https://perma.cc/8K2A-9C3U] (documenting the origin of the jock tax

to 1968 when Dennis Partee of the San Diego Chargers challenged the California state

board of equalization over state taxes he owed).

102

. Jesse Barnhill, Michael Jordan Accidentally Created the ‘Jock Tax’ and Hurt the

Paychecks of Pro Athletes Forever, SPORTSCASTING (Nov. 13, 2020), https://www.sports

casting.com/michael-jordan-accidentally-created-the-jock-tax-and-hurt-the-paychecks-

of-pro-athletes-forever [https://perma.cc/28VQ-FWP6].

2022] TAXING SPORTS 863

The jock tax has certainly been lucrative for select jurisdictions, with

California recouping more than $200 million in annual revenue;

103

however, the tax is not imposed universally. While many jurisdictions

levy their established income tax rates on nonresident professional

athletes, others have been more creative.

104

For example, in 2009,

Tennessee imposed a privilege tax on NBA and National Hockey

League (NHL) athletes playing in the state.

105

The tax was assessed at

$2,500 per game, with a maximum annual tax burden of $7,500.

106

Following outcry from league unions, in 2014, Tennessee repealed the

tax, with the state ultimately refunding more than $8 million of the

approximately $18 million it acquired.

107

Similarly, Cleveland faced challenges from players over its jock tax.

108

Former Chicago Bears player Hunter Hillenmeyer sued, arguing that

Cleveland’s jock tax violated due process by imposing a tax calculation

formula based on games played.

109

Specifically, nonresident athletes

who competed in games in Cleveland were taxed as though their sole

job responsibility was to play games.

110

By competing in just one game

per year in Cleveland (out of a possible twenty), the city assessed a tax

on 5% of their salary.

111

Players objected, arguing that their wages were

tied to substantially more activities than mere gameplay, and claimed

the Cleveland tax burden was unconstitutionally high.

112

The Ohio

103

. Stefanie Loh, Fun Facts About the Jock Tax, SAN DIEGO UNION-TRIB. (Apr. 20,

2015, 6:30 AM), https://www.sandiegouniontribune.com/sports/nfl/sdut-jock-tax-

fun-facts-origins-super-bowl-money-2015apr20-story.html.

104

. See, e.g., Jason Feingertz & Jonathon Nhering, Tennessee’s Failed Attempt to Be a Tax

Titan, CPA J. (Jan. 2017), https://www.cpajournal.com/2017/01/22/tennessees-failed-

attempt-to-be-a-tax-titan [https://perma.cc/3PSJ-7YSH] (describing how Tennessee, a

state without an income tax, imposed a professional privilege tax on out-of-state

athletes).

105

. Id.

106

. Id.

107

. Id.

108

. Ameet Sachdev, Former Chicago Bear Wins Suit over Cleveland’s ‘Jock Tax,’ CHI.

TRIB. (Apr. 30, 2015, 5:15 PM), https://www.chicagotribune.com/business/ct-clevela

nd-jock-tax-0501-biz-20150430-story.html.

109

. Hillenmeyer v. Cleveland Bd. of Rev., 41 N.E.3d 1164, 1167–68 (Ohio 2015);

Ohio Supreme Court Rules Cleveland’s Tax on Nonresident Football Players Violates

Constitutional Due Process, WINSTON & STRAWN (June 2015), https://www.winston.com/

images/content/9/7/97939/SALT-JUN2015-05-Cleveland-Tax-Football-Players.html

[https://perma.cc/86XX-D228].

110

. Hillenmeyer, 41 N.E.3d at 1167–68.

111

. Id. at 1171.

112

. Id. at 1168.

864 AMERICAN UNIVERSITY LAW REVIEW [Vol. 71:845

Supreme Court agreed, holding that Cleveland’s calculation formula

violated constitutional due process.

113

While select jurisdictions

continue to impose jock taxes as a means of capturing a piece of the

lucrative business pie (despite legal attacks from players and unions

114

),

others afford a more generous approach, relieving nonresident

professional athletes from tax imposition on their earnings.

115

3. Tax exemptions

The third professional sports matter that historically garnered

academic (and congressional) discourse pertains to the NFL and other

leagues’ tax-exempt status.

116

The NFL long-enjoyed Internal Revenue

Code (I.R.C.) § 501(c)(6) tax-exempt status under the business league

exemption.

