Statistical Briefing

2021-22

TDS Northern Ireland

is a wholly owned

subsidiary of

The Dispute Service,

providing both custodial

and insured tenancy

deposit protection.

The Tenancy Deposit

Scheme is operated

by The Dispute Service

providing tenancy deposit

protection in England

and Wales. TDS offers

both Insured deposit

protection, TDS Insured,

and Custodial deposit

protection, TDS Custodial.

SafeDeposits Scotland

is a custodial tenancy

deposit protection

scheme. It is a separate

company where The

Dispute Service is the key

partner and provides the

scheme’s key operational

services.

www.tdsnorthernireland.com

0300 037 3700

www.safedepositsscotland.com

03333 213 136

www.tenancydepositscheme.com

0300 037 1000

| TDS England & Wales

2

CONTENTS

Tenure in England & Wales 4

Tenancy Deposits in England & Wales 6

Disputes 8

TDS Northern Ireland 10

Tenure in Northern Ireland 11

Tenancy Deposits in Northern Ireland 13

Disputes 15

SafeDeposits Scotland 18

Tenure in Scotland 19

Tenancy Deposits in Scotland 21

Disputes 22

a

EXECUTIVE SUMMARY

This Statistical Brieng provides data on the work of the

tenancy deposit schemes across the UK; in England &

Wales, Scotland and Northern Ireland.

In each jurisdiction there are three government

authorised schemes which operate the statutory tenancy

deposit protection and dispute resolution services.

THE DISPUTE SERVICE

The Dispute Service is a Government approved,

not-for-prot company that provides Insured and

Custodial tenancy deposit protection (TDP) in the

private rented sector.

The tenancy deposit protection legislation was

introduced in April 2007 in England and Wales as a

result of the 2004 Housing Act. Similar provisions came

into force in Scotland in July 2012 and in Northern

Ireland in April 2013.

The Dispute Service provides TDP services through

the Tenancy Deposit Scheme in England & Wales,

SafeDeposits in Scotland and TDS Northern Ireland.

*Some of the data included is Government data released

under the Freedom of Information Act. Other data is The

Dispute Service’s own internal performance reporting.

| TDS England & Wales

3

TDS England & Wales

| TDS England & Wales

4

TENURE IN ENGLAND AND WALES

Source: Housing Review JRF/CIH

Year Owner occupation Social renting Private renting

2001 14.735 4.339 2.133

2002 14.846 4.310 2.197

2003 14.752 4.212 2.549

2004 14.986 4.120 2.578

2005 15.100 4.050 2.720

2006 15.052 4.034 2.987

2007 15.093 4.013 3.182

2008 15.067 4.000 3.443

2009 14.968 4.022 3.705

2010 14.895 4.032 3.912

2011 14.827 4.044 4.105

2012 14.754 4.068 4.286

2013 14.685 4.100 4.465

2014 14.674 4.012 4.623

2015 14.684 4.030 4.773

2016 14.801 4.009 4.832

2017 15.050 4.102 4.798

2018 15.311 4.088 4.773

2019 15.581 4.108 4.725

2020 15.379 4.120 4.799

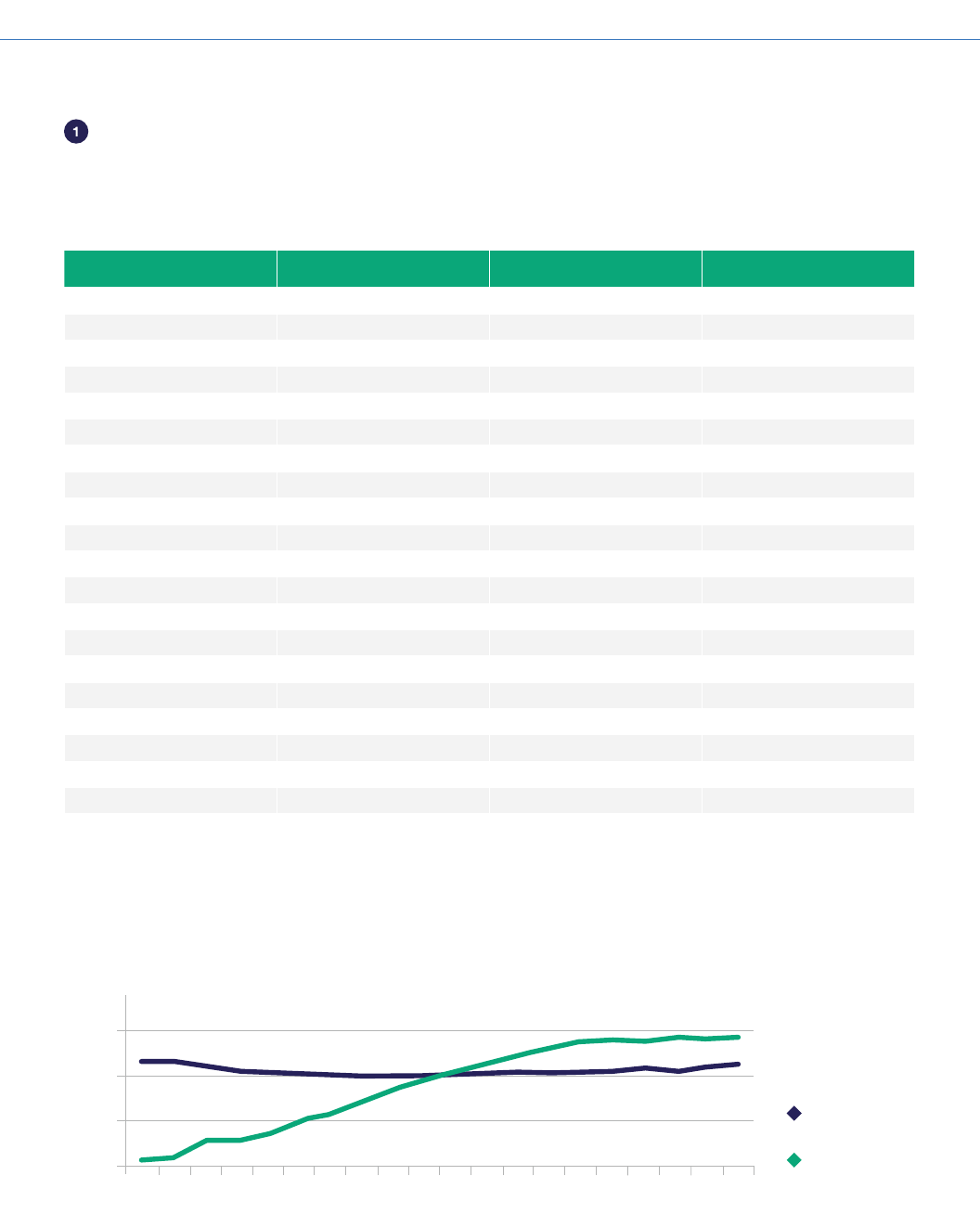

TABLE 1

TENURE IN ENGLAND (MILLIONS OF HOMES)

