CONTENTS

Tenure in England & Wales 4

Tenancy Deposits in England & Wales 6

Disputes 8

TDS Northern Ireland 10

Tenure in Northern Ireland 11

Tenancy Deposits in Northern Ireland 13

Disputes 15

SafeDeposits Scotland 18

Tenure in Scotland 19

Tenancy Deposits in Scotland 21

Disputes 22

a

TDS Northern Ireland

is a wholly owned

subsidiary of

The Dispute Service,

providing both custodial

and insured tenancy

deposit protection.

The Tenancy Deposit

Scheme is operated

by The Dispute Service

providing tenancy deposit

protection in England

and Wales. TDS offers

both Insured deposit

protection, TDS Insured,

and Custodial deposit

protection, TDS Custodial.

SafeDeposits Scotland

is a custodial tenancy

deposit protection

scheme. It is a separate

company where The

Dispute Service is the key

partner and provides the

scheme’s key operational

services.

www.tdsnorthernireland.com

0300 037 3700

www.safedepositsscotland.com

03333 213 136

www.tenancydepositscheme.com

0300 037 1000

EXECUTIVE SUMMARY

This Statistical Brieng provides data on the work of the

tenancy deposit schemes across the UK; in England &

Wales, Scotland and Northern Ireland.

In each jurisdiction there are three government

authorised schemes which operate the statutory tenancy

deposit protection and dispute resolution services.

THE DISPUTE SERVICE

The Dispute Service is a Government approved,

not-for-prot company that provides Insured and

Custodial tenancy deposit protection (TDP) in the

private rented sector.

The tenancy deposit protection legislation was

introduced in April 2007 in England and Wales as a

result of the 2004 Housing Act. Similar provisions came

into force in Scotland in July 2012 and in Northern

Ireland in April 2013.

The Dispute Service provides TDP services through

the Tenancy Deposit Scheme in England & Wales,

SafeDeposits in Scotland and TDS Northern Ireland.

*Some of the data included is Government data released

under the Freedom of Information Act. Other data is The

Dispute Service’s own internal performance reporting.