117

Although the NBA never established tax-exempt status,

the MLB enjoyed this preferential tax treatment until voluntarily

relinquishing it in 2007.

118

Eight years later, in an abrupt move, the

NFL surrendered its tax-exempt status in 2015, acknowledging that its

113

. Id. at 1174.

114

. See Bob Bauder, Pro Athletes, Players’ Unions Seek to Halt Pittsburgh ‘Jock Tax’,

TRIBLIVE (Nov. 7, 2019, 10:32 PM), https://triblive.com/local/pittsburgh-allegheny/

three-athletes-and-players-unions-seek-to-halt-pittsburgh-jock-tax [https://perma.cc/

5DAW-LZL7] (describing lawsuits filed over Pittsburgh’s jock tax).

115

. See Loh, supra note 103 (noting that Arizona does not tax the earnings of MLB

players who are in the state for spring training).

116

. See, e.g., Christian Schmied, Comment, Official Timeout on the Field: Critics Have

Thrown a Red Flag and Are Challenging the NFL’s Tax-Exempt Status, Calling for It to Be

Revoked, 21 JEFFREY S. MOORAD SPORTS L.J. 577, 580 (2014) (discussing how the IRS has

recently come under fire for targeting organizations that were applying for tax-exempt

status); Jami A. Maul, Comment, America’s Favorite “Nonprofits”: Taxation of the National

Football League and Sports Organizations, 80 UMKC L. REV. 199, 199–200 (2011)

(analyzing sports franchises that are classified as nonprofit organizations under I.R.C.

§ 501(c)(6) (2018)); Naomi Hatton, Note, Where Do Sports Leagues Stand After the NFL

Revokes Its Tax Exempt Status?, 15 AVE MARIA L. REV., 170, 170 (2017) (highlighting that

the NFL recently gave up its tax exemption status in 2017); Dylan P. Williams, Taking

a Knee: An Analysis of the NFL’s Decision to Relinquish Its § 501(c)(6) Federal Tax Exemption,

26 J. LEGAL ASPECTS SPORT 127, 127 (2016) (examining the NFL’s tax exempt status

under I.R.C. § 501(c)(6)); see also, Alec Fornwalt, Should Congress Reconsider the Tax

Exemption of Pro Sports Organizations?, TAX FOUND. (July 20, 2018), https://tax

foundation.org/congress-reconsider-tax-exemption-pro-sports-organizations

[https://perma.cc/8NJR-L4WH] (arguing that congress should reconsider the status

of tax exempted professional sports organizations).

117

. See I.R.C. § 501(c)(6); see also Hatton, supra note 116, at 170–71.

118

. Darren Rovell, NFL League Office Relinquishing Tax-Exempt Status, ESPN (Apr.

28. 2015), https://www.espn.com/nfl/story/_/id/12780874/nfl-league-office-gives-

tax-exempt-status [https://perma.cc/86RW-CHJ4].

2022] TAXING SPORTS 865

preferential tax treatment invited public distraction given the

organization’s multi-billion dollar annual revenues.

119

In 2018, Congress considered abolishing the tax-exempt status of

other professional leagues.

120

Specifically, on June 19, 2018, Iowa

Senator Joni Ernst introduced Senate Bill 3086 (S. 3086), or the PRO

Sports Act.

121

The bill’s singular purpose was to stop professional sports

leagues from qualifying for tax-exempt status.

122

The proposed

legislation identified the NHL, along with the Professional Golf

Association (PGA) Tour and Ladies Professional Golf Association

(LPGA) as organizations generating more than one billion dollars in

revenue, yet operating under the shield of I.R.C. § 501(c)(6).

123

While

this legislation specifically targeted the three named entities, if passed

the law would have stripped tax-exempt status from any organization

with gross receipts exceeding $10,000,000.

124

Variations of S. 3086 have been introduced repeatedly, but all have

failed to gain traction despite the significant revenues many of these

tax-exempt leagues enjoy.

125

Some note that the impetus to strip

professional leagues of their preferred tax status is largely

inconsequential.

126

As Professor and Economist Andrew Zimbalist

opines, while some leagues enjoy tax-exempt status, the teams

themselves (which serve as the profit-generating mechanisms of the

119

. Chris Isidore, NFL Gives Up Tax Exempt Status, CNN (Apr. 28, 2015, 4:48 PM),

https://money.cnn.com/2015/04/28/news/companies/nfl-tax-exempt-status/

index.html [https://perma.cc/L36R-FFQM].