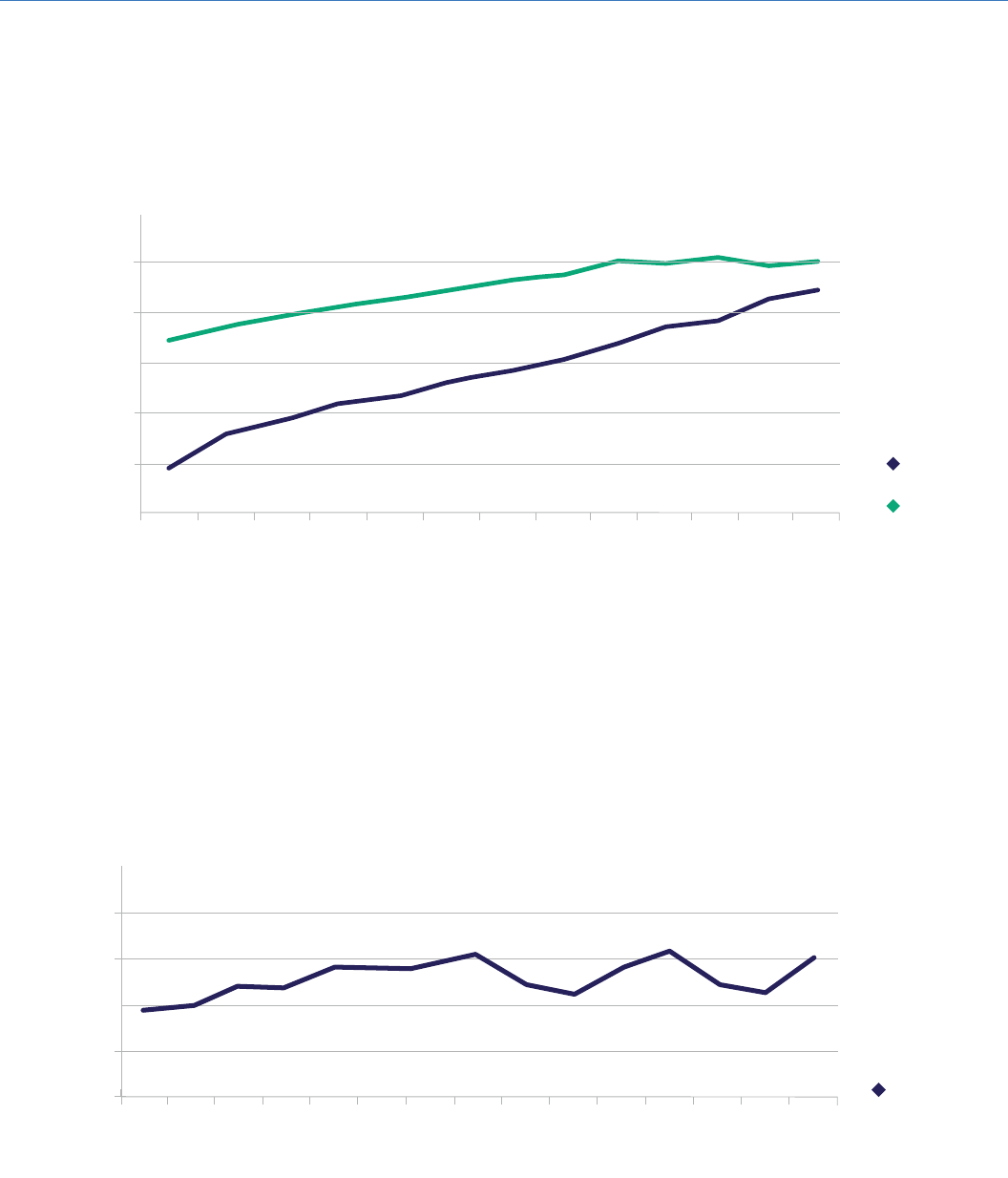

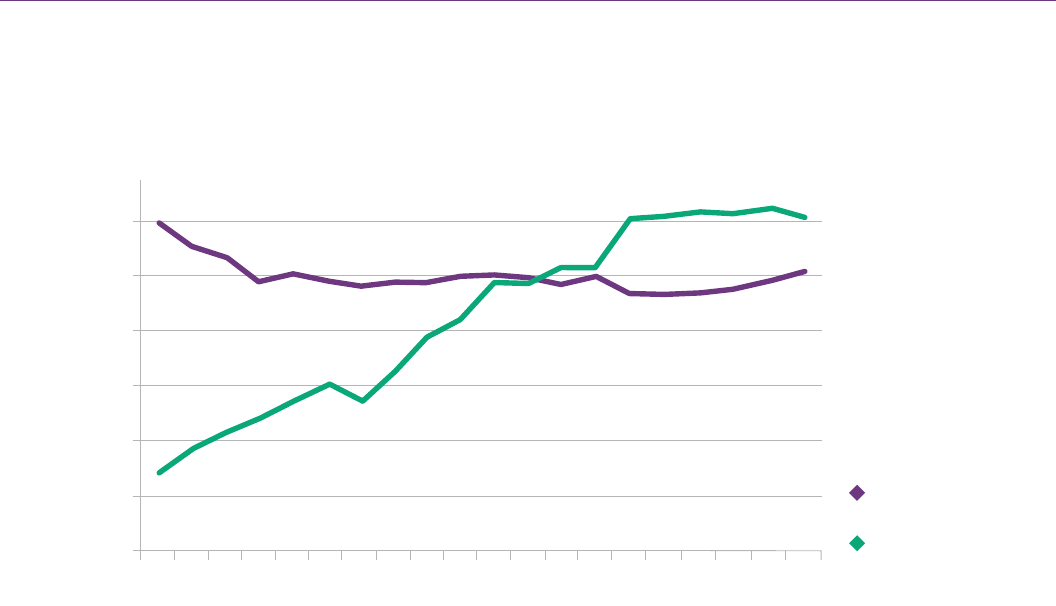

FIGURE 1

PRIVATE RENTING AND SOCIAL RENTING IN ENGLAND

(HOMES IN MILLIONS)

Source: Housing Review JRF/CIH

2016

2

3

4

5

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2018

2017

2020

2019

Social renting

Private renting

| TDS England & Wales

5

Year Owner occupation Social renting Private renting

2001 0.941 0.243 0.090

2002 0.957 0.240 0.089

2003 0.966 0.233 0.097

2004 0.980 0.226 0.103

2005 0.990 0.223 0.108

2006 0.998 0.222 0.113

2007 1.002 0.221 0.122

2008 1.001 0.221 0.135

2009 0.989 0.220 0.157

2010 0.983 0.221 0.171

2011 0.980 0.230 0.181

2012 0.977 0.223 0.191

2013 0.983 0.233 0.190

2014 0.981 0.223 0.196

2015 0.974 0.224 0.208

2016 0.986 0.224 0.202

2017 0.990 0.226 0.203

2018 0.994 0.227 0.204

2019 0.996 0.229 0.207

2020 1.003 0.230 0.205

TABLE 2

TENURE IN WALES (MILLIONS OF HOMES)

Source: Housing Review JRF/CIH

FIGURE 2

PRIVATE RENTING AND SOCIAL RENTING IN WALES

(HOMES IN MILLIONS)

Source: Housing Review JRF/CIH

0.000

0.050

0.100

0.150

0.200

0.250

0.300

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2017

2016

2019

2018

2020

Social renting

Private renting

| TDS England & Wales

6

In England and Wales, deposits taken on Assured Shorthold Tenancies (AST’s) must be protected in a

Government approved TDP scheme. Tenancy deposit protection legislation came into force in April 2007 and over

the years there has been a steady increase in the number of tenancy deposits protected, reflecting the increase in

the size of the private rented sector.

The table below (Table 3) illustrates the growth of tenancy deposits protected in England and Wales in both

Insured and Custodial schemes since March 2008.