| TDS England & Wales | TDS England & Wales

2 3

| TDS England & Wales | TDS England & Wales

4 5

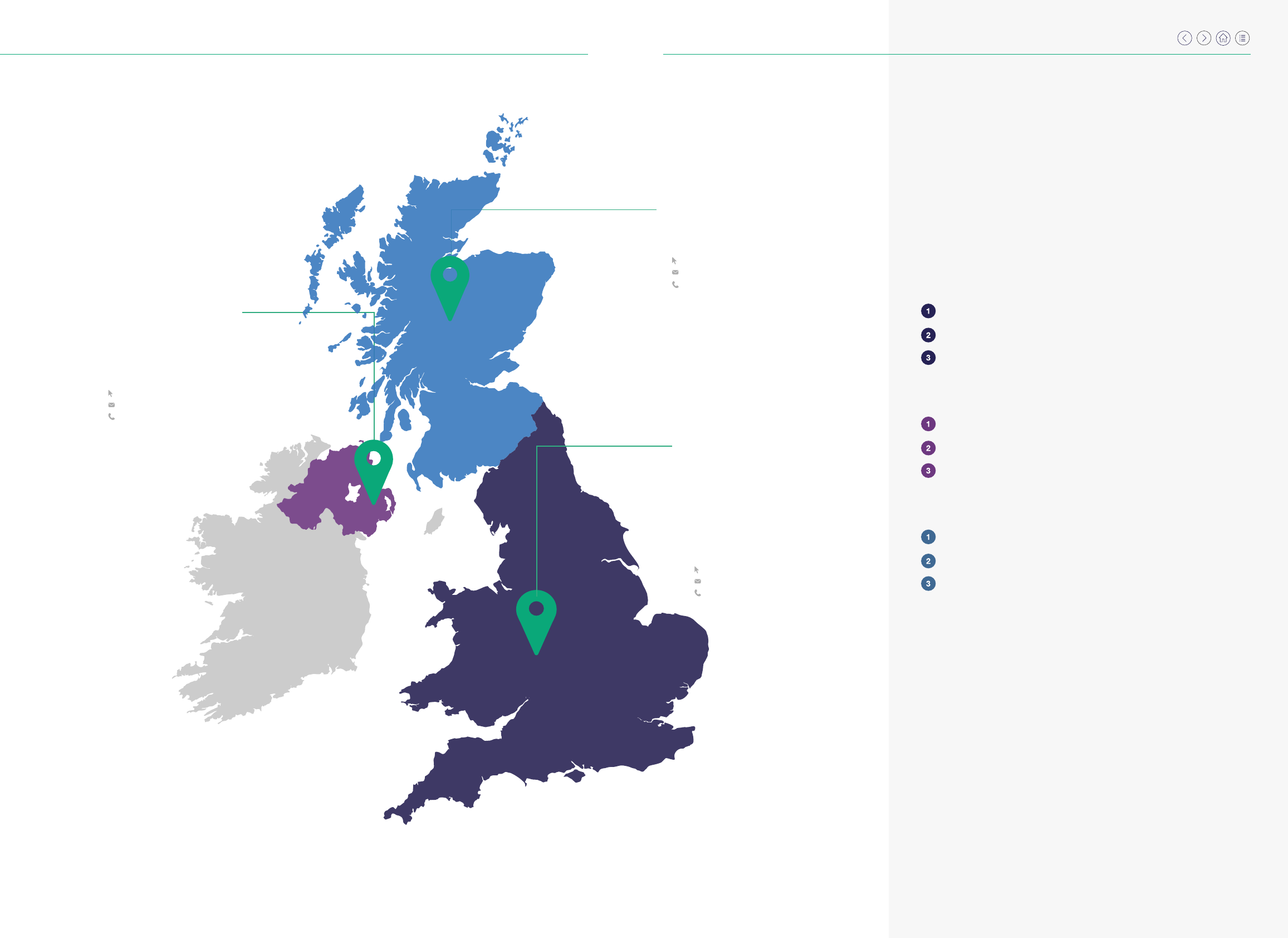

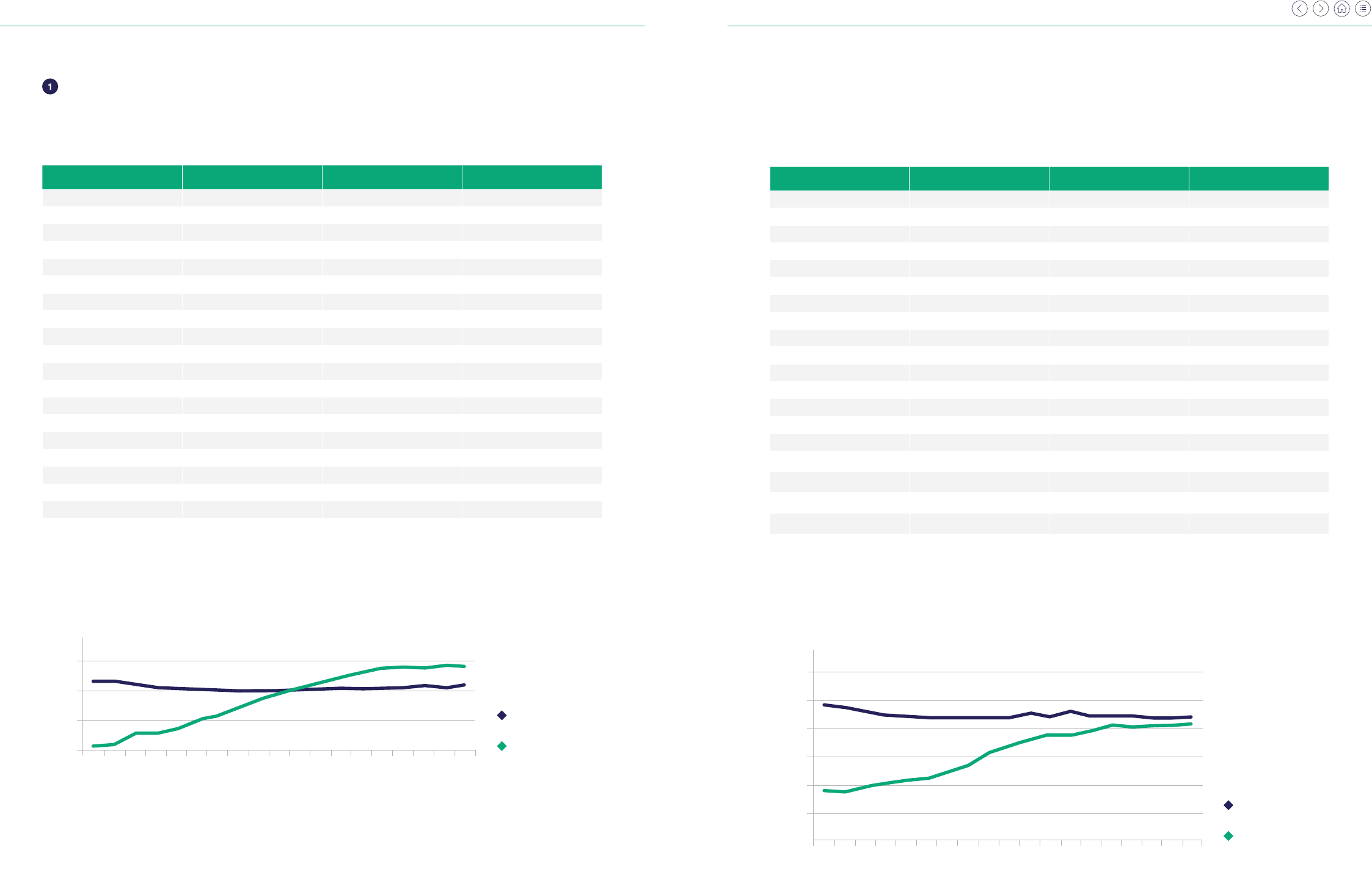

TENURE IN ENGLAND AND WALES

Source: Housing Review JRF/CIH 2021

Year Owner occupation Social renting Private renting

2001 14.735 4.339 2.133

2002 14.846 4.310 2.197

2003 14.752 4.212 2.549

2004 14.986 4.120 2.578

2005 15.100 4.050 2.720

2006 15.052 4.034 2.987

2007 15.093 4.013 3.182

2008 15.067 4.000 3.443

2009 14.968 4.022 3.705

2010 14.895 4.032 3.912

2011 14.827 4.044 4.105

2012 14.754 4.068 4.286

2013 14.685 4.100 4.465

2014 14.674 4.012 4.623

2015 14.684 4.030 4.773

2016 14801 4.009 4.832

2017 15.050 4.102 4.798

2018 15.311 4.088 4.773

2019 15.581 4.108 4.725

TABLE 1

TENURE IN ENGLAND (MILLIONS OF HOMES)