120

. Fornwalt, supra note 116.

121

. PRO Sports Act, S. 3086, 115th Cong. (2018).

122

. Id.

123

. Id.

124

. Id.

125

. See, e.g., PRO Sports Act, H.R. 363, 117th Cong. (2021); see also PRO Sports Act,

S. 1524, 113th Cong. (2013).

126

. Andrew Zimbalist, The Nonprofit Status of Sports Leagues Is Irrelevant, N.Y. TIMES

(Sept. 4, 2014, 12:59 PM), https://www.nytimes.com/roomfordebate/2014/09/03/

should-pro-sport-leagues-get-tax-breaks/the-nonprofit-status-of-sports-leagues-is-

irrelevant [https://perma.cc/WX8H-V7WA] (“The tax exemption does not apply to

the individual teams, which must pay taxes on their profits . . . [but does] appl[y] to

the central league offices . . . .”); see also Press Release, Greg Steube, House of

Representatives, Steube Introduces Legislation to Close Loophole Allowing

Professional Sports Organizations to Claim Nonprofit Status and Tax Breaks (Aug. 7,

2020), https://steube.house.gov/media/press-releases/steube-introduces-legislation-

close-loophole-allowing-professional-sports [https://perma.cc/P9XZ-3QCL]

(proposing to strip tax-exempt status from sports leagues for allowing players and

coaches to kneel in protest during the national anthem).

866 AMERICAN UNIVERSITY LAW REVIEW [Vol. 71:845

leagues) remain taxable entities.

127

Of import, the debate over the tax-

exempt status of sports organizations is not germane to the

professional arena. As detailed in the following section, the NCAA’s

not-for-profit tax status has likewise been scrutinized.

128

B. The Historic Relationship Between Taxes and College Sports

In 1906, the NCAA declared that college sports were to be founded

on the principle of amateurism.

129

Over a century later, many argue

that the primordial student-athlete model is misguided, given the

expansive economic growth of contemporary collegiate athletics.

130

Certainly, as this amateur sports arena morphed into a billion-dollar

enterprise,

131

increased tax deliberations ensued. Still, prior to the

signing of the TCJA, the greater college sports arena enjoyed quite

generous tax treatment, even amidst broader debates.

132

As this Section

addresses, tax issues that have invited historic dialogue include: (1) the

tax-exempt status of the NCAA and its member institutions; (2) the

unrelated business income (UBI) tax; (3) taxing student-athletes’

scholarship funds; and (4) the deductibility of charitable donations.

127

. Zimbalist, supra note 126.

128

. See infra Section I.B.1.

129

. Kisska-Schulze, supra note 11, at 350.

130

. See Robert A. McCormick & Amy Christian McCormick, The Myth of the Student-

Athlete: The College Athlete as Employee, 81 WASH L. REV. 71, 74 (2006) [hereinafter

McCormick & McCormick, The Myth of the Student-Athlete] (opining that the student-

athlete characteristic is, in reality, a façade); Robert John Givens, Comment,

“Capitamateuralism”: An Examination of the Economic Exploitation of Student-Athletes by the

National Collegiate Athletic Association, 82 UMKC L. REV. 205, 205–07 (2013) (arguing to

reform the NCAA’s principal of amateurism amidst commercialized exploitation of

student-athletes); Thomas A. Baker III et al., Debunking the NCAA’s Myth that Amateurism

Conforms with Antitrust Law: A Legal and Statistical Analysis, 85 TENN. L. REV. 661, 665

(2018) (noting that college sports is no longer “amateur” in nature, no matter the

NCAA’s insistence that it is); Kelly Charles Crabb, The Amateurism Myth: A Case for a New

Tradition, 28 STAN. L. & POL’Y REV. 181, 183 (2017) (calling for the NCAA to abandon

its amateurism model to allow student-athletes the ability to exploit themselves in

commercialized fashion); Amy Christian McCormick & Robert A. McCormick, The

Emperor’s New Clothes: Lifting the NCAA’s Veil of Amateurism, 45 SAN DIEGO L. REV. 495,

496 (2008) (portraying the collegiate sports arena as anything but amateurism).