TENANCY DEPOSITS IN ENGLAND AND WALES

Year Total deposits protected

March 2008 924,181

March 2009 1,553,130

March 2010 1,888,532

March 2011 2,220,543

March 2012 2,374,385

March 2013 2,659,301

March 2014 2,848,110

March 2015 3,066,130

March 2016 3,425,718

March 2017 3,691,242

March 2018 3,840,216

March 2019 3,979,202

March 2020 4,141,467

March 2021 4,242,373

March 2022 4,459,606

TABLE 3

NUMBER OF TENANCY

DEPOSITS PROTECTED IN

ENGLAND AND WALES

Source: FOI Data

Year Value of tenancy deposits

March 2008 £885,098,501

March 2009 £1,406,482,263

March 2010 £1,661,896,693

March 2011 £2,104,219,832

March 2012 £2,325,317,355

March 2013 £2,637,843,361

March 2014 £2,865,824,221

March 2015 £3,187,501,867

March 2016 £3,566,784,769

March 2017 £4,017,045,899

March 2018 £4,159,663,783

March 2019 £4,408,543,068

March 2020 £4,307,902,071

March 2021 £4,348,937,027

March 2022 £4,531,196,470

TABLE 4

TOTAL VALUE OF TENANCY

DEPOSITS PROTECTED IN

ENGLAND AND WALES

Source: FOI Data

| TDS England & Wales

7

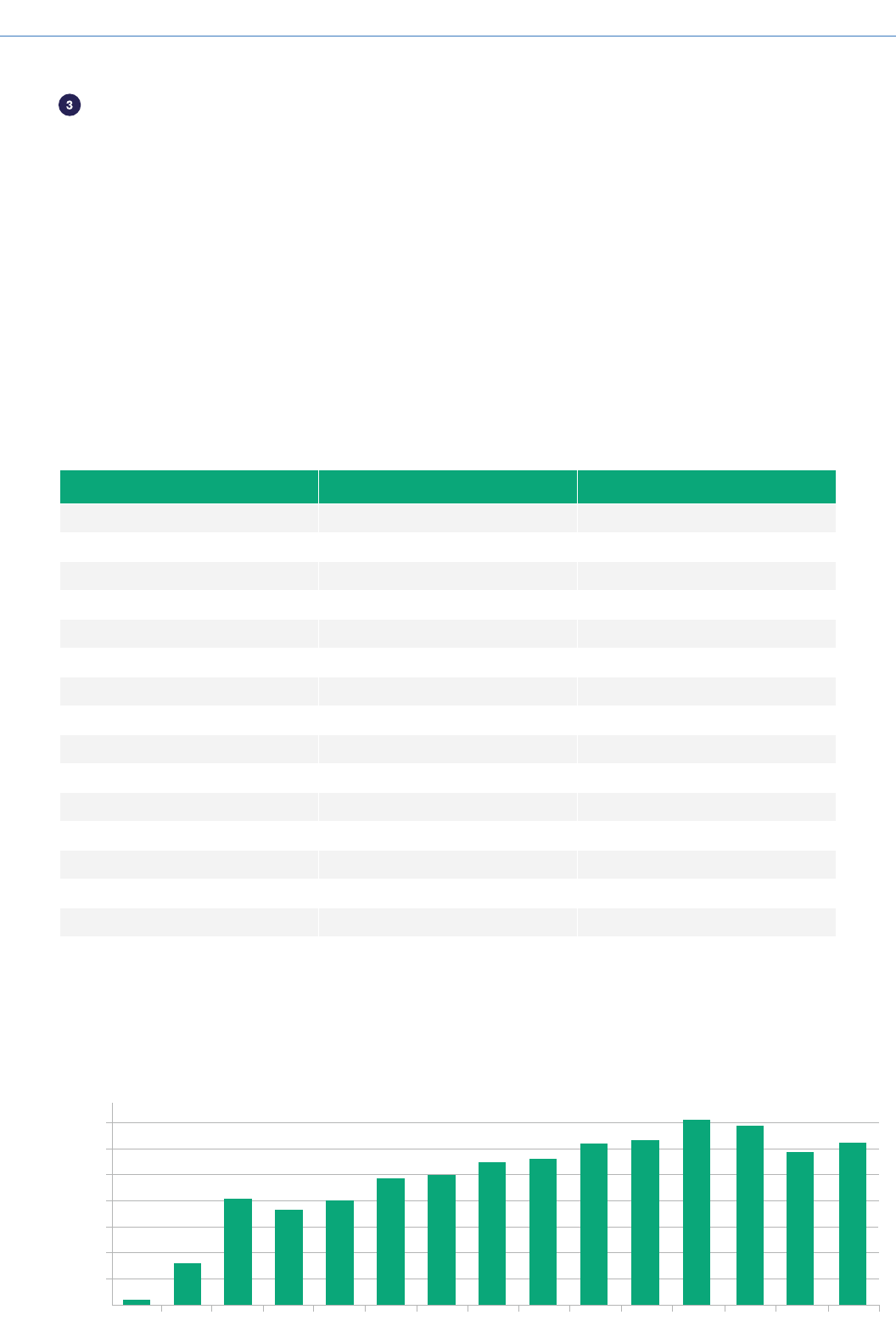

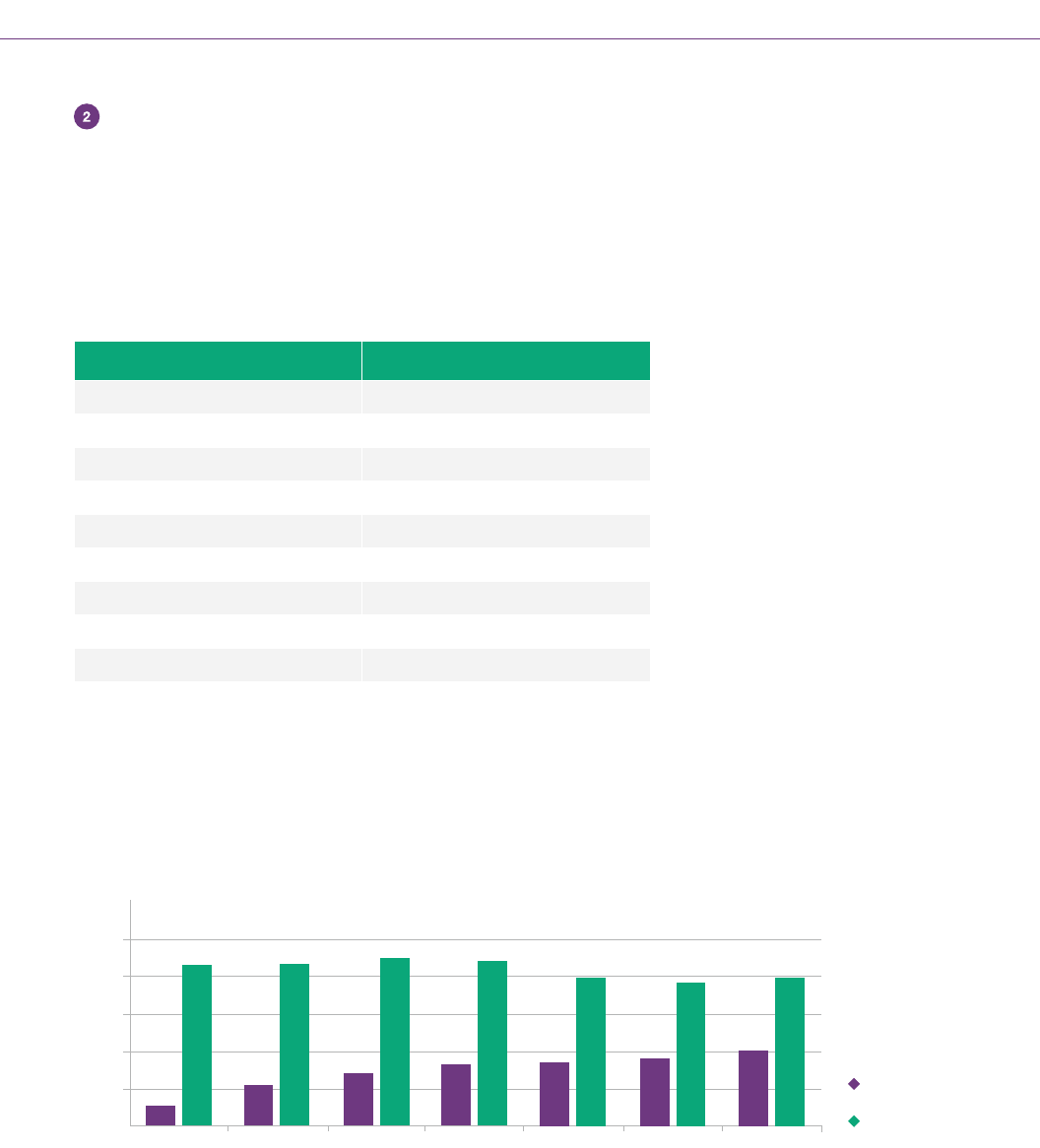

FIGURE 3

TENANCY DEPOSITS PROTECTED COMPARED TO THE NUMBER OF PRIVATE

RENTED SECTOR HOMES IN ENGLAND AND WALES SINCE MARCH 2008

Average value of tenancy deposits protected in England and Wales

Source: FOI Data

It should be noted that these gures do not illustrate the large variations between regions in England and Wales.

The drop in deposit values in 2020 is the result of the deposit cap which was introduced in England in June 2019.

FIGURE 4

AVERAGE VALUE OF TENANCY DEPOSITS PROTECTED IN ENGLAND AND WALES

0

1,000,000

2,000,000

3,000,000

Mar 2008

Mar 2009

Mar 2010

Mar 2011

Mar 2012

Mar 2013

Mar 2014

Mar 2015

Mar 2017

Mar 2016

Mar 2019

Mar 2018

Mar 2020

4,000,000

5,000,000

Deposits protected

PRS homes

£800

£900

£1,000

Mar 2008

Mar 2009

Mar 2010

Mar 2011

Mar 2012

Mar 2013

Mar 2014

Mar 2015

Mar 2016

Mar 2017

Mar 2019

Mar 2018

Mar 2021

Mar 2020

Mar 2022

£1,100

£1,200

Average deposit

| TDS England & Wales

8

Year Dispute percentage Total disputes

March 2008 0.05% 458

March 2009 0.52% 8,098

March 2010 1.08% 20,363

March 2011 0.82% 18,156

March 2012 0.85% 20,279

March 2013 0.92% 24,448

March 2014 0.88% 25,029

March 2015 0.89% 27,816

March 2016 0.82% 28,100

March 2017 0.83% 30,742

March 2018 0.85% 31,865

March 2019 0.89% 35,513

March 2020 0.84% 34,993

March 2021 0.70% 29,697

March 2022 0.70% 31,276

The legislation covering TDP in England and Wales provides for free alternative dispute resolution if the parties are

unable to agree how the tenancy deposit should be divided at the end of the tenancy.

DISPUTES

TABLE 5

ADJUDICATIONS AS A PERCENTAGE OF TENANCY DEPOSITS PROTECTED

IN ENGLAND AND WALES

Source: FOI Data

ADJUDICATIONS AS A PERCENTAGE OF TENANCY DEPOSITS PROTECTED

TDP legislation was introduced, in part, in response to concerns that a signicant minority of tenants felt that their

tenancy deposit was unreasonably withheld and had experienced difculty in getting their deposit back.

However, the consistent experience of the schemes is that disputes are raised in a low proportion of cases,

typically fewer than 1% of tenancy deposits protected.

3

Source: FOI Data

FIGURE 5

ADJUDICATIONS COMPLETED BY YEAR, FOR ALL TENANCY DEPOSIT SCHEMES IN

ENGLAND AND WALES

0

5,000

10,000

15,000

30,000

25,000

20,000

35,000

Mar 2008 Mar 2009 Mar 2010 Mar 2011 Mar 2012 Mar 2013 Mar 2014 Mar 2015 Mar 2016 Mar 2017 Mar 2019Mar 2018 Mar 2021Mar 2020 Mar 2022

| TDS England & Wales

9

Agent - 18%

REASONS FOR TENANCY DEPOSIT DISPUTES

The table below (Table 7) shows the issues arising in TDS’ dispute cases since 2013. Cleaning remains the most

common area of dispute in the cases we deal with, appearing in over half our cases in each year; damage claims

follow closely behind.

WHO RAISES TENANCY DEPOSIT DISPUTES WITH TDS?

TDS Insured is the only TDP scheme which allows agents, landlords and tenants to raise disputes in the Insured

scheme. Disputes in the Custodial scheme arise because the parties are unable to reach agreement during the

repayment process and are not specically raised by one party.