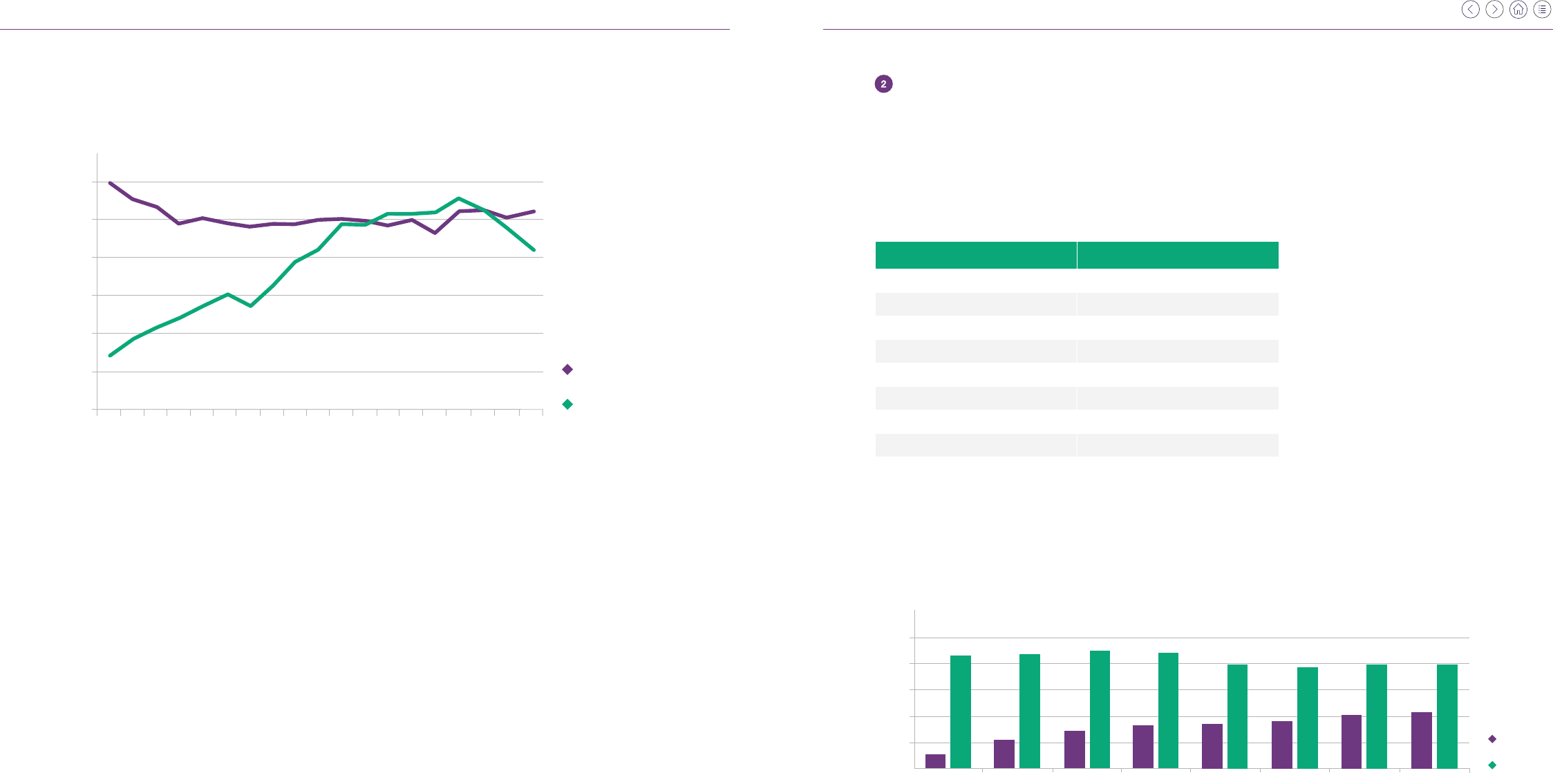

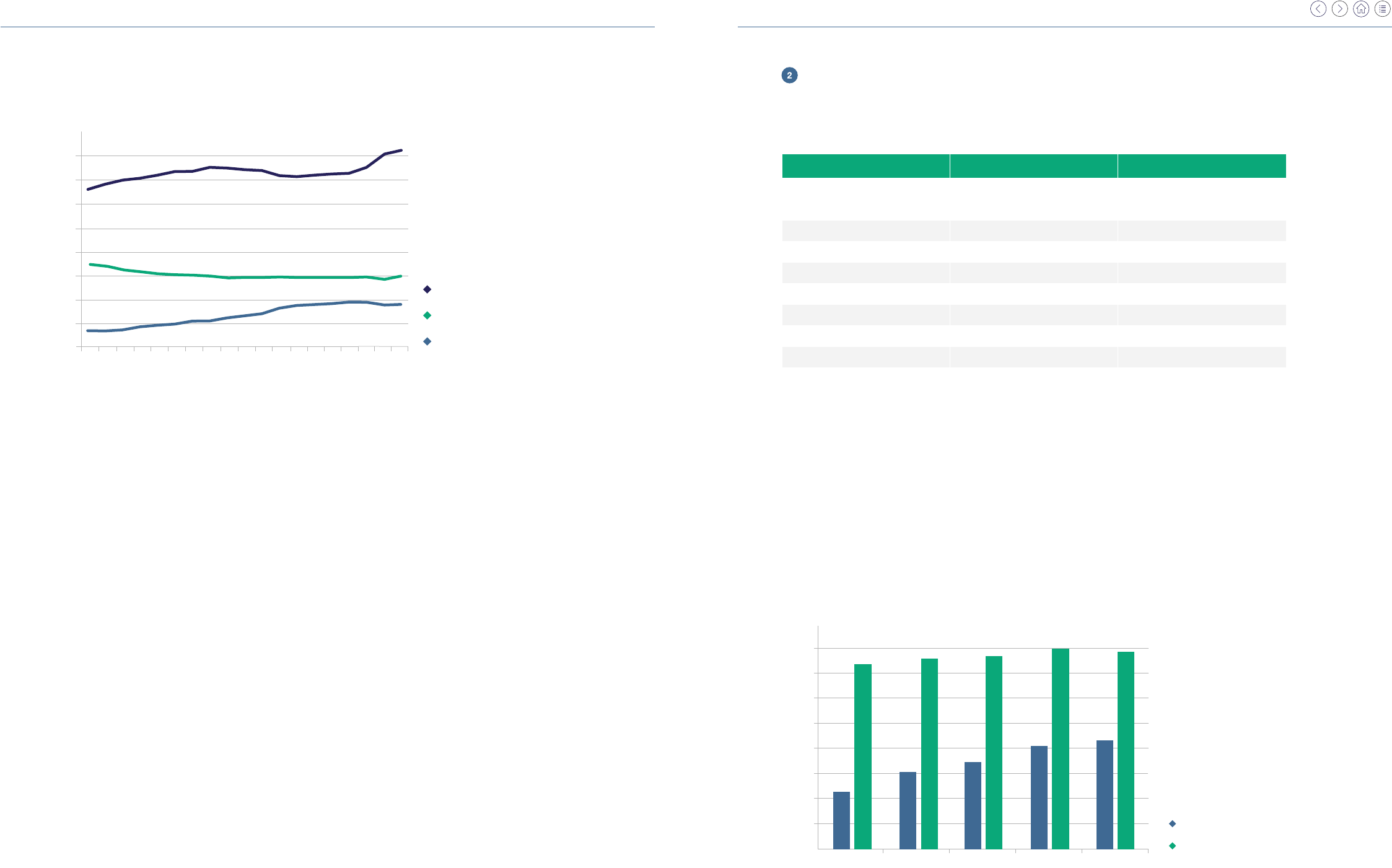

FIGURE 1

PRIVATE RENTING AND SOCIAL RENTING IN ENGLAND 2001-2019

(HOMES IN MILLIONS)

Source: Housing Review JRF/CIH 2021

Year Owner occupation Social renting Private renting

2001 0.941 0.243 0.090

2002 0.957 0.240 0.089

2003 0.966 0.233 0.097

2004 0.980 0.226 0.103

2005 0.990 0.223 0.108

2006 0.998 0.222 0.113

2007 1.002 0.221 0.122

2008 1.001 0.221 0.135

2009 0.989 0.220 0.157

2010 0.983 0.221 0.171

2011 0.980 0.230 0.181

2012 0.977 0.223 0.191

2013 0.983 0.233 0.190

2014 0.981 0.223 0.196

2015 0.974 0.224 0.208

2016 0.986 0.224 0.202

2017 0.990 0.226 0.203

2018 0.994 0.227 0.204

2019 0.996 0.229 0.207

TABLE 2

TENURE IN WALES (MILLIONS OF HOMES)

Source: Housing Review JRF/CIH 2021

FIGURE 2

PRIVATE RENTING AND SOCIAL RENTING IN WALES 2001-2019

(HOMES IN MILLIONS)

Source: Housing Review JRF/CIH 2021

2016

2

3

4

5

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2018

2017

2019

Social renting

Private renting

0.000

0.050

0.100

0.150

0.200

0.250

0.300

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2017

2016

2019

2018

Social renting

Private renting

| TDS England & Wales | TDS England & Wales

6 7

In England and Wales, deposits taken on Assured Shorthold Tenancies (AST’s) must be protected in a

Government approved TDP scheme. Tenancy deposit protection legislation came into force in April 2007 and over

the years there has been a steady increase in the number of tenancy deposits protected, reflecting the increase in

the size of the private rented sector.

The table below (Table 3) illustrates the growth of tenancy deposits protected in England and Wales in both

Insured and Custodial schemes since March 2008.