131

. Finances of Intercollegiate Athletics, NCAA, https://www.ncaa.org/about/

resources/research/finances-intercollegiate-athletics [https://perma.cc/DJ39-63RV]

(noting that in 2019 alone, NCAA athletic department revenues across all member

schools reached $18.9 billion).

132

. Kisska-Schulze, supra note 11, at 355.

2022] TAXING SPORTS 867

1. The NCAA and member institutions’ tax-exempt status

Akin to professional sports leagues as discussed earlier, the NCAA’s

tax-exempt status has been deliberated by many.

133

Along with

numerous of its member institutions, the NCAA relishes from I.R.C.

§ 501(c)(3) status, which offers tax exemptions to organizations that

advance “national or international amateur sports competition.”

134

Section 501(c)(3) found root in the Tax Reform Act of 1969, which

allowed qualifying non-profit entities to operate as private

foundations.

135

By 1976, Congress eased restrictions on non-profits to

the point that they were permitted to spend up to $1 million a year in

lobbying efforts.

136

The rationale for extending such benefits beyond

the NCAA and its member institutions, to include their affiliated

athletic departments, which are often run as separate entities, resides

in the conviction that college athletics compliment the overall

academic experience and thus serve an “educational purpose.”

137

Some argue that the NCAA and many of its member schools are not

promoting amateur sports per se, but are instead attempting to

133

. See, e.g., Andrew D. Appleby, for the Love of the Game: The Justification for Tax

Exemption in Intercollegiate Athletics, 44 J. MARSHALL L. REV. 179, 189 (2010)

(documenting that in 2006, the House Ways and Means Committee directed the

NCAA to substantiate its tax-exempt status); Brett T. Smith, The Tax-Exempt Status of the

NCAA: Has the IRS Fumbled the Ball?, 17 SPORTS LAWS. J. 117, 118 (2010) (proposing that

removal of the NCAA’s tax-exempt status would result in minimal economic benefits);

John D. Colombo, The NCAA, Tax Exemption, and College Athletics, 2010 U. ILL. L. REV.

109, 111–12 (2010) (examining the NCAA’s tax-exempt status, and recommending

alternatives to removing such beneficial tax treatment); Benjamin Kurrass, Comment,

The Swelling Tide of Commercialized Amateur Athletics: How Growing Revenues Have Called

Public Attention to the NCAA and Its Member Universities’ Tax-Exempt Status, 27 JEFFREY S.

MOORAD SPORTS L.J. 285, 291 (2020) (recommending the passage of the Student-

Equity Act to “close the gap” between the NCAA and member institutions’ tax-exempt

revenue and amateur student-athletes); see also Ronald Katz, Ending the NCAA’s Tax

Exemption Should Be a Slam Dunk, NATION (Mar. 27, 2019),

https://www.thenation.com/article/archive/march-madness-tax-exemption-

inequality.

134

. I.R.C. § 501(c)(3); see also Colombo, supra note 133, at 113.

135

. Hana Muslic, A Brief History of Nonprofit Organizations (and What We Can Learn),

NONPROFIT HUB (Oct. 27, 2017), https://nonprofithub.org/a-brief-history-of-

nonprofit-organizations [https://perma.cc/D28U-NDGX].

136

. Id.

137

. Lindsey Luebchow, Are Tax Deductions for College Athletics Worth the Price?, NEW AM.

(Oct. 8, 2007), https://www.newamerica.org/education-policy/higher-education/high

er-ed-watch/are-tax-deductions-for-college-athletics-worth-the-price [https://perma.cc/

AGA5-FFEX].

868 AMERICAN UNIVERSITY LAW REVIEW [Vol. 71:845

“maximize revenue.”

138

Even Congress challenged the NCAA’s status

in 2006, following the organization’s evolution into a billion-dollar

enterprise; however, such a move failed to gain traction.

139

More recent

and creative efforts to eradicate the Association’s tax-exempt status

include recommendations that the NCAA’s status be tethered to the

opportunities it provides, which would allow student-athletes to

monetize their publicity rights.

140

Still, despite the seemingly broad

support for reining in tax-exemptions for sports organizations,

Congress has thus far failed to act.

141

2. The unrelated business income tax

While most colleges and universities qualify as tax-exempt entities,

any UBI they earn is taxable.

142