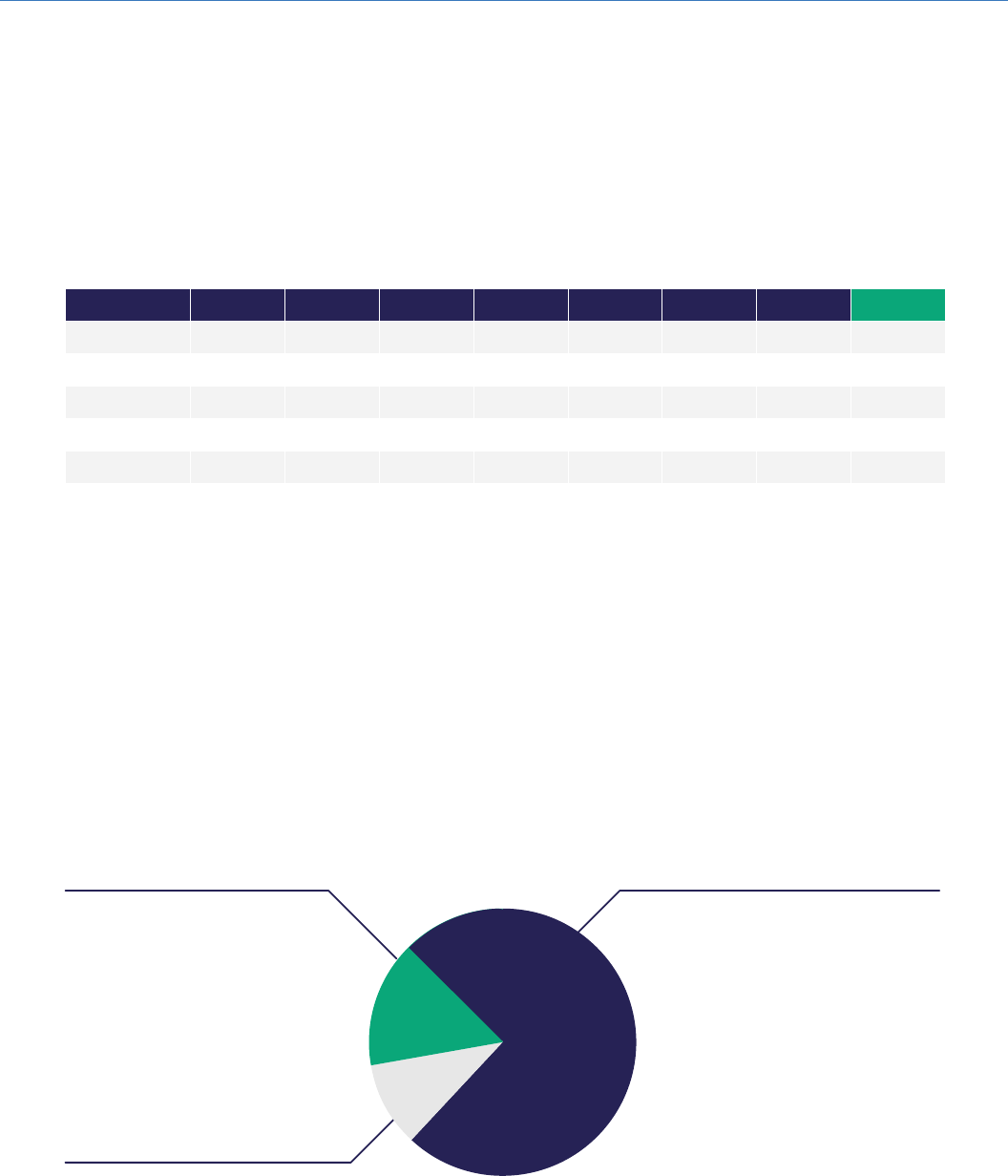

FIGURE 6

WHO RAISES DISPUTES WITH TDS INSURED?

Source: TDS Insured Disputes Data

TABLE 6

REASONS FOR TENANCY DEPOSIT DISPUTES IN TDS INSURED

Dispute 2014-15 2015-16 2016-17 2017-18 2018-19 2019-20 2020-21 2021-22

Cleaning 58% 57% 56% 54% 53% 42% 49% 50%

Damage 51% 51% 51% 49% 49% 41% 35% 46%

Redecoration 31% 32% 28% 31% 30% 39% 26% 28%

Gardening 17% 16% 16% 16% 15% 23% 12% 13%

Rent arrears 19% 19% 20% 20% 18% 14% 15% 13%

Source: TDS disputes data

*Percentage of cases where claims arise

Tenant - 74%

Landlord - 8%

*Some of the data included is released by the NI Department

for Communities. Other data is the Tenancy Deposit Scheme

Northern Ireland’s own internal performance reporting.

TDS NORTHERN IRELAND

The Tenancy Deposit Scheme Northern Ireland is a

Government approved, not-for-prot company that

provides Insured and Custodial tenancy deposit

protection in the private rented sector.

The tenancy deposit protection legislation was

introduced in April 2013 in Northern Ireland under

the Tenancy Deposit Schemes Regulations (Northern

Ireland) 2012. This follows the introduction of similar

provisions in England and Wales in April 2007 and in

Scotland in July 2012.

| TDS Northern Ireland

11

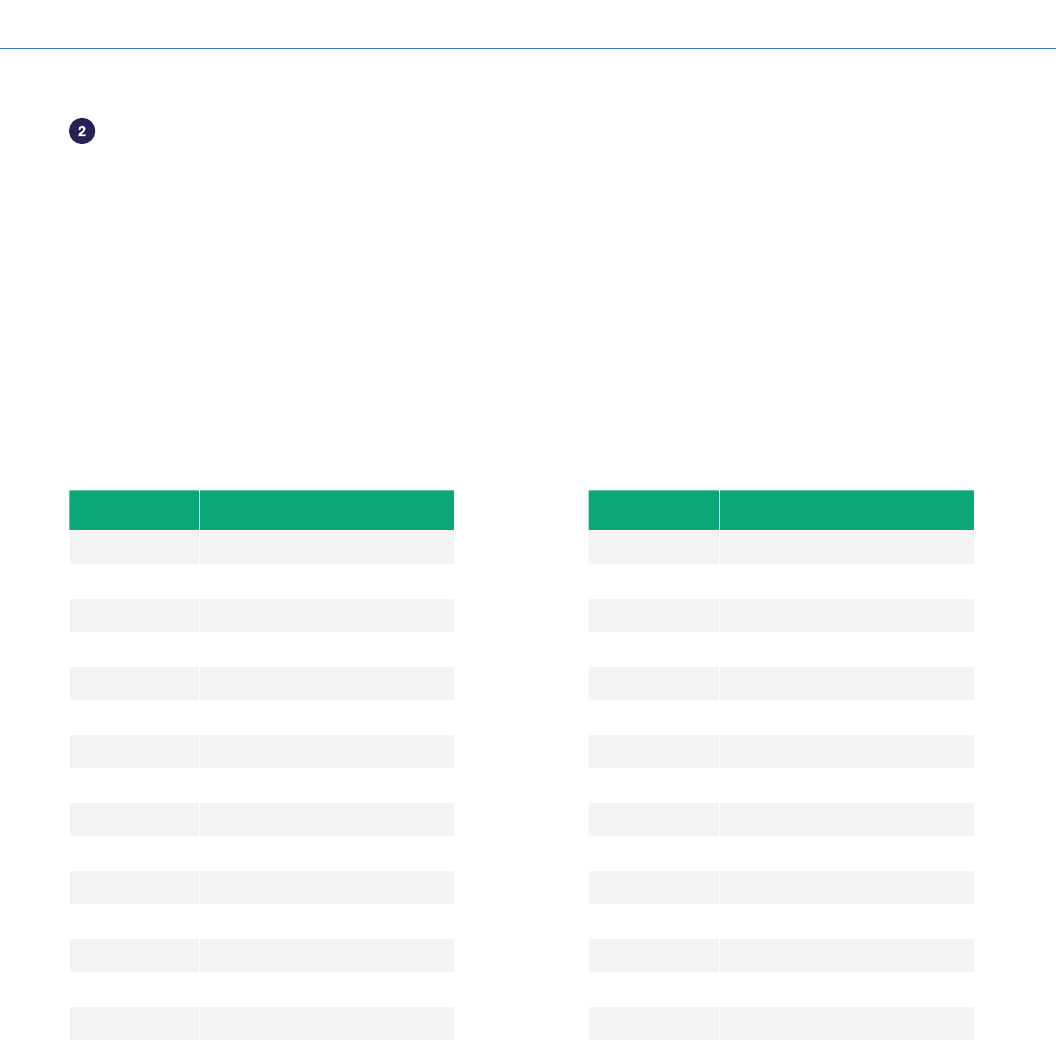

TENURE IN NORTHERN IRELAND

Source: Housing Review JRF/CIH

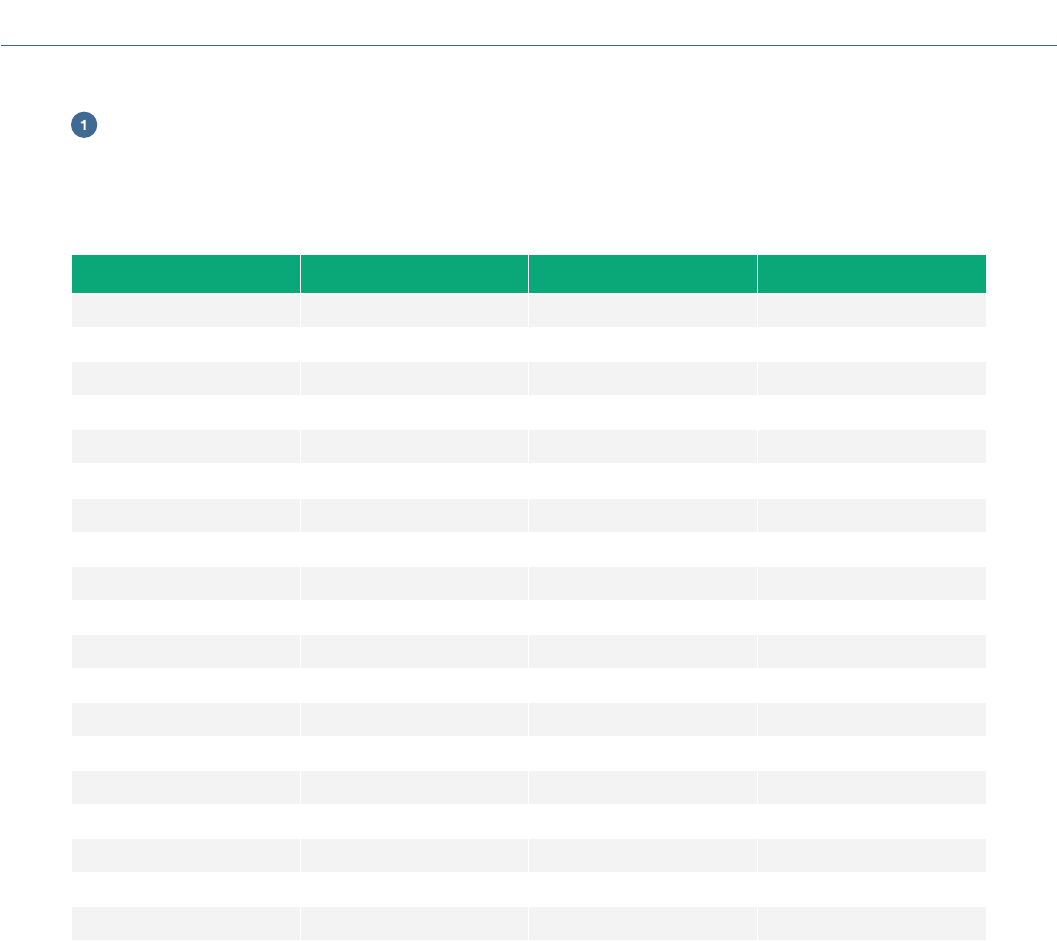

Year Owner occupation Social renting Private renting

2001 488 149 37

2002 481 140 47

2003 491 134 54

2004 501 122 61

2005 505 125 68

2006 508 122 76

2007 523 121 69

2008 524 123 83

2009 517 123 97

2010 521 125 106

2011 512 126 121

2012 514 124 121

2013 510 123 130

2014 513 124 130

2015 504 116 151

2016 510 115 152

2017 514 115 154

2018 521 116 153

2019 524 121 154

2020 531 126 151

TABLE 7

TENURE IN NORTHERN IRELAND (THOUSANDS OF HOMES)