TENANCY DEPOSITS IN ENGLAND AND WALES

Year Total deposits protected

March 2008 924,181

March 2009 1,553,130

March 2010 1,888,532

March 2011 2,220,543

March 2012 2,374,385

March 2013 2,659,301

March 2014 2,848,110

March 2015 3,066,130

March 2016 3,425,718

March 2017 3,691,242

March 2018 3,840,216

March 2019 3,979,202

March 2020 4,141,467

March 2021 4,242,373

TABLE 3

NUMBER OF TENANCY

DEPOSITS PROTECTED IN

ENGLAND AND WALES

Source: MHCLG FOI Data 2021

Year Value of tenancy deposits

March 2008 £885,098,501

March 2009 £1,406,482,263

March 2010 £1,661,896,693

March 2011 £2,104,219,832

March 2012 £2,325,317,355

March 2013 £2,637,843,361

March 2014 £2,865,824,221

March 2015 £3,187,501,867

March 2016 £3,566,784,769

March 2017 £4,017,045,899

March 2018 £4,159,663,783

March 2019 £4,408,543,068

March 2020 £4,307,902,071

March 2021 £4,348,937,027

TABLE 4

TOTAL VALUE OF TENANCY

DEPOSITS PROTECTED IN

ENGLAND AND WALES

Source: MHCLG FOI Data 2021

TABLE 5

TOTAL NUMBER AND VALUE OF TENANCY DEPOSITS PROTECTED BY TDS IN WALES

(31 MARCH 2019)