FIGURE 7

TENURE IN NORTHERN IRELAND IN 2020 (PERCENTAGE OF HOMES)

Owner occupation - 66%

Private renting - 19%

Social renting - 15%

| TDS Northern Ireland

12

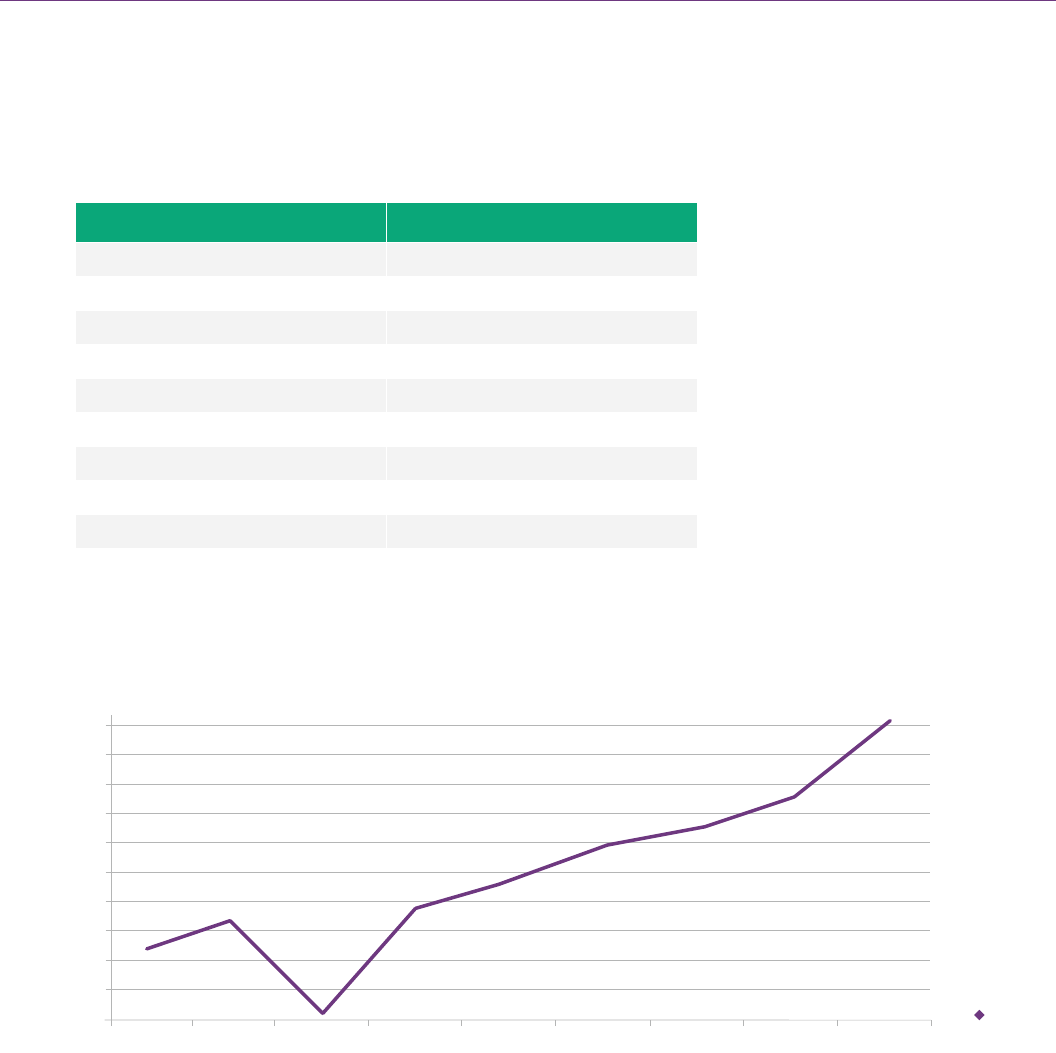

FIGURE 8

PRIVATE RENTING AND SOCIAL RENTING IN NORTHERN IRELAND

(HOMES IN MILLIONS)

Source: Housing Review JRF/CIH

0

25

50

75

100

125

150

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2017

2016

2019

2018

2020

Social renting

Private renting

| TDS Northern Ireland

13

TENANCY DEPOSITS IN NORTHERN IRELAND

In Northern Ireland, deposits taken for private tenancies must be protected in a Government approved tenancy

deposit scheme. Tenancy deposit legislation came into force in April 2013 and there has been consistent growth

in the number of tenancy deposits protected since.

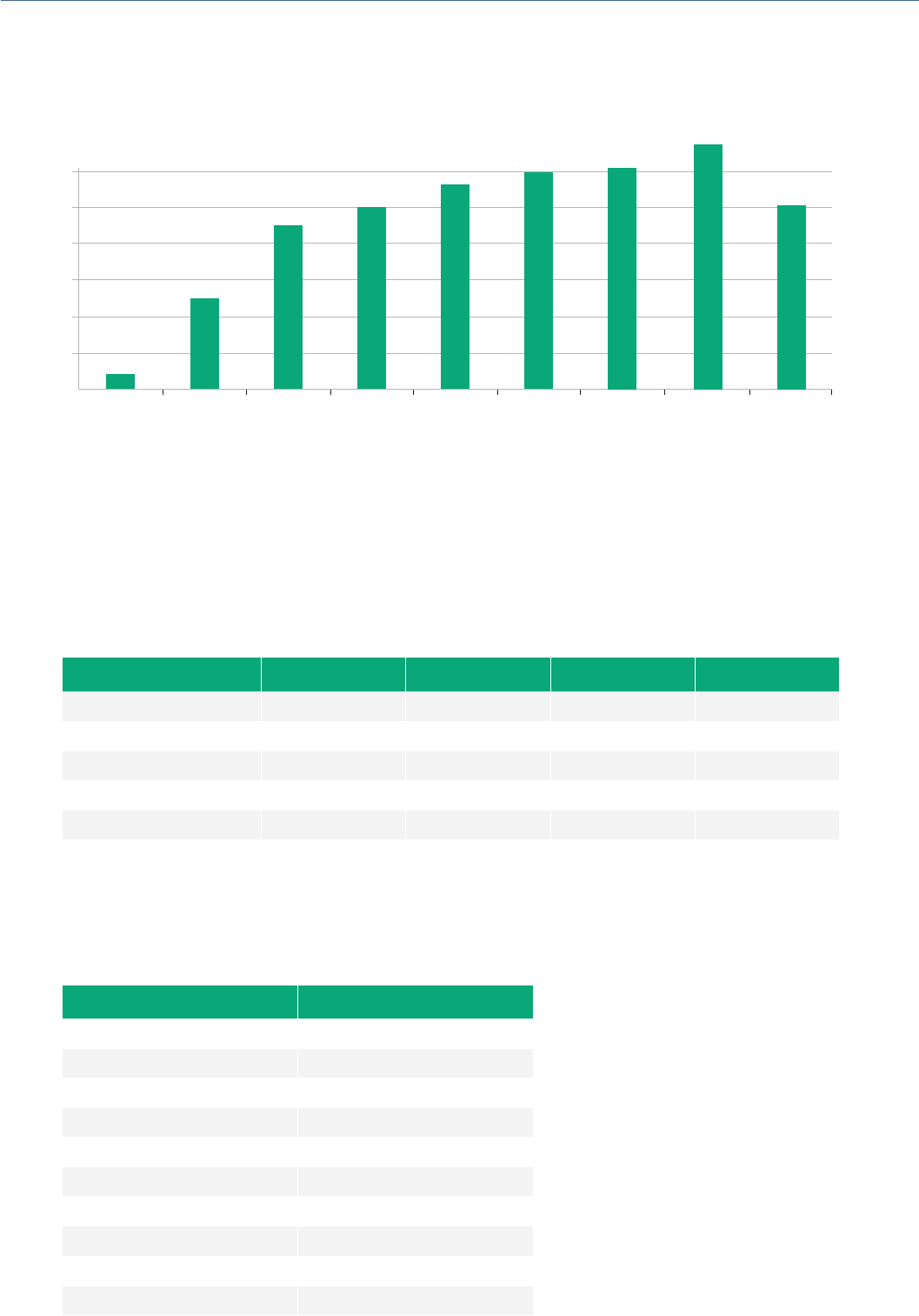

TABLE 8

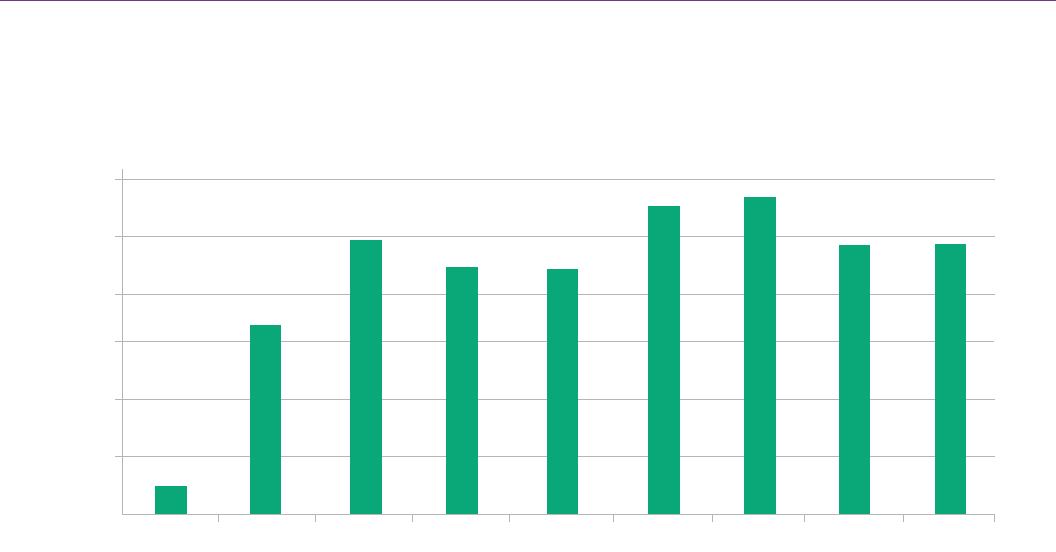

NUMBER OF TENANCY DEPOSITS PROTECTED IN NORTHERN IRELAND

Year Total deposits protected

March 2014 17,544

March 2015 32,722

March 2016 43,211

March 2017 49,102

March 2018 53,510

March 2019 56,786

March 2020 60,613

March 2021 63,905

March 2022 67,197

Source: NI Department for Communities

Source: NI Department for Communities

FIGURE 9

TENANCY DEPOSITS PROTECTED COMPARED TO THE NUMBER OF PRIVATE

RENTED SECTOR HOMES IN NORTHERN IRELAND

0

Mar 2014 Mar 2015 Mar 2016

30,000

60,000

90,000

120,000

150,000

Deposits protected

PRS homes

Mar 2017 Mar 2018 Mar 2019 Mar 2020

| TDS Northern Ireland

14

TABLE 9

TOTAL VALUE OF TENANCY DEPOSITS PROTECTED IN NORTHERN IRELAND

Year Value of tenancy deposits

March 2014 £9,901,267

March 2015 £18,757,501

March 2016 £23,430,569

March 2017 £28,405,824

March 2018 £31,395,767

March 2019 £34,064,162

March 2020 £36,759,231

March 2021 £39,388,442

March 2022 £43,092,615

Source: NI Department for Communities

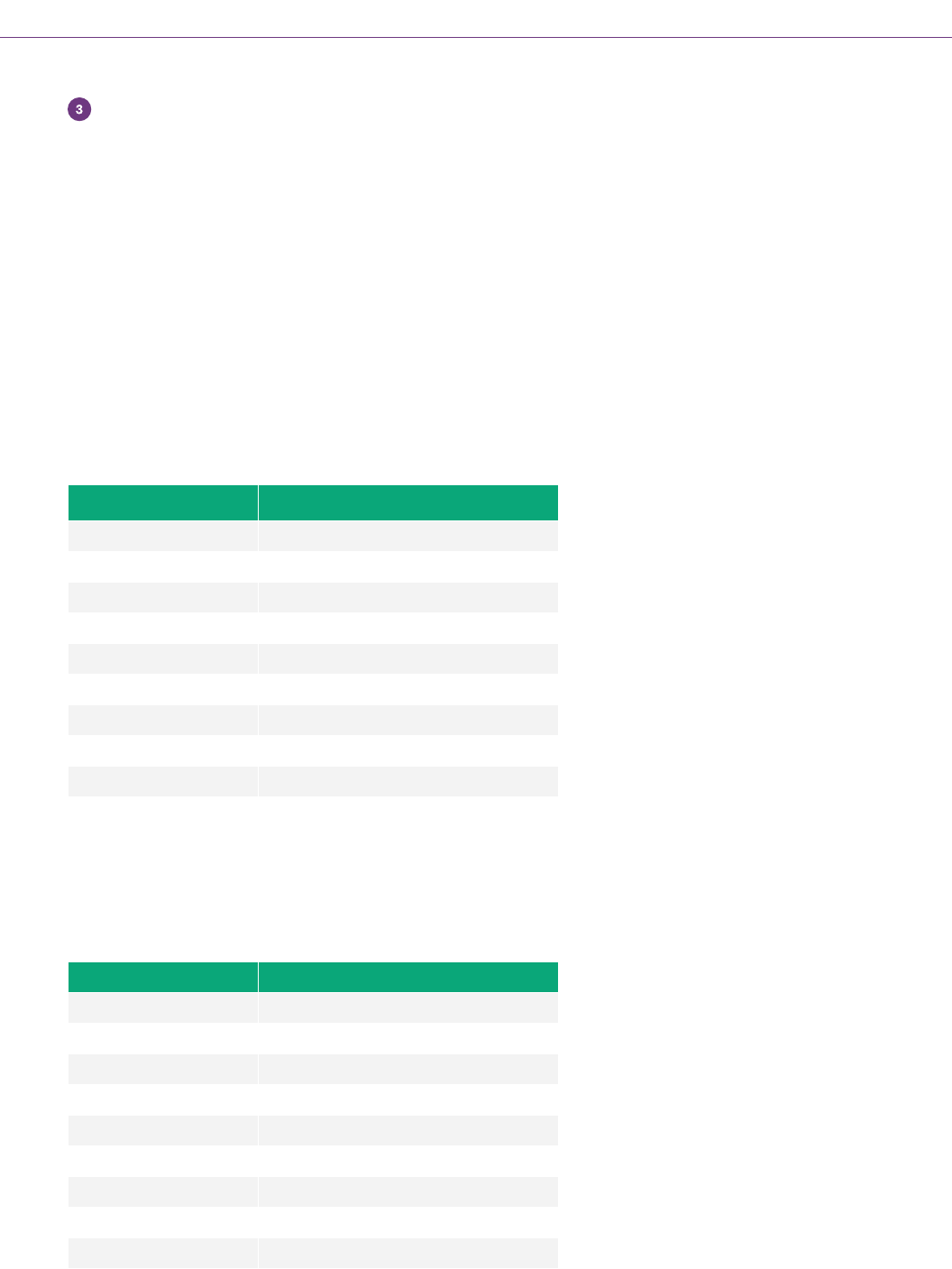

FIGURE 10

AVERAGE VALUE OF DEPOSITS PROTECTED IN NORTHERN IRELAND

Source: NI Department for Communities

TENANCY DEPOSITS BY VALUE

£540

£550

Mar 2014

Mar 2015 Mar 2016

Mar 2017

Mar 2020 Mar 2022Mar 2018 Mar 2019 Mar 2021

£560

£580

£590

£600

£570

£610

£620

£630

£640

Average deposit

| TDS Northern Ireland

15

Year Dispute percentage

March 2014 0.35%

March 2015 1.02%

March 2016 1.14%

March 2017 0.94%

March 2018 0.86%

March 2019 0.98%

March 2020 0.94%

March 2021 0.76%

March 2022 0.73%

DISPUTES AS A PERCENTAGE OF TENANCY DEPOSITS PROTECTED

As the table below shows (Table 11), the TDP schemes consistently experience a very low proportion of dispute

cases raised. Since 2014, the rate has ranged from 0.35% to 1.14%. This indicates that parties are generally

successful in reaching agreement without the need to raise a dispute with the schemes.

Legislation covering tenancy deposit protection in Northern Ireland provides for free alternative dispute resolution

if the parties are unable to agree how the tenancy deposit should be repaid at the end of the tenancy.

TABLE 10

ADJUDICATIONS AS A PERCENTAGE OF TENANCY DEPOSITS PROTECTED

IN NORTHERN IRELAND

Source: NI Department for Communities

DISPUTES

TABLE 11

ADJUDICATIONS COMPLETED BY YEAR, FOR ALL TENANCY DEPOSIT SCHEMES IN

NORTHERN IRELAND

Source: NI Department for Communities

Year Total disputes

March 2014 62

March 2015 335

March 2016 492

March 2017 461

March 2018 460

March 2019 556

March 2020 568

March 2021 487

March 2022 488

| TDS Northern Ireland

16

Source: NI Department for Communities 2020

FIGURE 11

ADJUDICATIONS COMPLETED BY YEAR, FOR ALL TENANCY DEPOSIT SCHEMES

IN NORTHERN IRELAND

0

100

200

300

500

600

400

Mar 2014

Mar 2015

Mar 2016

Mar 2017

Mar 2019 Mar 2021Mar 2020 Mar 2022

Mar 2018

| TDS Northern Ireland

17

TABLE 12

REASONS FOR TENANCY DEPOSIT DISPUTES IN TDSNI

Dispute 2016-17 2017-18 2018-19 2019-20 2020-21 2021-22

Cleaning 43% 45% 45% 45% 42% 47%

Damage 43% 35% 38% 41% 40% 45%

Redecoration 29% 26% 28% 28% 27% 28%

Gardening 11% 13% 10% 12% 12% 10%

Rent arrears 19% 26% 22% 24% 26% 22%

Allocation of awards TDSNI 2021-22

100% of disputed deposit awarded to Agent/Landlord 34%

100% of disputed deposit awarded to the tenant 28%

Split awards 38%

Source: TDS NI Disputes Data 2014-2018

Source: TDSNI Disputes Data

*Percentage of cases where claims arise

ALLOCATION OF AWARDS TDSNI 2021-22

*Some of the data included is the latest available data

released by the Scottish Government. Other data is

SafeDeposits Scotland’s own internal performance

reporting.