TDS Insured TDS Custodial

Number of deposits protected at

31 March 2019

41,928 2,634

Value of deposits protected at

31 March 2019

£29,080,837.06 £1,677,892.88

Source: MHCLG FOI Data 2019

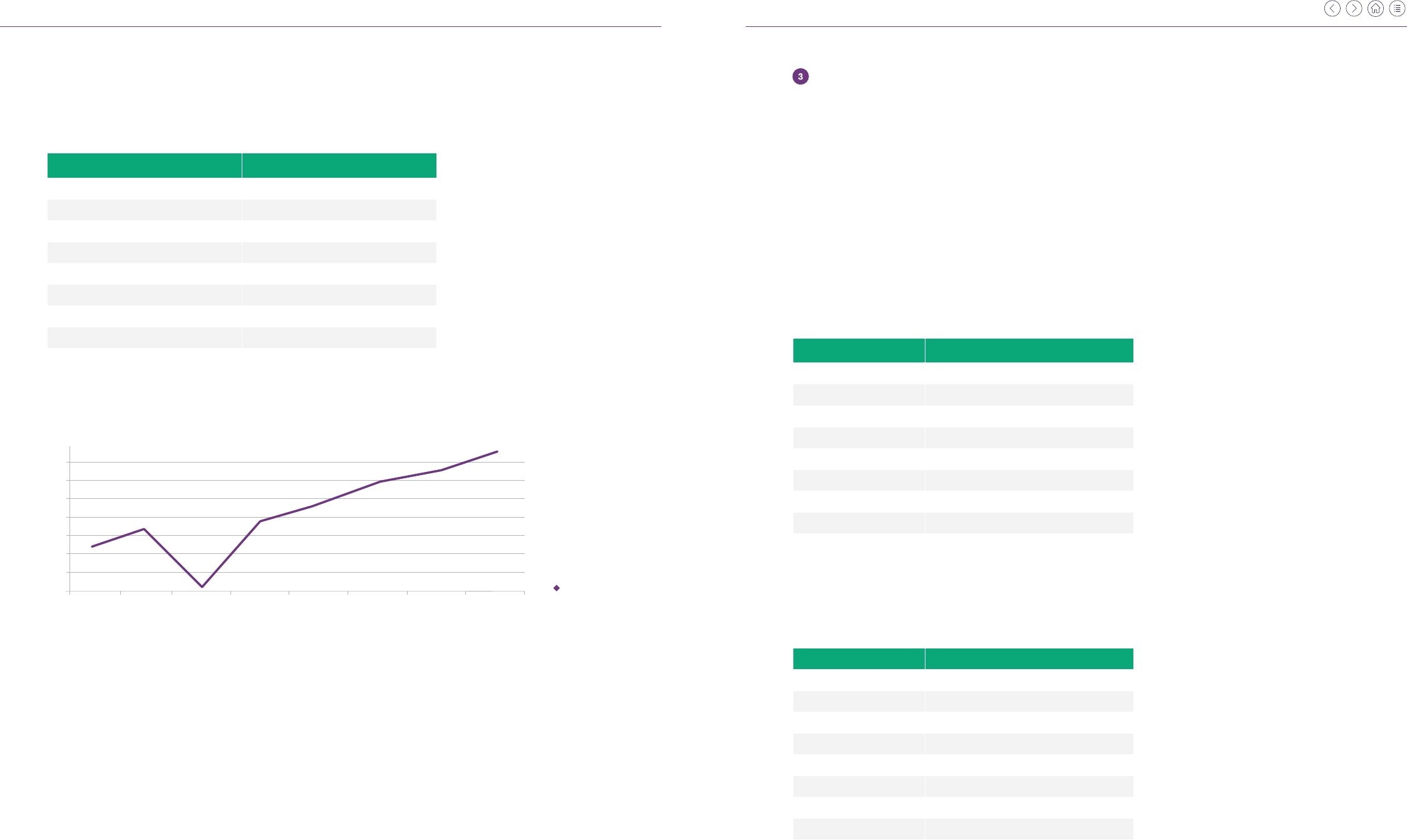

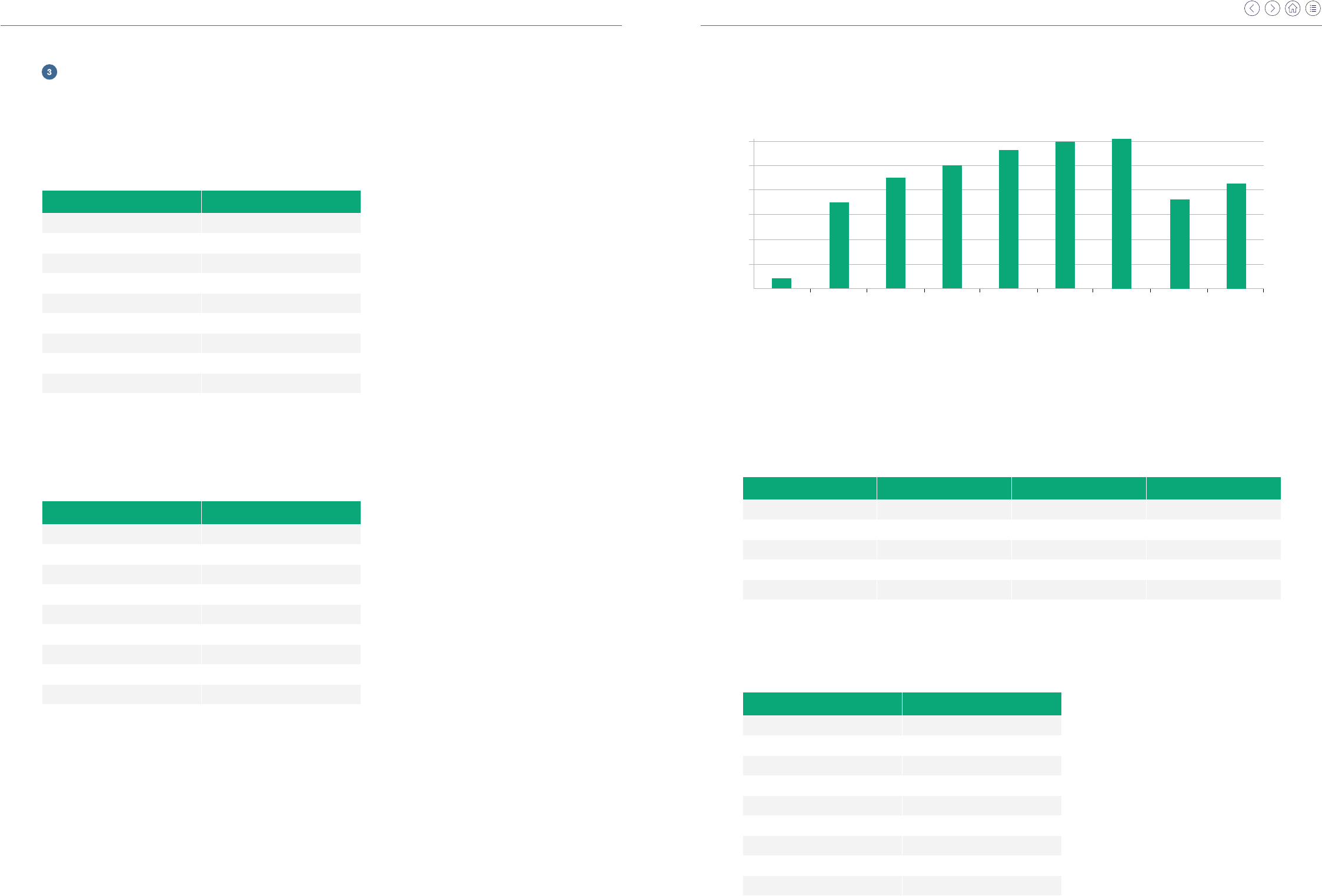

FIGURE 3

TENANCY DEPOSITS PROTECTED COMPARED TO THE NUMBER OF PRIVATE

RENTED SECTOR HOMES IN ENGLAND AND WALES SINCE MARCH 2008

Average value of tenancy deposits protected in England and Wales

Source: MHCLG FOI Data 2020

It should be noted that these gures do not illustrate the large variations between regions in England and Wales.

The drop in deposit values in 2020 is the result of the deposit cap which was introduced in England in June 2019.

FIGURE 4

AVERAGE VALUE OF TENANCY DEPOSITS PROTECTED IN ENGLAND AND WALES

0

1,000,000

2,000,000

3,000,000

Mar 2008

Mar 2009

Mar 2010

Mar 2011

Mar 2012

Mar 2013

Mar 2014

Mar 2015

Mar 2017

Mar 2016

Mar 2019

Mar 2018

4,000,000

5,000,000

Deposits protected

PRS homes

£800

£900

£1,000

Mar 2008

Mar 2009

Mar 2010

Mar 2011

Mar 2012

Mar 2013

Mar 2014

Mar 2015

Mar 2016

Mar 2017

Mar 2019

Mar 2018

Mar 2021

Mar 2020

£1,100

£1,200

Average deposit

| TDS England & Wales | TDS England & Wales

8 9

Year Dispute percentage Total disputes

March 2008 0.05% 458

March 2009 0.52% 8,098

March 2010 1.08% 20,363

March 2011 0.82% 18,156

March 2012 0.85% 20,279

March 2013 0.92% 24,448

March 2014 0.88% 25,029

March 2015 0.89% 27,816

March 2016 0.82% 28,100

March 2017 0.83% 30,742

March 2018 0.85% 31,865

March 2019 0.89% 35,513

March 2020 0.84% 34,993

March 2021 0.70% 29,697

The legislation covering TDP in England and Wales provides for free alternative dispute resolution if the parties are

unable to agree how the tenancy deposit should be divided at the end of the tenancy.

DISPUTES

TABLE 6

ADJUDICATIONS AS A PERCENTAGE OF TENANCY DEPOSITS PROTECTED

IN ENGLAND AND WALES

Source: MHCLG FOI Data 2021

ADJUDICATIONS AS A PERCENTAGE OF TENANCY DEPOSITS PROTECTED

TDP legislation was introduced, in part, in response to concerns that a signicant minority of tenants felt that their

tenancy deposit was unreasonably withheld and had experienced difculty in getting their deposit back.

However, the consistent experience of the schemes is that disputes are raised in a low proportion of cases,

typically fewer than 1% of tenancy deposits protected.

3

Source: MHCLG FOI Data

FIGURE 5

ADJUDICATIONS COMPLETED BY YEAR, FOR ALL TENANCY DEPOSIT SCHEMES IN

ENGLAND AND WALES

Agent - 17%

REASONS FOR TENANCY DEPOSIT DISPUTES

The table below (Table 7) shows the issues arising in TDS’ dispute cases since 2013. Cleaning remains the most

common area of dispute in the cases we deal with, appearing in over half our cases in each year; damage claims

follow closely behind.

WHO RAISES TENANCY DEPOSIT DISPUTES WITH TDS?

TDS is the only TDP scheme which allows agents, landlords and tenants to raise disputes in its principal

membership category in the Insured scheme. Disputes in the Custodial scheme arise because the parties are

unable to reach agreement during the repayment process and are not specically raised by one party.

FIGURE 6

WHO RAISES DISPUTES WITH TDS?

Source: TDS Insured Disputes Data 2020-21

TABLE 7

REASONS FOR TENANCY DEPOSIT DISPUTES IN TDS INSURED

Dispute 2013-14 2014-15 2015-16 2016-17 2017-18 2018-19 2019-20 2020-21

Cleaning 53% 58% 57% 56% 54% 53% 42% 49%

Damage 46% 51% 51% 51% 49% 49% 41% 35%

Redecoration 29% 31% 32% 28% 31% 30% 39% 26%

Gardening 14% 17% 16% 16% 16% 15% 23% 12%

Rent arrears 16% 19% 19% 20% 20% 18% 14% 15%

Source: TDS disputes data

*Percentage of cases where claims arise

Tenant - 75%

Landlord - 8%

0

5,000

10,000

15,000

30,000

25,000

20,000

35,000

Mar 2008 Mar 2009 Mar 2010 Mar 2011 Mar 2012 Mar 2013 Mar 2014 Mar 2015 Mar 2016 Mar 2017 Mar 2019Mar 2018 Mar 2021Mar 2020

| TDS Northern Ireland

11

*Some of the data included is data released by the

NI Department for Communities. Other data is the

Tenancy Deposit Scheme Northern Ireland’s own internal

performance reporting.