SAFEDEPOSITS SCOTLAND

SafeDeposits Scotland is a Government approved,

not-for-prot company that provides tenancy deposit

protection in Scotland’s private rented sector (PRS).

The tenancy deposit protection regulations were

introduced in Scotland in 2011 and came into force

on 2nd July 2012. There were some transitional

arrangements but all deposits had to be protected with

a Government approved scheme by 15th May 2013.

| SafeDeposits Scotland

19

TENURE IN SCOTLAND

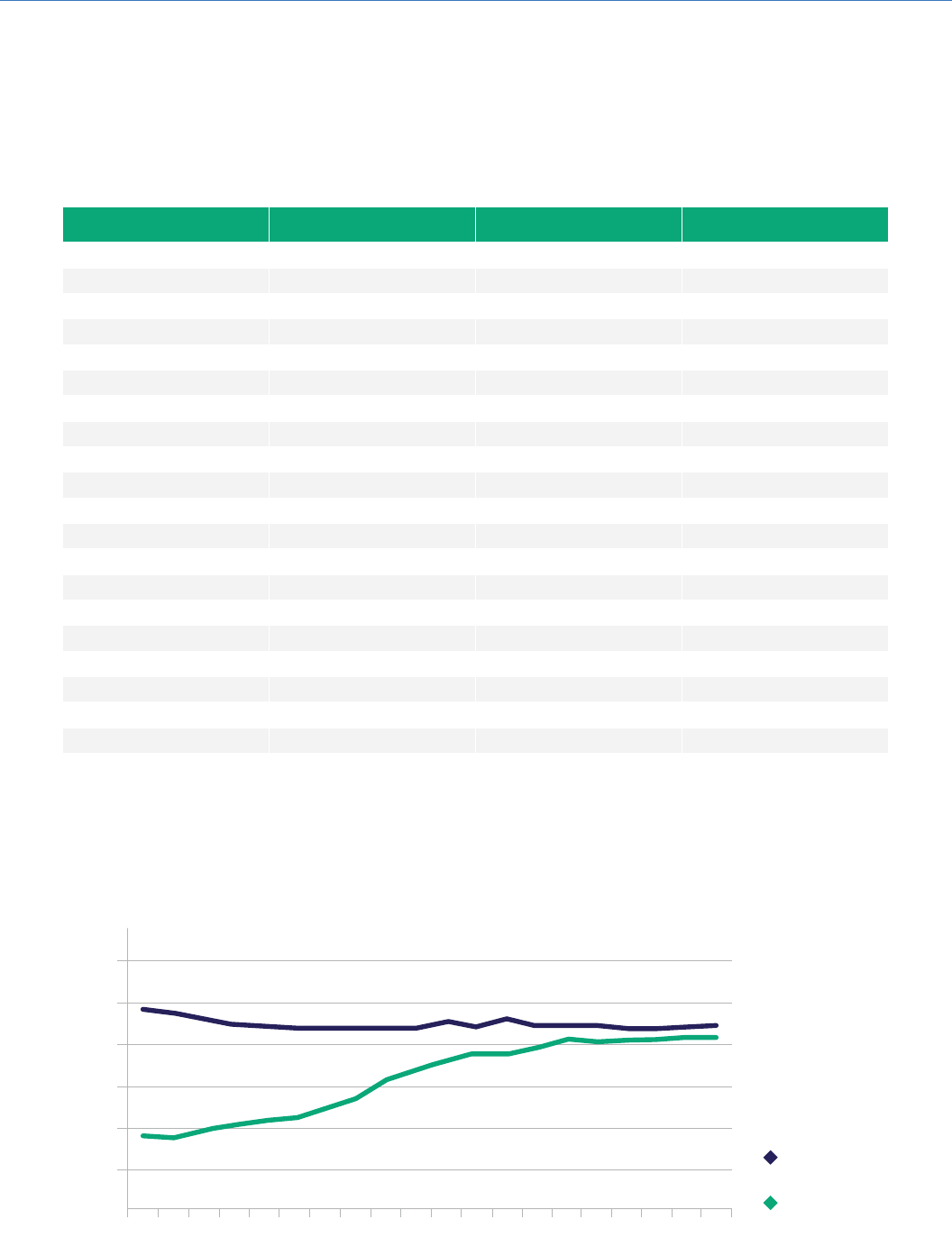

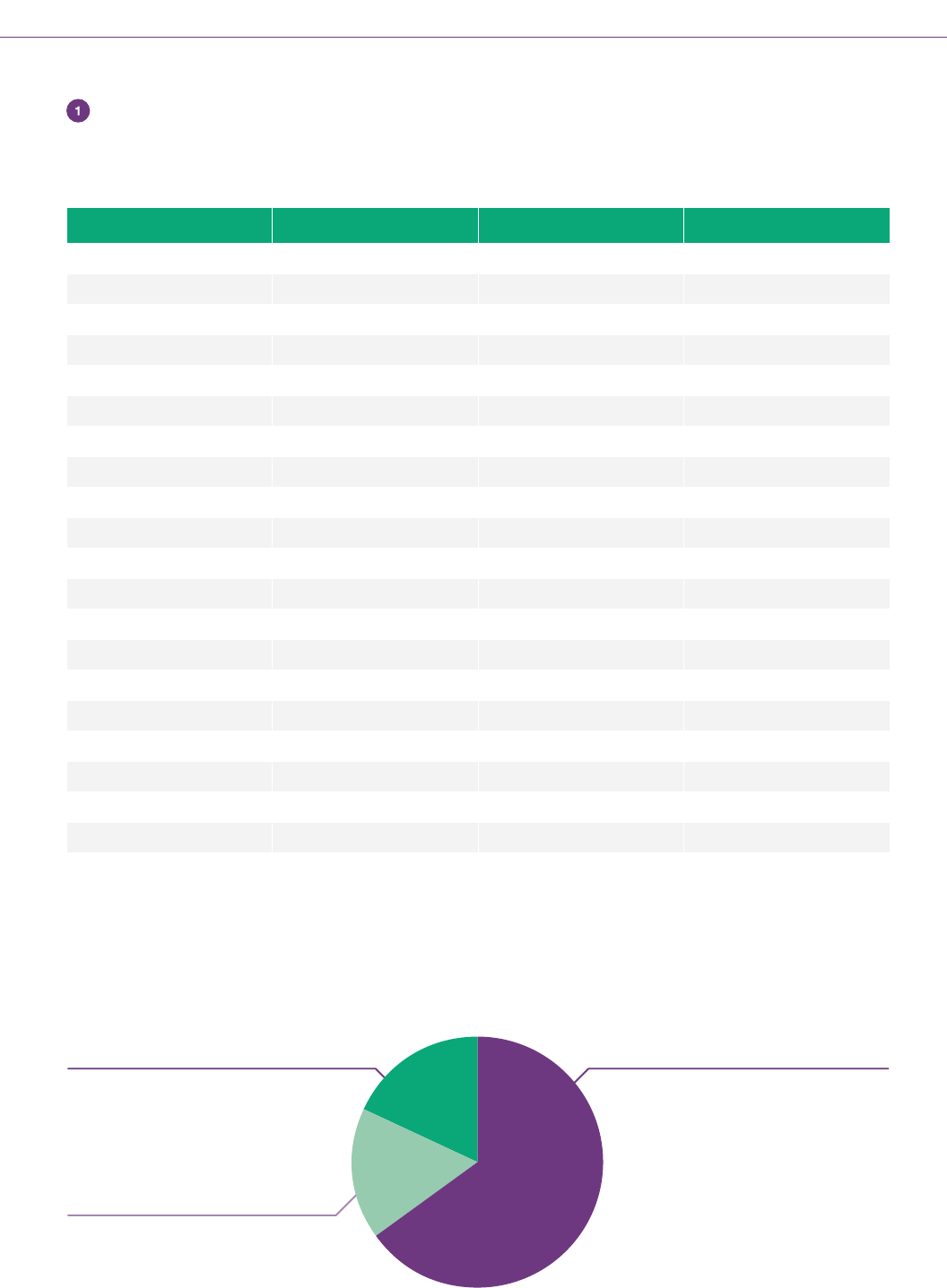

TABLE 13

TENURE IN SCOTLAND (THOUSANDS OF HOMES)

Year Owner occupation Social renting Private renting

2001 1,370 692 181

2002 1,406 674 179

2003 1,434 655 188

2004 1,447 640 213

2005 1,468 626 225

2006 1,493 613 234

2007 1,562 607 259

2008 1,592 599 259

2009 1,590 594 285

2010 1,584 596 303

2011 1,580 595 320

2012 1,545 597 366

2013 1,537 596 389

2014 1,545 594 394

2015 1,552 595 402

2016 1,558 595 414

2017 1,502 594 393

2018 1,619 596 389

2020 1,651 608 389

Source: Housing Review JRF/CIH

| SafeDeposits Scotland

20

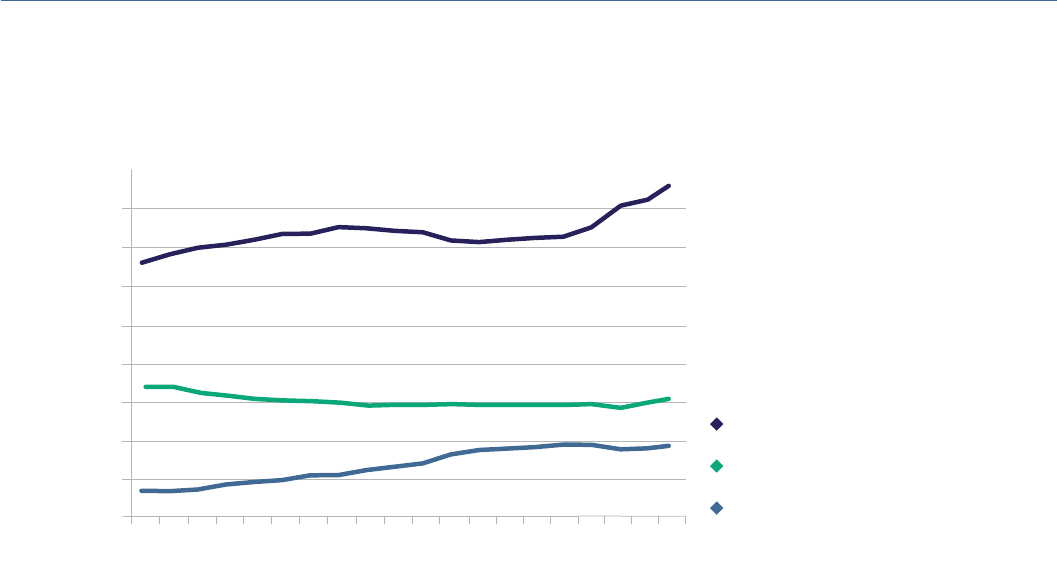

FIGURE 13

OWNER OCCUPATION, SOCIAL RENTING AND PRIVATE RENTING IN SCOTLAND

(HOMES IN THOUSANDS)

Source: Housing Review JRF/CIH

0.000

200

400

600

800

1000

1200

1400

1600

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2019

2018

2020

2016

2017

Owner occupation

Social renting

Private renting

| SafeDeposits Scotland

21

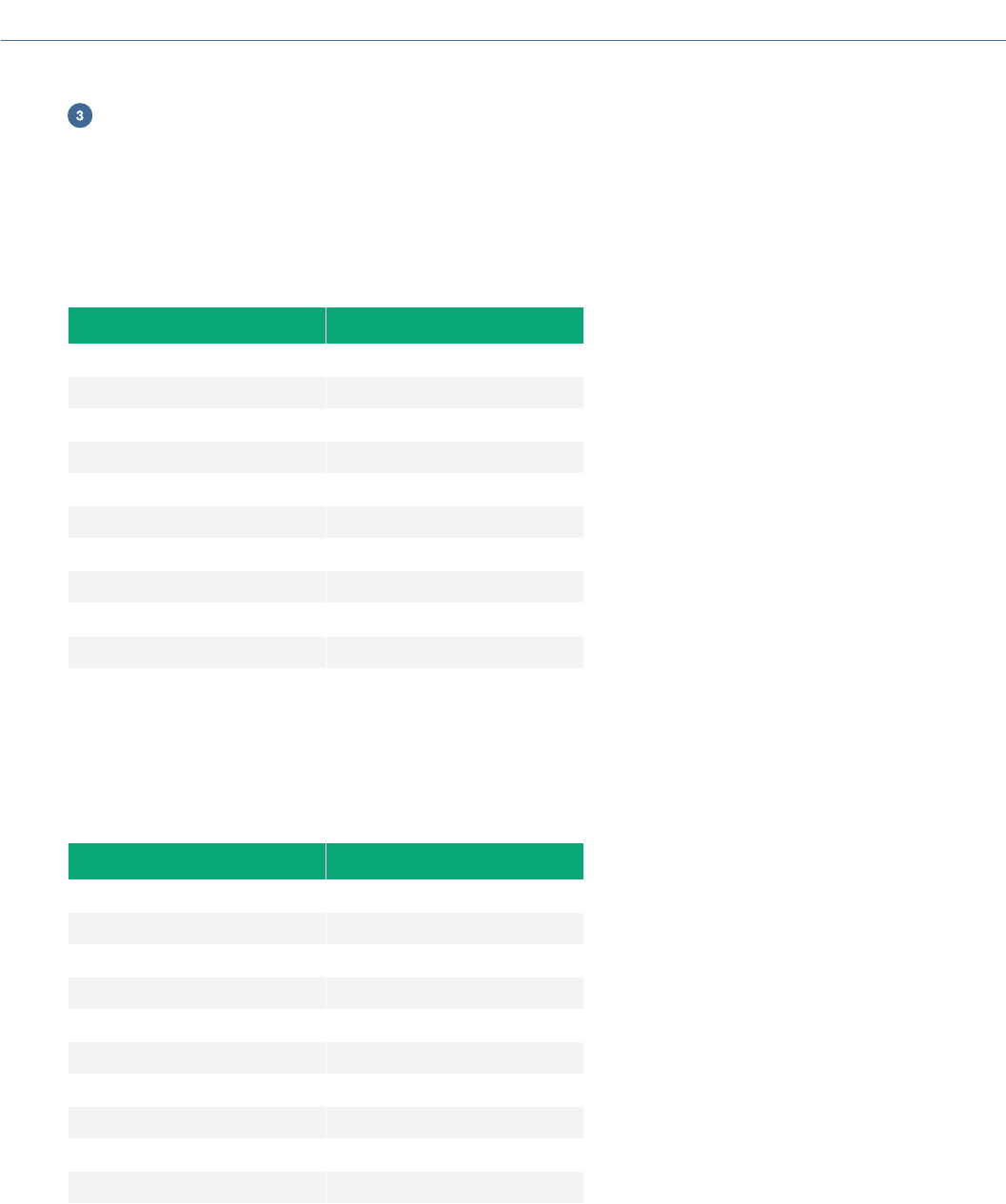

TENANCY DEPOSITS IN SCOTLAND

Figure 14 illustrates how the number of tenancy deposits protected have increased in line with the growth of the

private rented sector in Scotland.

TABLE 14

NUMBER OF TENANCY DEPOSITS PROTECTED IN SCOTLAND

FIGURE 14

TENANCY DEPOSITS PROTECTED COMPARED TO THE NUMBER OF PRIVATE

RENTED SECTOR HOMES IN SCOTLAND

Year Total deposits protected Value

March 2013 116,839 £77,773,059

March 2014 149,639 £99,988,374

March 2015 171,466 £112,768,955

March 2016 186,070 £124,603,219

March 2017 202,514 £135,192,767

March 2018 211,955 £142,967,951

March 2019 219,629 £150,844,370

March 2020 221,834 £157,558,331

March 2021 220,791 £161,981,025

March 2022 235,117 £176,043,524

Source: Scottish Government statistics

Source: Scottish Government statistics

0

50000

100000

150000

250000

200000

Mar 2014

Mar 2015

Mar 2016

Mar 2019

Mar 2017

Mar 2020

Deposits protected

PRS homes

300000

350000

400000

| SafeDeposits Scotland

22

DISPUTES

Legislation covering tenancy deposit protection in Scotland provides free alternative dispute resolution if the

parties are unable to agree how the tenancy deposit should be divided at the end of the tenancy.

TABLE 15

ADJUDICATIONS AS A PERCENTAGE OF TENANCY DEPOSITS PROTECTED IN SCOTLAND

TABLE 16

ADJUDICATIONS COMPLETED BY YEAR, FOR ALL TENANCY DEPOSIT SCHEMES

IN SCOTLAND

Source: Scottish Government statistics

Source: Scottish Government statistics

Year Total disputes

March 2013 224

March 2014 2,525

March 2015 4,530

March 2016 4,970

March 2017 5,662

March 2018 5,918

March 2019 6,139

March 2020 6,678

March 2021 5,012

March 2022 PENDING DATA

Year Dispute percentage

March 2013 0.19%

March 2014 1.69%

March 2015 2.64%

March 2016 2.67%

March 2017 2.80%

March 2018 2.79%

March 2019 2.80%

March 2020 3.01%

March 2021 2.27%

March 2022 PENDING DATA

| SafeDeposits Scotland

23

TABLE 16

ADJUDICATIONS COMPLETED BY YEAR, FOR ALL TENANCY DEPOSIT SCHEMES

IN SCOTLAND

TABLE 18

AVERAGE TENANCY DEPOSITS

Source: Scottish Government statistics

Year Average value of deposits

March 2013 £665.64

March 2014 £668.20

March 2015 £657.68

March 2016 £669.66

March 2017 £667.57

March 2018 £674.52

March 2019 £686.81

March 2020 £710.25

March 2021 £733.64

March 2022 £748.75

Source: SafeDeposits Scotland statistics

Table 19 shows the types of disputes arising in SafeDeposits Scotland’s dispute cases.

FIGURE 15

ADJUDICATIONS COMPLETED BY YEAR, FOR ALL TENANCY DEPOSIT SCHEMES

IN SCOTLAND

REASONS FOR TENANCY DEPOSIT DISPUTES

Source: Scottish Government statistics

*Percentage of cases where claims arise

Dispute 2018-19 2019-20 2020-21 2021-22

Cleaning 66% 69% 70% 71%

Damage 42% 42% 43% 46%

Redecoration 18% 21% 20% 25%

Gardening 8% 9% 15% 8%

Rent arrears 18% 15% 9% 11%

TABLE 17

PERCENTAGE OF DISPUTES ARISING IN SAFEDEPOSITS SCOTLAND

0

Mar 2013 Mar 2014 Mar 2015 Mar 2016 Mar 2017 Mar 2018

1000

2000

3000

4000

5000

6000

Mar 2019 Mar 2020 Mar 2021

0300 037 1000

www.tenancydepositscheme.com

Dispute Service Statistical Brieng 2021-22, © TDS