TDS NORTHERN IRELAND

The Tenancy Deposit Scheme Northern Ireland is a

Government approved, not-for-prot company that

provides Insured and Custodial tenancy deposit

protection in the private rented sector.

The tenancy deposit protection legislation was

introduced in April 2013 in Northern Ireland under

the Tenancy Deposit Schemes Regulations (Northern

Ireland) 2012. This follows the introduction of similar

provisions in England and Wales in April 2007 and in

Scotland in July 2012.

TENURE IN NORTHERN IRELAND

Source: Housing Review JRF/CIH

Year Owner occupation Social renting Private renting

2001 488 149 37

2002 481 140 47

2003 491 134 54

2004 501 122 61

2005 505 125 68

2006 508 122 76

2007 523 121 69

2008 524 123 83

2009 517 123 97

2010 521 125 106

2011 512 126 121

2012 514 124 121

2013 510 123 130

2014 513 124 130

2015 524 116 131

2016 505 132 140

2017 517 133 133

2018 545 127 119

2019 554 129 114

TABLE 8

TENURE IN NORTHERN IRELAND (THOUSANDS OF HOMES)

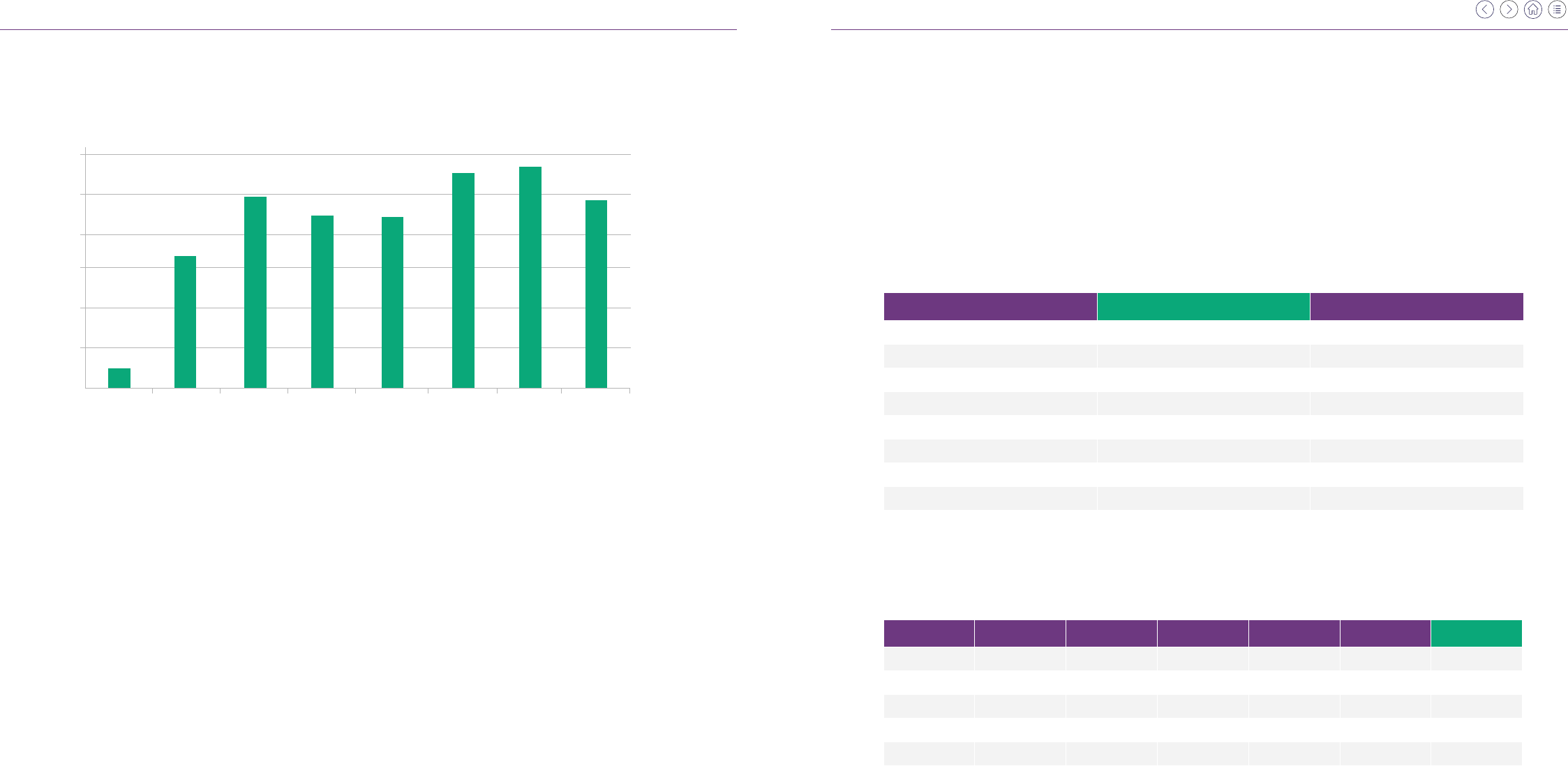

FIGURE 7

TENURE IN NORTHERN IRELAND IN 2019 (PERCENTAGE OF HOMES)

Owner occupation - 70%

Private renting - 14%

Social renting - 16%

| TDS Northern Ireland | TDS Northern Ireland

12 13

FIGURE 8

PRIVATE RENTING AND SOCIAL RENTING IN NORTHERN IRELAND

(HOMES IN MILLIONS)

Source: Housing Review JRF/CIH

TENANCY DEPOSITS IN NORTHERN IRELAND

In Northern Ireland, deposits taken for private tenancies must be protected in a Government approved tenancy

deposit scheme. Tenancy deposit legislation came into force in April 2013 and there has been consistent growth

in the number of tenancy deposits protected since.

TABLE 9

NUMBER OF TENANCY DEPOSITS PROTECTED IN NORTHERN IRELAND

Year Total deposits protected

March 2014 17,544

March 2015 32,722

March 2016 43,211

March 2017 49,102

March 2018 53,510

March 2019 56,786

March 2020 60,613

March 2021 63,905

Source: NI Department for Communities

Source: NI Department for Communities

FIGURE 9

TENANCY DEPOSITS PROTECTED COMPARED TO THE NUMBER OF PRIVATE

RENTED SECTOR HOMES IN NORTHERN IRELAND

0

25

50

75

100

125

150

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2017

2016

2019

2018

Social renting

Private renting

0

Mar 2014 Mar 2015 Mar 2016

30,000

60,000

90,000

120,000

150,000

Deposits protected

PRS homes

Mar 2017 Mar 2018 Mar 2019 Mar 2020 Mar 2021

| TDS Northern Ireland | TDS Northern Ireland

14 15

TABLE 10

TOTAL VALUE OF TENANCY DEPOSITS PROTECTED IN NORTHERN IRELAND

Year Value of tenancy deposits

March 2014 £9,901,267

March 2015 £18,757,501

March 2016 £23,430,569

March 2017 £28,405,824

March 2018 £31,395,767

March 2019 £34,064,162

March 2020 £36,759,231

March 2021 £39,388,442

Source: NI Department for Communities

FIGURE 10

AVERAGE VALUE OF DEPOSITS PROTECTED IN NORTHERN IRELAND

Source: NI Department for Communities

TENANCY DEPOSITS BY VALUE

Year Dispute percentage

March 2014 0.35%

March 2015 1.02%

March 2016 1.14%

March 2017 0.94%

March 2018 0.86%

March 2019 0.98%

March 2020 0.94%

March 2021 0.76%

DISPUTES AS A PERCENTAGE OF TENANCY DEPOSITS PROTECTED

As the table below shows (Table 11), the TDP schemes consistently experience a very low proportion of dispute

cases raised. Since 2014, the rate has ranged from 0.35% to 1.14%. This indicates that parties are generally

successful in reaching agreement without the need to raise a dispute with the schemes.

Legislation covering tenancy deposit protection in Northern Ireland provides for free alternative dispute resolution

if the parties are unable to agree how the tenancy deposit should be repaid at the end of the tenancy.

TABLE 11

ADJUDICATIONS AS A PERCENTAGE OF TENANCY DEPOSITS PROTECTED

IN NORTHERN IRELAND

Source: NI Department for Communities

DISPUTES

TABLE 12

ADJUDICATIONS COMPLETED BY YEAR, FOR ALL TENANCY DEPOSIT SCHEMES IN

NORTHERN IRELAND

Source: NI Department for Communities

Year Total disputes

March 2014 62

March 2015 335

March 2016 492

March 2017 461

March 2018 460

March 2019 556

March 2020 568

March 2021 487

£540

£550

Mar 2014

Mar 2015 Mar 2016

Mar 2017

Mar 2020Mar 2018 Mar 2019 Mar 2021

£560

£580

£590

£600

£570

£610

£620

Average deposit

| TDS Northern Ireland | TDS Northern Ireland

16 17

Source: NI Department for Communities 2020

FIGURE 11

ADJUDICATIONS COMPLETED BY YEAR, FOR ALL TENANCY DEPOSIT SCHEMES

IN NORTHERN IRELAND

DISPUTE RATES IN TDS NORTHERN IRELAND [TDSNI]

Table 13 compares TDSNI dispute rates in the Insured and Custodial schemes against the average of all TDP

schemes.

TDSNI allows only tenants to raise disputes. The dispute rates, combining both the Insured and Custodial

schemes, has remained fairly close to the overall average rates across all TDP schemes in Northern Ireland. In

2016, across both schemes, TDSNI saw its highest dispute rate of 1.24%, while the lowest was 0.39% in the rst

year of the company’s operation in 2013-14.

TABLE 13

DISPUTE RATES

Year TDSNI Insured & Custodial All TDP schemes average

March 2014 0.39% 0.35%

March 2015 0.99% 1.02%

March 2016 1.24% 1.14%

March 2017 1.05% 0.94%

March 2018 0.94% 0.86%

March 2019 1.10% 0.98%

March 2020 1.07% 0.94%

March 2021 0.86% 0.76%

Source: NI Department for Communities

TABLE 14

REASONS FOR TENANCY DEPOSIT DISPUTES IN TDSNI

Dispute 2015-16 2016-17 2017-18 2018-19 2019-20 2020-21

Cleaning 14% 43% 45% 45% 45% 42%

Damage 24% 43% 35% 38% 41% 40%

Redecoration 10% 29% 26% 28% 28% 27%

Gardening 2% 11% 13% 10% 12% 12%

Rent arrears 14% 19% 26% 22% 24% 26%

Source: TDSNI Disputes Data

*Percentage of cases where claims arise

0

100

200

300

500

600

400

Mar 2014

Mar 2015

Mar 2016

Mar 2017

Mar 2019 Mar 2021Mar 2020

Mar 2018

| SafeDeposits Scotland

19

*Some of the data included is the latest available data

released by the Scottish Government. Other data is

SafeDeposits Scotland’s own internal performance

reporting.

SAFEDEPOSITS SCOTLAND

SafeDeposits Scotland is a Government approved,

not-for-prot company that provides tenancy deposit

protection in Scotland’s private rented sector (PRS).

The tenancy deposit protection regulations were

introduced in Scotland in 2011 and came into force

on 2nd July 2012. There were some transitional

arrangements but all deposits had to be protected with

a Government approved scheme by 15th May 2013.

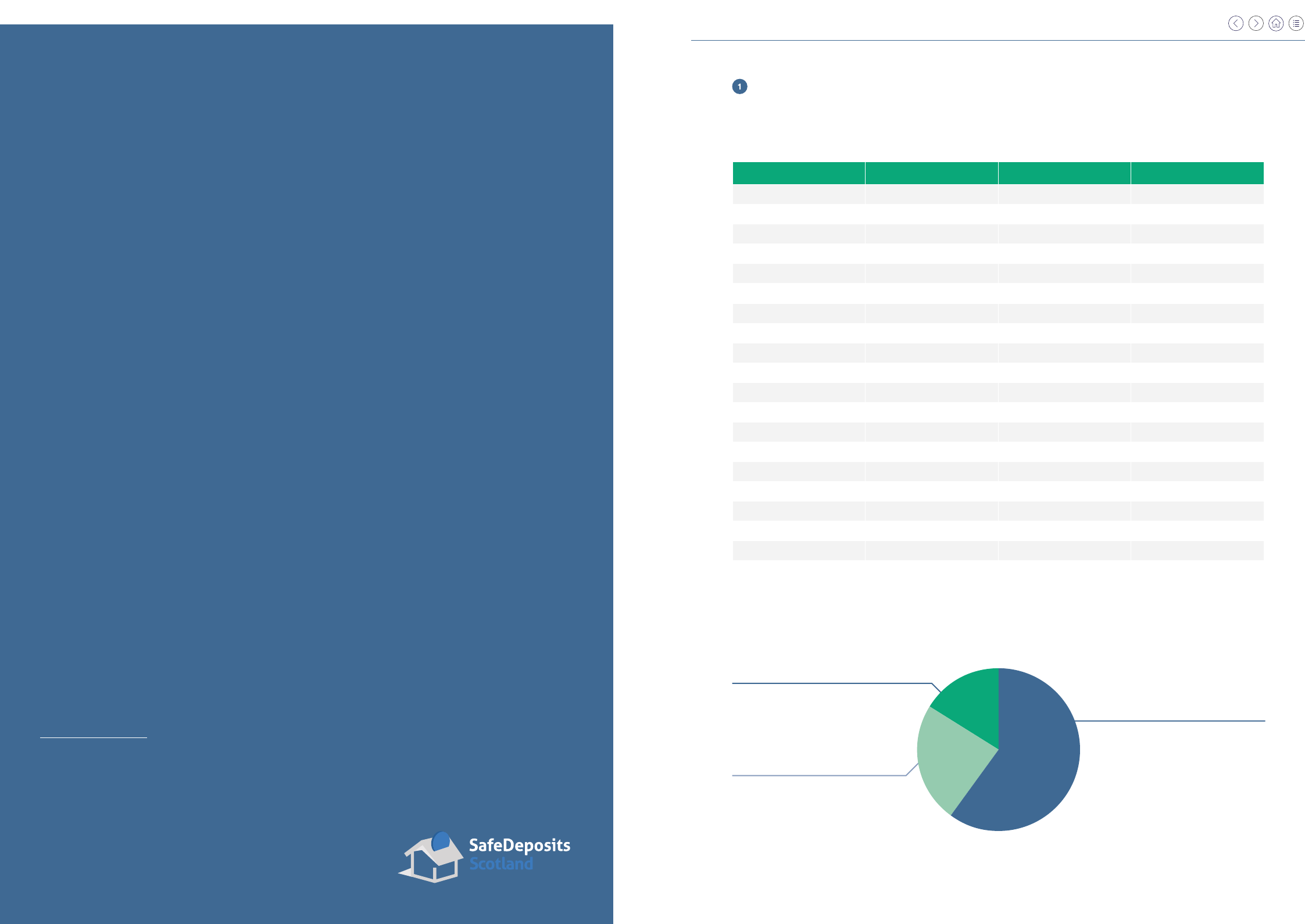

Owner occupation - 62%

Private renting - 15%

Social renting - 23%

TENURE IN SCOTLAND

TABLE 15

TENURE IN SCOTLAND (THOUSANDS OF HOMES)

FIGURE 12

TENURE IN SCOTLAND IN 2019 (PERCENTAGE OF HOMES)

Year Owner occupation Social renting Private renting

2001 1,370 692 181

2002 1,406 674 179

2003 1,434 655 188

2004 1,447 640 213

2005 1,468 626 225

2006 1,493 613 234

2007 1,562 607 259

2008 1,592 599 259

2009 1,590 594 285

2010 1,584 596 303

2011 1,580 595 320

2012 1,545 597 366

2013 1,537 596 389

2014 1,545 594 394

2015 1,552 595 402

2016 1,558 595 414

2017 1,502 594 393

2018 1,619 596 389

2019 1,635 603 389

Source: Housing Review JRF/CIH

| SafeDeposits Scotland | SafeDeposits Scotland

20 21

FIGURE 13

OWNER OCCUPATION, SOCIAL RENTING AND PRIVATE RENTING IN SCOTLAND

(HOMES IN THOUSANDS)

Source: Housing Review JRF/CIH

TENANCY DEPOSITS IN SCOTLAND

Figure 14 illustrates how the number of tenancy deposits protected have increased in line with the growth of the

private rented sector in Scotland.

In 2018, there were 389,000 homes in the private rented sector in Scotland compared with 219,629 tenancy

deposits protected. Not all of the homes in the private rented sector will take a deposit and a number of homes

are not covered by tenancy deposit regulations.

However there is a signicant gap between the number of homes in the private rented sector and the number of

deposits protected.

TABLE 16

NUMBER OF TENANCY DEPOSITS PROTECTED IN SCOTLAND

FIGURE 14

TENANCY DEPOSITS PROTECTED COMPARED TO THE NUMBER OF PRIVATE

RENTED SECTOR HOMES IN SCOTLAND

Year Total deposits protected Value

March 2013 116,839 £77,773,059

March 2014 149,639 £99,988,374

March 2015 171,466 £112,768,955

March 2016 186,070 £124,603,219

March 2017 202,514 £135,192,767

March 2018 211,955 £142,967,951

March 2019 219,629 £150,844,370

March 2020 221,834 £157,558,331

March 2021 220,791 £161,981,025

Source: Scottish Government statistics

Source: Scottish Government statistics

0.000

200

400

600

800

1000

1200

1400

1600

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2019

2018

2016

2017

Owner occupation

Social renting

Private renting

0

50000

100000

150000

250000

200000

Mar 2014

Mar 2015

Mar 2016

Mar 2019

Mar 2017

Deposits protected

PRS homes

300000

350000

400000

| SafeDeposits Scotland | SafeDeposits Scotland

22 23

DISPUTES

Legislation covering tenancy deposit protection in Scotland provides free alternative dispute resolution if the

parties are unable to agree how the tenancy deposit should be divided at the end of the tenancy.

TABLE 17

ADJUDICATIONS AS A PERCENTAGE OF TENANCY DEPOSITS PROTECTED IN SCOTLAND

TABLE 18

ADJUDICATIONS COMPLETED BY YEAR, FOR ALL TENANCY DEPOSIT SCHEMES

IN SCOTLAND

TABLE 20

AVERAGE TENANCY DEPOSITS

Source: Scottish Government statistics

Source: Scottish Government statistics

Source: Scottish Government statistics

Year Total disputes

March 2013 224

March 2014 3,525

March 2015 4,530

March 2016 4,970

March 2017 5,662

March 2018 5,918

March 2019 6,139

March 2020 3,503

March 2021 4,260

Year Average value of deposits

March 2013 £665.64

March 2014 £668.20

March 2015 £657.68

March 2016 £669.66

March 2017 £667.57

March 2018 £674.52

March 2019 £686.81

March 2020 £710.25

March 2021 £733.64

Year Dispute percentage

March 2013 0.19%

March 2014 2.35%

March 2015 2.64%

March 2016 2.67%

March 2017 2.79%

March 2018 2.79%

March 2019 2.79%

March 2020 2.80%

March 2021 3.01%

Source: SafeDeposits Scotland statistics

Table 19 shows the types of disputes arising in SafeDeposits Scotland’s dispute cases.

FIGURE 15

ADJUDICATIONS COMPLETED BY YEAR, FOR ALL TENANCY DEPOSIT SCHEMES

IN SCOTLAND

REASONS FOR TENANCY DEPOSIT DISPUTES

Source: Scottish Government statistics

*Percentage of cases where claims arise

Dispute 2018-19 2019-20 2020-21

Cleaning 66% 69% 70%

Damage 42% 42% 43%

Redecoration 18% 21% 20%

Gardening 8% 9% 15%

Rent arrears 18% 15% 9%

TABLE 19

PERCENTAGE OF DISPUTES ARISING IN SAFEDEPOSITS SCOTLAND

0

Mar 2013 Mar 2014 Mar 2015 Mar 2016 Mar 2017 Mar 2018

1000

2000

3000

4000

5000

6000

Mar 2019 Mar 2020 Mar 2021